Rebel HSBC shareholders urge SFC to bargain with Bank of England over lost dividends

- HSBC shareholders call on SFC to ask Bank of England to reverse dividend decision

- Latest move in HSBC shareholder rebellion fighting dividend cancellation

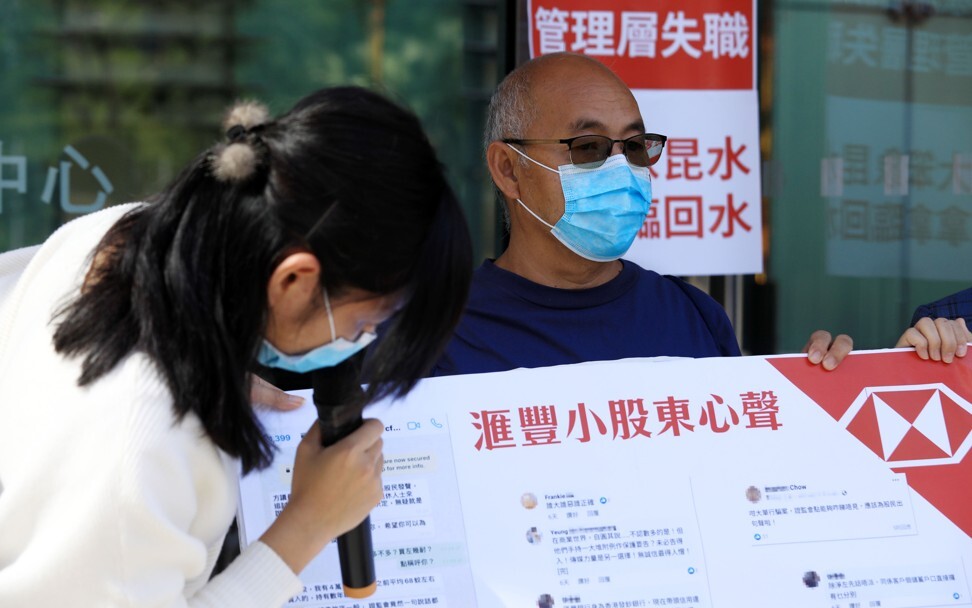

A band of rebel HSBC shareholders converged on the doorstep of Hong Kong’s securities regulator on Thursday, urging the local watchdog to intercede on their behalf with the Bank of England over their loss of dividends.

Christine Fong Kwok-shan, a district councillor in Hong Kong, took a letter representing over 500 HSBC investors to the Securities and Futures Commission’s headquarters demanding that the regulator fight to safeguard the interests of local investors.

“We understand that HSBC cancelled dividend payments at the order of the British regulator. As usual, it needs a regulator to talk to another regulator,” Fong said. An SFC employee accepted the letter but declined to comment on the brewing conflict.

The British regulator was aiming to bolster banks’ capital buffers when it made the request to protect them against the economic crisis triggered by the coronavirus pandemic, which has infected more than 2 million people worldwide.

“The PRA’s orders have hit many retirees hard in Hong Kong, including my father who invested in HSBC shares for decades,” Fong said.

The rebel shareholders are gunning for the support of 5 per cent of the shareholder base, enough to call an extraordinary general meeting. As of Thursday, about 3 per cent had pledged their support.

Fong said her 500-strong group of HSBC shareholders would support the call for an EGM to demand that the bank revoke its decision to suspend the dividend or to pay the dividend in the form of shares instead of cash.

A 69-year old protester at the SFC, who only wanted to identify himself as Uncle Man, owns 40,000 HSBC shares, half of which he bought after the bank declared in February it would pay a fourth interim dividend for the financial year ended December 31 of US$0.21 a share on Tuesday. He would have received HK$65,520.

“I expected to receive the HSBC dividend to cover my daily expenses, but now it is all gone,” Man said.

Hong Kong retail investors own around one-third of the bank's total shares and lost US$1.28 billion from the latest dividend cancellation.

The bank, the largest note-issuing bank in the city, is favoured by local investors for its high dividend yield at 5.9 per cent, higher than banks’ deposit rates in the city which are languishing at close to zero.

HSBC shares dropped 2.2 per cent on Thursday to close at HK$39.7, fell 10 per cent from March 31 the day before the bank cancelled the dividend.