Financial watchdog SFC has fined 10 banks almost HK$1 billion for IPO failures … but investors got nothing. Now they’re demanding change

- Investors want compensation from banks found to have neglected their IPO sponsorship duties in cases where a firm collapses shortly after listing

- Hong Kong lawmaker Kenneth Leung said the city could consider setting up a compensation fund for IPO investors by collecting a fee from each new listing

Investors and lawmakers in Hong Kong are urging regulators to seek compensation for people who lose money when listed companies collapse shortly after their initial public offerings.

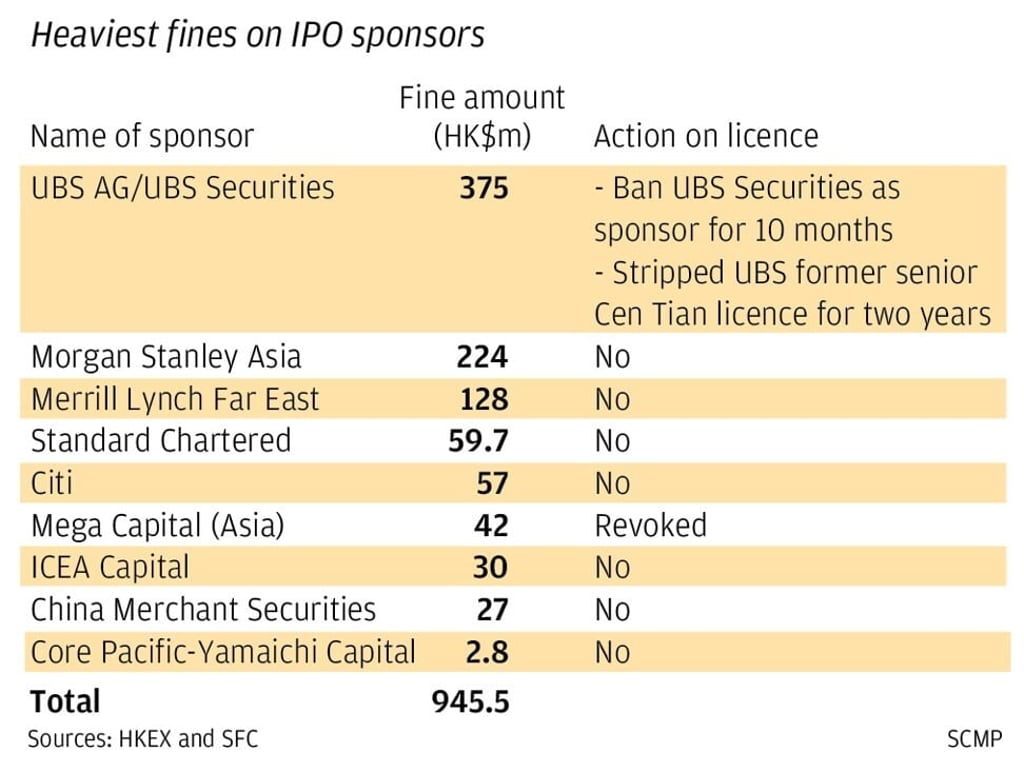

Under the current system, when banks sponsoring IPOs are found to have fallen short in their due diligence duties, the proceeds of any fine imposed by the watchdog goes to the government, not investors. Those fines amount to almost HK$1 billion (US$130 million) over the last 20 years, according to calculations by the Post.

In a recent example, one Hong Kong-based investor was left “shocked” after losing a large sum of money when the firm she had invested in 11 years ago was delisted.

Joan, who did not wish to give her surname, bought 15,000 shares in Real Gold Mining at between HK$9 (US$1.16) and HK$12 per share when it first listed in 2009 – a time when gold was performing very well.

Two years later the company’s shares were suspended, and then it was another nine years before they were delisted.