Chinese e-commerce firm JD.com files for secondary listing in Hong Kong, sources say

- Beijing-headquartered company aims to raise US$2 billion in Hong Kong listing

- JD.com’s move follows Alibaba’s secondary listing in Hong Kong last year

JD.com, one of China’s largest e-commerce sites, has applied for a secondary listing in Hong Kong, in what could be the largest fundraising exercise so far this year in the city.

The Beijing-headquartered company lodged a confidential filing with the Hong Kong stock exchange, according to three people familiar with the matter. It could raise as much as US$2 billion via the listing, although the exact amount has yet to be finalised and would depend on the performance of JD.com’s Nasdaq-traded shares, one of the sources said.

Hong Kong trails the United States, Shanghai and Thailand in terms of proceeds raised on its exchange through IPOs so far this year, according to data from Refinitiv. At a rough estimate of US$2 billion, JD.com’s secondary listing will be the world’s third-largest initial public offering behind Beijing-Shanghai High Speed Railway’s US$4.4 billion IPO and Central Retail Corporation’s US$2.5 billion offering.

To compete with other financial hubs, Hong Kong changed its rules in April 2018 to make it easier for companies with dual classes of shares – a structure favoured by technology companies such as Facebook and Google – to seek IPOs as well as secondary listings in the city. The shake-up came after the Hong Kong stock exchange lost out to New York in a bid to host Alibaba’s US$25 billion IPO in 2014.

New investors are likely to query how China’s slowing economy and the coronavirus pandemic will impact shoppers’ confidence. JD.com has been guiding market analysts to expect double-digit top-line growth during the first quarter compared with a year earlier, as the world’s largest work-from-home experiment has changed consumer behaviour. More people are logging on and shopping from the relative comfort and safety of their homes.

Its management expects users, especially in lower tier Chinese cities, to continue to order over the internet as the health crisis abates. The company, which operates its own logistics business, is looking to boost cross-product purchases on its platform this year and penetrate deeper into China’s smaller cities.

To be sure, the coronavirus pandemic has reduced the number of deliveries of larger packages, while free deliveries to hard-hit provinces at the height of the crisis will weigh on margins.

It remains unclear how many new shares JD.com will issue as part of the secondary listing, as management will want to balance the dilution of existing shareholders against creating a sizeable enough float to avoid Hong Kong’s trading volume leaching away to New York. JD.com has an overweening market capitalisation of US$64 billion in the US.

The Hong Kong stock exchange requires companies to float a minimum of 25 per cent of their shares, but a company already listed elsewhere can win a waiver. Alibaba’s primary share deal represented about 2.76 per cent of its outstanding equity.

JD.com will hope to be admitted swiftly into the Hang Seng Composite Index and subsequently into the Shenzhen and Shanghai Stock Connect programmes. A tranche of the deal will be reserved for Hong Kong retail investors, although the size of the tranche will depend on the overall level of subscription.

The shares will be priced close to JD.com’s US trading level to limit the chance for arbitrage between the trading venues. Its shares closed at US$43.58 on Tuesday in New York, after rising about 24 per cent year to date.

A secondary listing is a far easier and faster process for the company than an IPO, as JD.com is already well known to international investors and can leverage documents already disclosed to US regulators.

JD.com had net cash of roughly 23 billion yuan (US$3.25 billion ) and negative free cash flow of 156 million yuan, so analysts at Chinese brokerage Haitong suggested that the firm does not need to raise capital and that the attraction of a second listing lies more in the possibility of lowering its cost of equity, making yuan funding easier, and for political reasons.

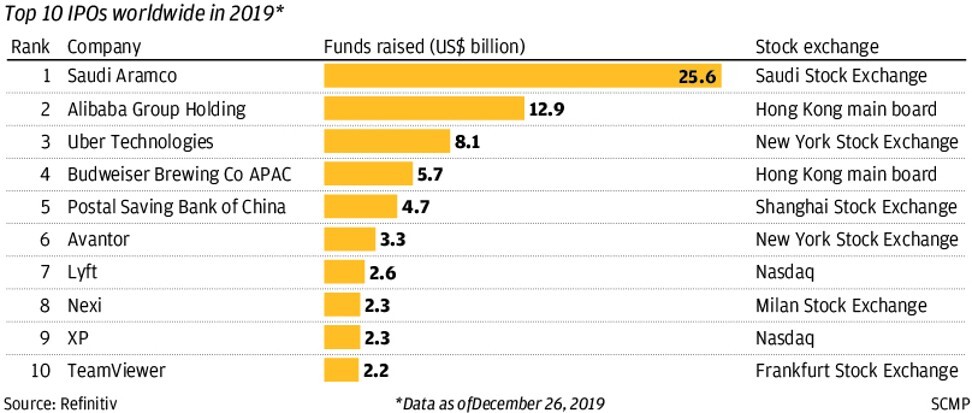

The success of Hangzhou-based Alibaba’s secondary listing in Hong Kong – the second-biggest globally last year after Saudi Aramco’s IPO and the third-largest technology offering on record – has spurred more Chinese companies to seek their own listings closer to home, according to market watchers. Other liquid, solely US-listed Chinese stocks include Baidu, NetEase and Pinduoduo.

Secondary listings also give Chinese companies greater financial flexibility as the US-China trade war rumbles on. Alibaba was able to diversify its shareholder base through Hong Kong. Following its secondary listing, it became the most valuable listed company by market capitalisation in Hong Kong, eclipsing the likes of Tencent Holdings, HSBC and China Mobile. Alibaba has also been one of the bourse’s most liquid stocks since it began trading on November 26. Its Hong Kong-listed shares are trading 12 per cent higher than their IPO price of HK$176, its ADRs are up 3.3 per cent and the benchmark Hang Seng Index has fallen by 5.6 per cent.

Hong Kong’s IPO market has been a relatively resilient and efficient capital raising hub despite the coronavirus pandemic, according to an April report by consultancy Euromonitor. The city ranks third globally, behind China and the US, in terms of the security and stability of its IPO market, it said.

JD.com has chosen Bank of America, CLSA and UBS to advise it on the Hong Kong listing, other people familiar with the appointments said. The two investment banks also advised on the US debut of JD.com’s American depositary receipts in 2014. Hong Kong’s securities watchdog lifted a ban on UBS accepting sponsor roles in January.

Bank of America, CLSA and UBS declined to comment on JD.com’s Hong Kong listing plans.