Charles Li moves on in surprise announcement to step down in 18 months as chief executive of Hong Kong’s stock exchange

- HKEX has formed a selection committee, led by chairwoman Laura Cha, to find a replacement for Charles Li

- Government wants successor to pay more attention to corporate governance

Charles Li, one of the longest-serving chief executives of a global financial marketplace, has thrown in the towel after more than a decade as head of the Hong Kong stock exchange (HKEX), in a surprise announcement to let his contract lapse in October 2021.

The former oilfield worker, journalist and banker, also known as Li Xiaojia, will not seek reappointment when his current term expires at the end of October next year, according to a statement. He will continue to lead Asia’s third-largest exchange while a selection committee headed by HKEX chairwoman Laura Cha Shih May-lung looks for a successor, and may leave earlier if a replacement is found sooner, the filing said.

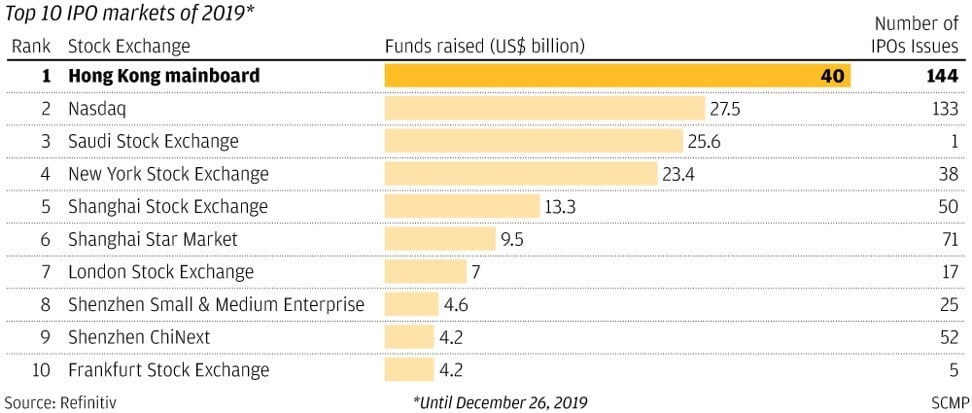

The unexpected move is a bookend in a career that has taken Li, who turned 59 in March, from the oilfields of north-eastern China to Wall Street before landing in Hong Kong in the city’s highest-paid financial job. The exchange’s market capitalisation has doubled since Li took over the helm in January 2010 to HK$35 trillion (US$4.48 trillion) at the end of last week, and Hong Kong has seized the crown as the world’s hub for initial public offerings (IPO) in seven of the past 11 years.

“I have passed the most exciting 10 years of my career at the exchange with a dream team, and we have achieved what we want to achieved,” Li said during a teleconference with Cha, after the exchange posted a 13 per cent drop in first-quarter net profit. “It is the right time to call it a day as it will allow me to have 18 months to wind things up.”

The China Chairman of JPMorgan Chase & Co. before being hired to head the HKEX, Li is best known as the architect of the Connect programme, a series of cross-border investment channels that allow global investors to tap China’s yuan-denominated A shares and bonds, while letting Chinese institutions and individuals invest in shares and financial instruments listed in Hong Kong and London. The Connect programme now contributes to about 10 per cent of the HKEX’s revenue.

A successor to Li, dubbed “Mr China” since his investment banking days for his links to Chinese businesses, should know the financial markets of Hong Kong and mainland China inside out, said a senior government source, talking about the changing of guards on condition of anonymity.

Shares of HKEX, which are themselves listed on the city’s exchange, have risen 76 per cent since Li took over in 2010 to HK$246.40 each on Thursday, declining by as much as 4.1 per cent to an intraday low after he announced he would step down. The number of companies on the local exchange has more than doubled during Li’s tenure to 2,473 as of March.

“Thanks to his vision and leadership, Mr. Li has laid a solid and strong foundation for our stock market, rendering Hong Kong the largest IPO market in the world for seven times in the past 11 years,” said Hong Kong’s Financial Secretary Paul Chan Mo-po.

The rot reached deep into the exchange itself, with the city’s Independent Commission Against Corruption (ICAC) charging former senior executive Eugene Yeoh Kim-loong for accepting HK$9.15 million (US$1.18 million) in bribes between 2017 and 2019 to approve IPOs.

Li himself was not implicated in any wrongdoing or was part of any probe, but the episode marred the exchange’s credibility, so much so that any applicant to the chief executive’s post would need to pay special attention to governance, said the senior government source.

“It is likely the HKEX will hire a local to succeed Li, as he or she needs to know Hong Kong well,” said Joseph Tong Tang, chairman of Morton Securities.

Born in Beijing, Li spent his childhood in Gansu province in the country’s rural northwest. He got his first job at the age of 16 in 1977 during the twilight of China’s Cultural Revolution on an offshore oil rig.

Four years on, as China embarked on its market reforms, Li signed up for a course in English Literature at Xiamen University, where he would also meet his future wife. After graduating in 1984, he worked as a reporter for China Daily for two years before going on to earn two more degrees in the United States, including a law degree from Columbia University.

In 1994, a year after China started allowing mainland Chinese state-owned enterprises to list in Hong Kong, he began his career as an investment banker with Merrill Lynch in New York. The bank would move Li to Hong Kong in 1995 and make him president for China in 1999. In 2003, he joined JPMorgan as its China chairman, before moving to HKEX in 2010.

In his 15-year career as an investment banker, Li handled many deals for state-owned companies such as China Mobile, China Telecom and China National Offshore Oil Corporation (CNOOC).

Li would spend almost 12 years as chief executive of Hong Kong Exchanges & Clearing Limited when his terms ends next year, longer than Xavier Rolet’s almost decade-long tenure at the London Stock Exchange from 2009 to 2018. Li’s predecessor Paul Chow Man-yiu had two six-year terms at the exchange from 1991 to 1997, and then from 2003 to 2009. Richard Grasso spent eight years as head of the New York Stock Exchange, while the late Magnus Bocker spent six years at the helm of the Singapore Exchange (SGX).

His experience has proved crucial for HKEX’s successful diversification. “I have done a lot of things,” Li said. “I [have] made progress at each step, in terms of skills, experience and financially.”

He earned HK$28.97 million in salary, bonus and other benefits in 2018, which makes him the highest paid financial industry official in Hong Kong. He lives in the city with his wife and three dogs. Three grown-up children - a son and two daughters - live abroad but visit frequently.

An ardent footballer, Li is a regular - and competitive, by his own admission - player in the financial industry, finding time to take to the fields several times a week against teams from other stock exchanges and regulatory agencies.

“I may have more time to play football and may create a football team,” he said on his conference call, adding that he has no plans for the next step in his career.

With additional reporting by Yujing Liu, Peggy Sito in Hong Kong.

Help us understand what you are interested in so that we can improve SCMP and provide a better experience for you. We would like to invite you to take this five-minute survey on how you engage with SCMP and the news.