Covid-19, less deadly than Sars, takes a heavier toll on Hong Kong’s financial markets and economy than the 2003 outbreak

- Covid-19 has taken a far greater toll on Hong Kong’s financial markets and economy in seven out of 10 measures, compared with the city’s 122-day brush with Sars 17 years ago

- Stock market transactions rose, while home prices are holding up better this time compared with Sars in 2003

“I see no future this time around,” in an unprecedented crisis compared with Hong Kong's struggle with the 2003 severe acute respiratory syndrome, or Sars, Fong said during a recent interview. “The business is so bad that I lost 90 per cent of business in the first four months. It was never so bad in my 50 years of working as a tailor.”

Covid-19, as the coronavirus pandemic is called, has extracted a far greater toll on Hong Kong’s financial markets and economy in seven out of 10 measures, compared with the city’s 122-day brush with Sars 17 years ago, based on calculations by South China Morning Post. The one-two punch from the protests and Covid-19 has pushed the city’s economy into its deepest recession in decades.

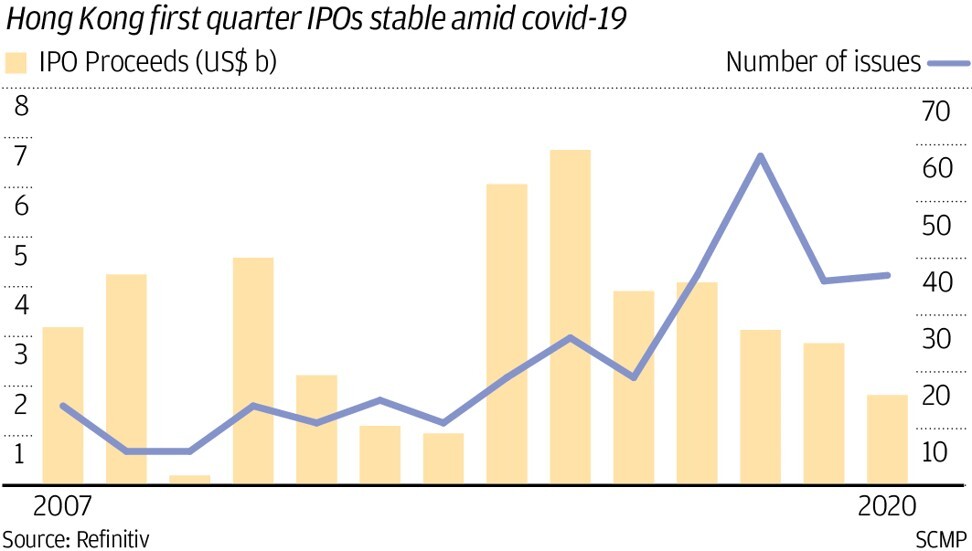

The economic cost was far greater this time around. The city’s Hang Seng benchmark stock index fell and the amount raised through initial public offerings (IPOs) contracted, while indicators plunged in economic output, total export, employment, retail sales and tourist arrivals. Turnover in the stock market rose during the period, owing to increased volatility as global central banks unleashed an estimated US$8 trillion to stave off a worldwide recession during the pandemic’s spread.

It's a slump that is driving the city's financial tsar to reach deep for a solution.

“This time around, the outbreak is much more severe, widespread and prolonged” compared with Sars, which was “a regional epidemic affecting mainly some regions of China, and [which] only had a limited impact worldwide,” said Hong Kong's Financial Secretary Paul Chan Mo-po, writing in response to queries by South China Morning Post. “Also, the external environment is not as favourable. The same formula we used last time will not be sufficient” this time, Chan said.

“I believe the cash payout will encourage local consumption, and improve the income of workers and enterprises, and help set the stage for economic recovery,” he said.

The pandemic gathered pace and spread to all corners of the globe in February, and it’s now afflicting almost 5 million people worldwide and killing more than 300,000 people. The health crisis drove governments to impose varying degrees of quarantine, stay-at-home orders and lockdowns. Business executives and tourists alike stopped flying to Hong Kong, causing hotels, restaurants and bars, and retail shops to sit empty. Up to 78,500 jobs were lost by the end of April, extending the unemployment queue to 202,500, compared with 54,000 jobs lost amid 300,000 jobless during Sars.

