US Senate’s bill to fence off Wall Street from Chinese companies may turn into a helping hand to Hong Kong stock exchange

- The US Senate passed a bill to fence off Wall Street from Chinese companies, requiring non-US IPO applicants to prove they are not owned by the Chinese government

- The bill follows proposed changes by the Nasdaq to raise the bar on IPO applicants

Hong Kong’s stock exchange may turn out to be the winner in the escalating tension between the US and Chinese capital markets, after the United States Senate passed an unprecedented bill to fence off Wall Street from Chinese companies.

“Chinese companies with smaller market capitalisation have tended to list in the US due to better liquidity” in the world’s largest and deepest capital market, said BNP Paribas’ Asia head of equity capital markets Christopher Wong. “With tighter listing requirement by Nasdaq, and increasing US-China tension, the Hong Kong stock exchange would stand to be the beneficiary.”

Shares of Hong Kong Exchanges & Clearing Limited (HKEX), the exchange operator that is itself listed on the city’s bourse, advanced for a fifth day, jumping by as much as 2.9 per cent to an intraday high of HK$273.40, their highest level in almost four months.

The heightened scrutiny of Chinese companies follows the order given last week to kick out Luckin Coffee for accounting fraud, the first expulsion of a China-domiciled listing from Nasdaq. The Xiamen-based company, which has touted itself as the Starbucks of China, admitted on April 1 that 2.2 billion yuan (US$310 million of its sales had been fabricated.

Luckin Coffee’s scandal underscored the distrust of the US financial markets of Chinese companies, as they lack on-the-ground access to the companies’ books. The non-profit PCAOB, which oversees the audits of US-listed public companies, has singled out four markets – Belgium, China, France and Hong Kong – whose accounts are restricted to US auditors.

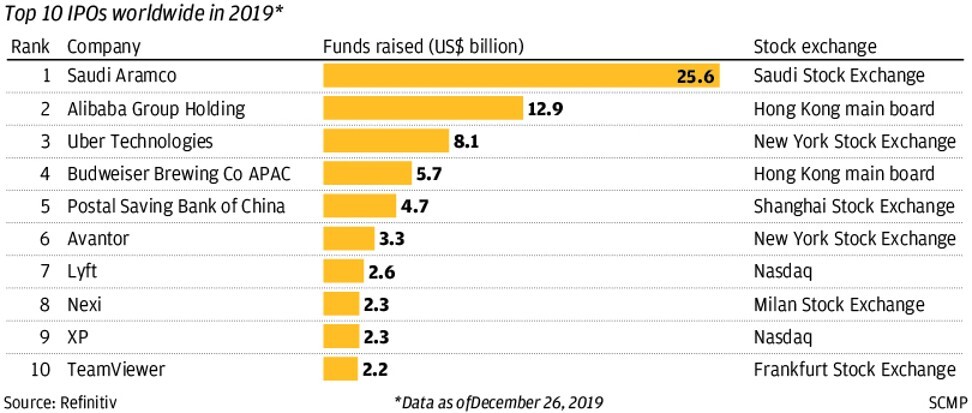

While Belgium and France each had bilateral agreements – the French agreement lapsed in December and is pending a renewal – with the US that allow American auditors access, it’s the Chinese restriction that rankles, especially since Chinese companies had been making greater inroads on Wall Street. The US$25 billion IPO in 2014 by this newspaper’s owner Alibaba Group Holding in New York still holds the record for the most amount of money raised in an American exchange.

Shares of Luckin Coffee, which said it would appeal Nasdaq’s expulsion order, plunged by 35.7 per cent overnight as shareholders rushed for the exit. Luckin Coffee’s major shareholders included Singapore’s GIC and the Qatar Investment Authority, according to filings in January and February.

Between 2018 and May this year, just 2.3 per cent of the overall IPO proceeds raised by Chinese companies were from deals below US$25 million, or about a third of the 52 IPOs from Chinese issuers, data from Refinitiv shows. Hence, the impact from this proposed listing rule would unlikely put a big dent in the overall proceeds raised by Chinese firms, bankers said.

To be sure, a US$25 million minimum is not quite as onerous as it looks, given the higher valuations that Nasdaq applicants can get, compared with other markets. The US exchange trades at 36.8 times current earnings, more than three times higher than the 10.1 times on the Hang Seng Index, and 8.1 times on the Hang Seng China Enterprises Index.

As at Tuesday, the Nasdaq Composite has been steadily gaining nearly 34 per cent since this year’s low seen at 6879.5 reached on March 20th. Despite the coronavirus, there is still liquidity in the capital market chasing after new stocks as more central banks globally have launched asset buying programmes and lowered interest rates close to zero.

“Given the US stock market has risen that much, the price-to-earning multiples that these new issuers could be valued at in the US would likely be higher,” assuming that these Chinese companies’ revenue could return to pre-coronavirus level, said Jeffrey Sun, a partner in Shanghai at the law firm Orrick.

This has all been made possible by reforms made in the Hong Kong listing rules in 2018 that enable for companies with weighted voting rights to list in Hong Kong, which led to Alibaba’s US$12.9 billion mega IPO last November. That was followed by reports that JD.com and NetEase.com are also planning secondary listings in Hong Kong.

“Hong Kong has always played second fiddle when it comes to listing of Chinese companies in the new economy and biotech sectors, with the US always being on forefront. But over the last few years HK has made good progress in encouraging listing by these companies through a series of reforms,” said Wong.