China’s health care companies rush to raise capital during fight against coronavirus pandemic

- Health care firms have raised US$7.9 billion in Hong Kong, Shanghai and Shenzhen so far this year, up from US$2.7 billion a year ago

- More biotech companies are pursuing dual listings in Hong Kong and mainland markets,says 3H Health Investment

Health care companies are raising capital at a faster clip this year in Hong Kong and mainland China, encouraged by supportive government policies and investors clamouring to participate in the sector’s growth.

The companies are riding on tailwinds created by increased government spending in the fight to contain the coronavirus pandemic, the race to find a vaccine and rising consumer adoption of technologies designed to supplement China’s overcrowded hospitals, industry experts said during a South China Morning Post webinar.

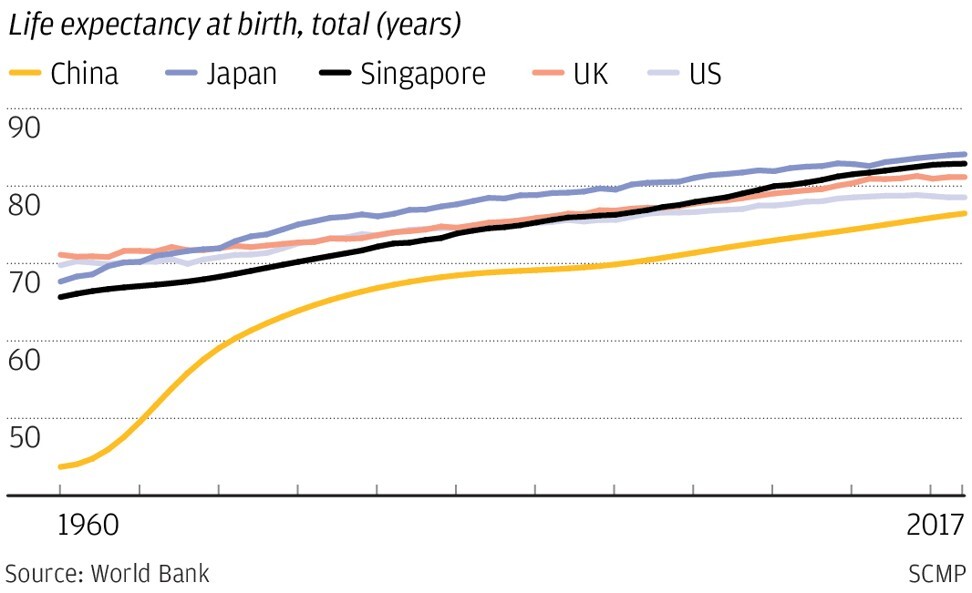

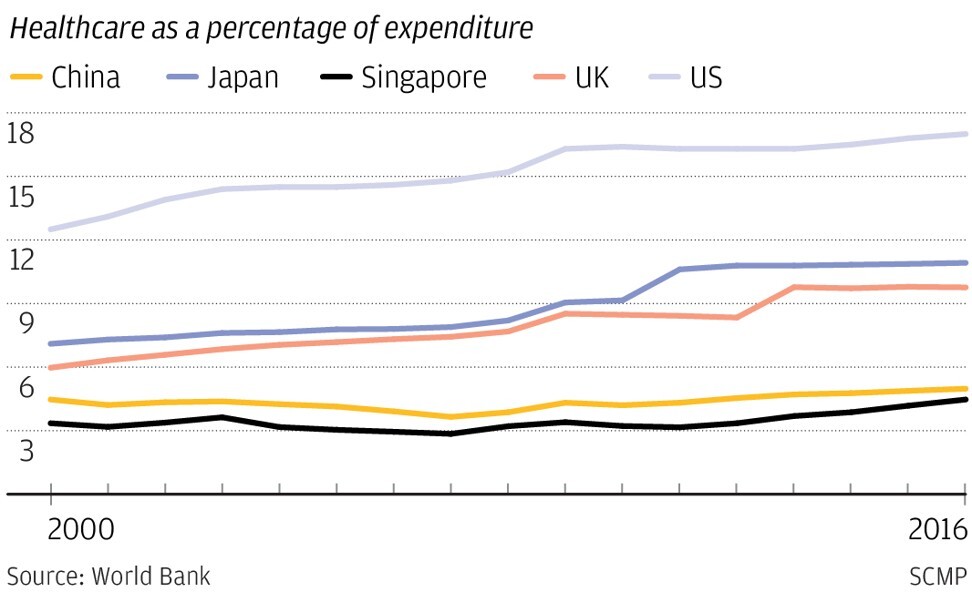

“This crisis has highlighted the gap in the quality of health care and the equipment between China and the developed world,” said John Woods, Credit Suisse’s Asia-Pacific chief investment officer, during the webinar on “Investment Opportunities in China’s Healthcare Sector after Covid-19”.

He noted that Wuhan, where the novel coronavirus originated, has 7.5 hospital beds per 1,000 people versus 4.3 beds per 1,000 in other parts of China, yet was still overwhelmed by the virus. Woods also pointed out that China has just four intensive care unit beds per 100,000 people, whereas the average across the Group of Seven largest economies’ is 16.6 beds.

“China needs more doctors,” he added as China has two per 1,000 people versus the G7 average of 3.2, despite China being the world’s most populous nation.

These data points will spur public investment in the broad provision of medical services for several years, said Woods.

To supplement this government largesse, Woods sees growth in privately run online medical services for patients seeking advice from doctors. Advances in diagnostic artificial intelligence can help address the shortage of doctors across China, reduce misdiagnosis rates and improve early disease detection, he said.

“These are all natural applications for AI-driven platforms and that’s where you will see a substantial amount of price appreciation,” said Woods.

Beijing has adopted a raft of policies in the past five years to support growth in the industry, including faster new drugs approval processes, and allocation of more funds to pay for innovative drugs from the national health insurance scheme.

“For the first time, the Chinese government is outspending the US in terms of R&D,” said Yang Liu, chief investment officer at Hong Kong-headquartered Atlantis Investment Management.

As a result, Liu is advising her clients to top up their investment in the sector. “It’s the ‘must’ overweight sector for the coming five years,” she said.

The changes on the two bourses match Hong Kong’s April 2018 listing rule reform, which propelled the local stock exchange to become the world’s second-largest market for biotech IPOs after New York.

Chinese biotech companies are keen to raise capital in Hong Kong, not just for the financial resources, but also for the international connections that come with a listing, said Dr Minchuan Wang, partner and managing director at private equity fund 3H Health Investment.

Hong Kong can help biotech companies reach international investors who can help them build relationships within the biotech industry internationally and boost collaboration across the industry.

“Collaboration is very important in biotech,” said Wang, in fields such as shared platforms and the exchange of ideas.

“Hong Kong has a unique position in this field,” said Wang, who has invested in about 30 biotech companies, more than half of which chose to list in Hong Kong.

However, more companies will also seek to benefit from burgeoning health care investment on the mainland via dual listings, he said.

3H Health Investment has backed Tianjin-based CanSino Biologics which has just won approval to list on Shanghai’s Star market in the next few months. The biotech firm hopes to benefit from favourable policies and strong investor appetite in both markets, said Wang.

“It’s good to have a foot in both markets,” he said.