The banks are also getting some help, in the form of government guarantees so that they can continue to lend money without fear of risks, similar to the support offered in 2003. The scheme, which covers more industrial sectors this time, has extended HK$2.9 billion of support to 1,300 applicants three weeks since its launch, six times more than the financial support during Sars.

“By its very nature, the pandemic will go one day, and things will eventually return to normal,” Hong Kong’s financial secretary said. “Hong Kong will hopefully be able to come out of the recession gradually in the second half of this year.”

Still, Chan’s optimism may be pushed back, if Hong Kong’s anti-government protesters return to the streets.

Hong Kong’s cafes, restaurants and entertainment venues are bearing the brunt of the economic slump caused by the Covid-19 pandemic, said Allan Zeman, the entrepreneur dubbed the Father of Lan Kwai Fong for his lead in turning the area into Hong Kong’s dining and clubbing hub with 300 bars and restaurants.

“Some restaurants, which have operated for several decades, have decided to close permanently,” Zeman said, adding that many tenants are demanding between 20 and 50 per cent cuts in rent. “They passed through Sars but not the current pandemic. That is very sad.”

Still, not every number pointed downward. The average daily turnover in Hong Kong’s stock market jumped 14 per cent during the first four months of this year, as the pandemic and the financial aid by global central banks caused stock traders to rush out, only to return in droves.

The amount of capital raised in Hong Kong through initial public offerings (IPOs) plummeted 60 per cent while Covid-19 raged on, pushing the city to fifth position in the global rankings, far worse than the 30 per cent decline during Sars.

The “crisis highlights the importance of research and development in life sciences, biotech and technology, which enable changes in [our] ways of working and [in our] behaviour,” said Andrew Weir, chairman of the Hong Kong stock exchange’s listing committee, in a written comment. Four health care companies raised a combined US$1.2 billion through IPOs during the pandemic, representing 60 per cent of funds raised on the Hong Kong exchange during the period.

“Covid-19 is a game-changer for all types of businesses, because people have been forced to stay home and work remotely,” benefiting any business that operates online, said Yat Siu, co-founder and chairman of online gaming developer Animoca Brands in Hong Kong. “The same did not happen during Sars. Overseas companies avoided companies in Hong Kong, which was the centre of the outbreak. Covid-19 is a global pandemic, so that sentiment of shunning Hong Kong has not occurred this time.”

The online migration of business activities and personal behaviour is here to stay even if the pandemic were to end, as shown by data of the Hong Kong Monetary Authority’s faster payment system. Average daily turnover on the system, which lets more than 4 million people transfer money through smartphones or personal computers, jumped 60 per cent to 267,000 transactions in March, compared with December.

“It has become a new normal,” Siu said. “Massive number of people have quickly become used to seeing online as the primary means for shopping, work, and playing games while staying at home. The companies that cannot shift their business models to focus their efforts online may find it difficult to survive.”

That change may be a bridge too far for Fong the tailor, who learned his craft from his late father when he was 20 years old.

Ship Street, where his 200-square foot (18.6 square metres) hole-in-the-wall shop sits, has turned into one of Hong Kong's prime dining neighbourhoods, complete with a 2-Michelin star restaurant and two eateries that charge at least HK$120 (US$15) for a designer hamburger.

Like many small and medium enterprises (SMEs) in the city, Fong’s business cannot move online. His suits, shirts and overcoats depend on personal contact with the customer for that perfect fit.

“The social unrest from mid last year has already discouraged overseas businessmen to come. This year, the Covid-19 is worse. The hotels, bars, restaurants are all empty, so does my shop,” Fong said. “I have no choice but to retire, although I think I am still too young to stop working. The outbreak has cut my career short. ”

Help us understand what you are interested in so that we can improve SCMP and provide a better experience for you. We would like to invite you to take this five-minute survey on how you engage with SCMP and the news.