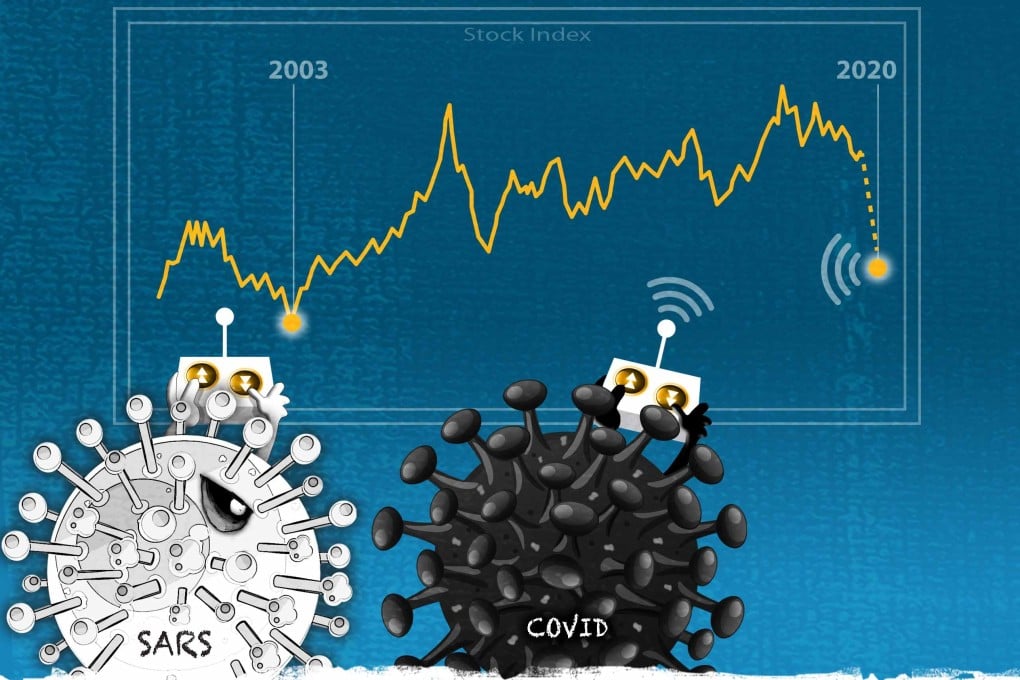

Coronavirus has sparked an ‘infodemic,’ with stock markets battered by news spreading panic via smartphones and tablets, say analysts

- People are hard-wired to be cautious and watch the herd. But by the time they react, markets usually have already fallen, says behavioural economist

- China plays a bigger role in the global economy now – meaning what happens in China is magnified around the world

Feeling spooked yet?

If so, you belong to a rapidly growing crowd around the world reacting strongly to the coronavirus outbreak. The respiratory illness that began in mainland China has upended global stock markets, supply chains, company earnings and investors’ portfolios.

China’s bigger role in the global economy – it accounted for 4.3 per cent of the world’s GDP in 2003 during the Sars outbreak versus 16.5 per cent now – is part of the reason the coronavirus is causing so much turmoil. Global heavy hitters from Apple to Starbucks have raised alarms about the virus’ impact on revenue tied to China.

Meanwhile, global stocks were on track for their worst week since the financial crisis in 2008. Hong Kong stocks – as well as those on the mainland – fell hard on Friday.

That all means that what happens in China doesn’t stay in China any more.