Hong Kong’s equity punters drive up cost of money as demand for local currency increases amid fervour for initial public offerings

- Shares of Values Cultural Investment, which makes TV serials, is estimated to have been oversubscribed up to 1,500 times by retail investors, according to brokers’ estimates

- Retail tranche of Jiumaojiu International Holdings, a restaurant chain, is oversubscribed 500 times

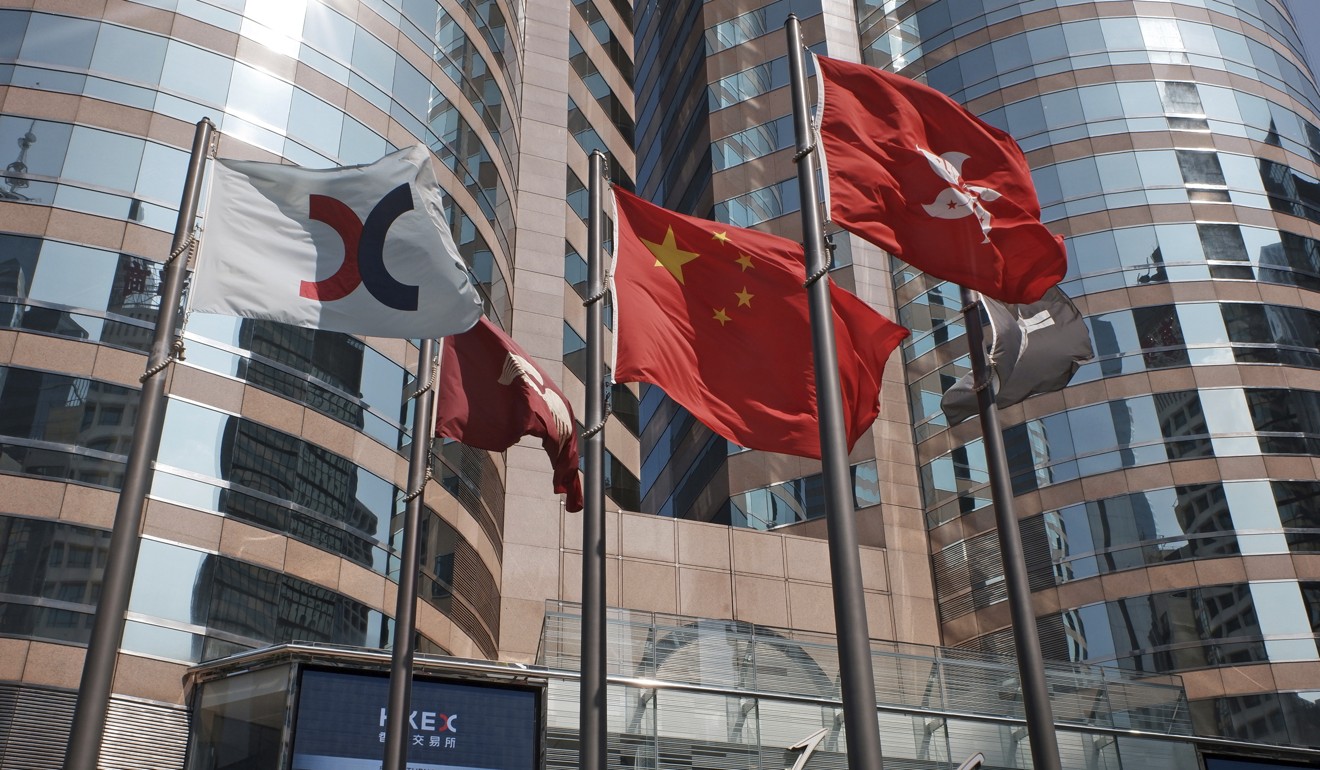

Hong Kong's stock punters have returned to the city's market for initial public offerings, putting so much money into the fundraising by two mainland Chinese companies that they drove up the city's cost of money, which sent the local currency to a recent high against the US dollar.

Retail investors pumped some HK$138 billion (US$17.75 billion) to subscribe to the shares of TV drama maker Values Cultural Investment and restaurant chain Jiumaojiu International Holdings, which closed at noon on Wednesday, proving that the city’s status as a fundraising hub has not been affected by the seven-month long anti-government protests.

This excitement comes on the back of Alibaba Group Holding’s US$13 billion secondary listing on November 26. Shares of Alibaba, which owns South China Morning Post, have risen almost 20 per cent since. Alibaba’s listing in turn has led to a flurry of IPOs, including 22 in the past two weeks alone.

Values Cultural Investment, known for its TV serials such as The Distant Distance, Yan Yang Chun and National Spirit, is the hottest IPO among the 22 companies, as stockbrokers estimate the retail portion could have been oversubscribed up to 1,500 times.

The company priced its offering of 250 million shares between HK$0.5 and HK$0.74 apiece, with 10 per cent, or 25 million shares, set aside for retail investors. The IPO opened for subscription on December 30 and closed at noon on Wednesday.

Charles Li says the best is still to come, as Hong Kong bourse reclaims world’s IPO crown

If the company prices it at the top end, it could raise up to HK$185 million from both retail and international investors, which brokers believe should not be a problem as the retail portion has been massively oversubscribed, locking up about HK$27.7 billion.

“Values Cultural Investment is a unique stock, and since the offering is so small it has been easily oversubscribed,” said Edmond Hui, chief executive of Bright Smart Securities, which has extended HK$4 billion in margin financing to investors to subscribe to the IPO. “The overall market sentiment is positive, which has also helped the IPO market sentiment.”

If Values Cultural’s retail tranche is oversubscribed 1,500 times, it will surpass Chinese mobile internet company Newborn Town’s IPO in December last year as the seventh most oversubscribed IPO in the past two years, according to data from AAStocks.com. Newborn Town was oversubscribed 1,449 times. Online media company Most Kwai Chung’s IPO in March 2018 was 6,288 times oversubscribed, making it the most popular offering in the past two years.

Hui said that Guangzhou-based Jiumaojiu International Holdings’ retail portion of the IPO was estimated to have been oversubscribed about 500 times, locking up about HK$110.22 billion.

The restaurant chain plans to raise up to HK$2.2 billion from the sale of 333.4 million shares at HK$5.5 to HK$6.60 apiece, with 10 per cent of the IPO set aside for retail investors and the rest for international investors.

The company runs the Tai Er chain, known for its pickled fish dish, while its Jiumaojiu brand, which means 99 cents in the Chinese language, offers Shanxi noodles and other dishes from the northern mainland province.

Jiumaojiu will start trading on January 15 while Value Cultural will list a day later on the main board of Hong Kong stock exchange.

Hong Kong expected to ‘stay competitive’ as a top IPO destination in 2020, KPMG says

The bourse has been ranked the world’s No 1 IPO market seven times in the past 11 years, including 2019. Last year, the stock exchange’s main board raised HK$314.5 billion through 169 IPOs, while GEM, the smaller secondary board, raised HK$1 billion, according to PwC. The accounting firm has predicted that Hong Kong will remain among top three IPO markets worldwide this year.

Clement Chan Kam-wing, managing director of accounting firm BDO, said that the thriving IPO market proves that Hong Kong is an important capital-raising hub for mainland-based companies, adding that the social unrest will have more of an impact on the local retailing and hospitality sectors than the IPO market.

“The strong performance of Alibaba Group Holding’s IPO since its listing in November will encourage more mainland companies to pursue secondary offerings in Hong Kong. This will provide continuous support for the Hong Kong IPO market,” Chan said.