Exclusive | AMTD plans IPO of digital assets on Singapore and US exchanges, build out of regional virtual banking platform

- The group plans to add Malaysian virtual bank licence as part of IPO assets if bid is successful, sources say

- AMTD Digital to be among the first companies to have dual listings in Singapore and the US if IPO plans succeed

AMTD Group, a financial services group founded by CK Hutchison, is planning to list its digital assets in Singapore and the US later this year to help fund its plans to develop a regional financial technology platform, according to people familiar with the plan.

The privately held group led by former UBS banker Calvin Choi is spinning off a clutch of services spanning virtual banking, insurance broking, digital asset exchange and payment systems under a fintech unit called AMTD Digital, they said, declining to be identified because discussions are private and ongoing.

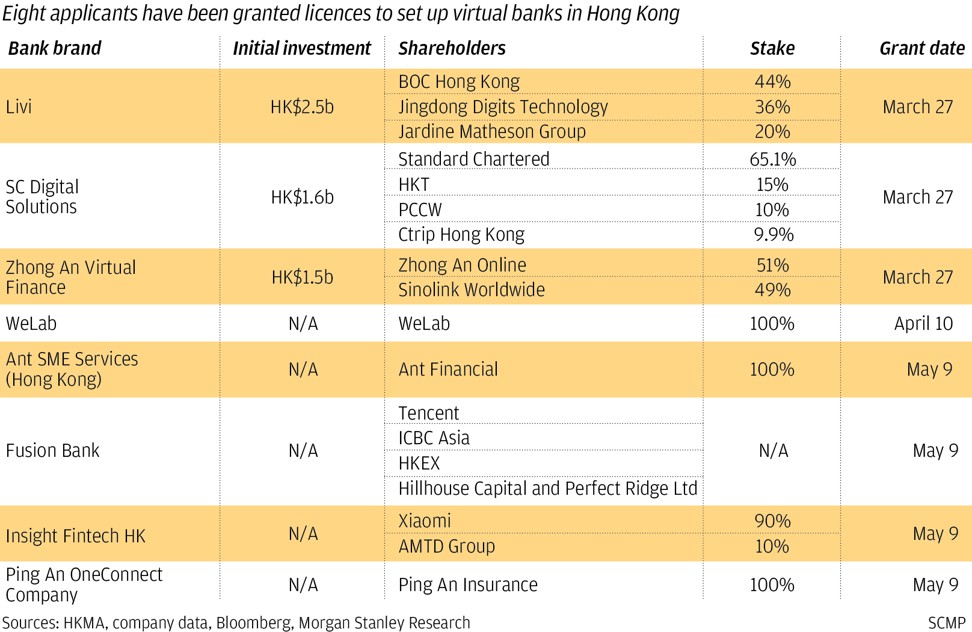

AMTD Digital owns one of the eight virtual banking licences in Hong Kong in partnership with Chinese smartphone maker Xiaomi Corp, as well as a talent programme and a data research hub for listed Chinese companies. The group is seeking a digital banking licence in Malaysia, which if successful, will be included in the initial public offering (IPO) plan, the people said.

The Hong Kong-based group’s idea is to weave together an Asia-wide virtual-banking platform to serve small and medium-sized businesses as well as retail banking customers. Only a handful of other fintech players have the makings of such a platform, including Ant Financial, an affiliate of Alibaba Group which owns the South China Morning Post.

Ant Financial and Xiaomi among 21 applicants for Singapore digital bank licence

While AMTD Digital has already raised over US$100 million through a pre-IPO round of funding, details of its IPO are not yet public, specifically regarding the valuation it is seeking or which companies will be its major backers.

Under the leadership of entrepreneur Choi, AMTD Group has harnessed its relationships with regional banks in China, particularly Shandong-based Bank of Qingdao in which AMTD Group is a major shareholder and Choi is a director. Its fintech partner Xiaomi separately owns a stake in Xinwang Bank, an internet bank in China that has links to agribusiness tycoon Liu Yonghao.

Singapore Exchange brings dual-class IPO battle to Hong Kong, offers better listing terms

If the listings go according to plan, AMTD Digital will be one of the first companies to hold dual listings in Singapore and the US. Singapore’s exchange has been encouraging co-listing idea with other bourses including Nasdaq to compete more aggressively regional rivals such as Hong Kong.

AMTD Group listed AMTD International on the New York Stock Exchange in August last year, creating an investment banking business with a market capitalisation of US$2 billion. AMTD International plans a secondary listing in Singapore in the first half of this year without initially issuing new shares. It plans to raise capital later this year in Singapore, the people said.

AMTD Group has also been building out its SpiderNet ecosystem block by block, offering services from asset management to property investment to its clients.