Bitcoiners go wild after Goldman defies expectations with report dismissing cryptocurrency as akin to tulip mania of the 1600s

- In its much-anticipated report, Goldman Sachs said it does not recommend bitcoin on a strategic or tactical basis for clients

- One by one, Goldman’s report laid out the rebuttals against many of the merits cited by cryptocurrency enthusiasts

Goldman Sachs just forged a lot of new enemies – in the cryptocurrency world.

Buzz that Goldman would release a report discussing the state of the economy as well as gold and cryptocurrencies set enthusiasts ablaze, with many hoping the bank would finally put its weight behind digital tokens. But Goldman disappointed and upset many once details of its report were brought to light, with the bank blasting bitcoin and other coins as unsuitable investments for its clients.

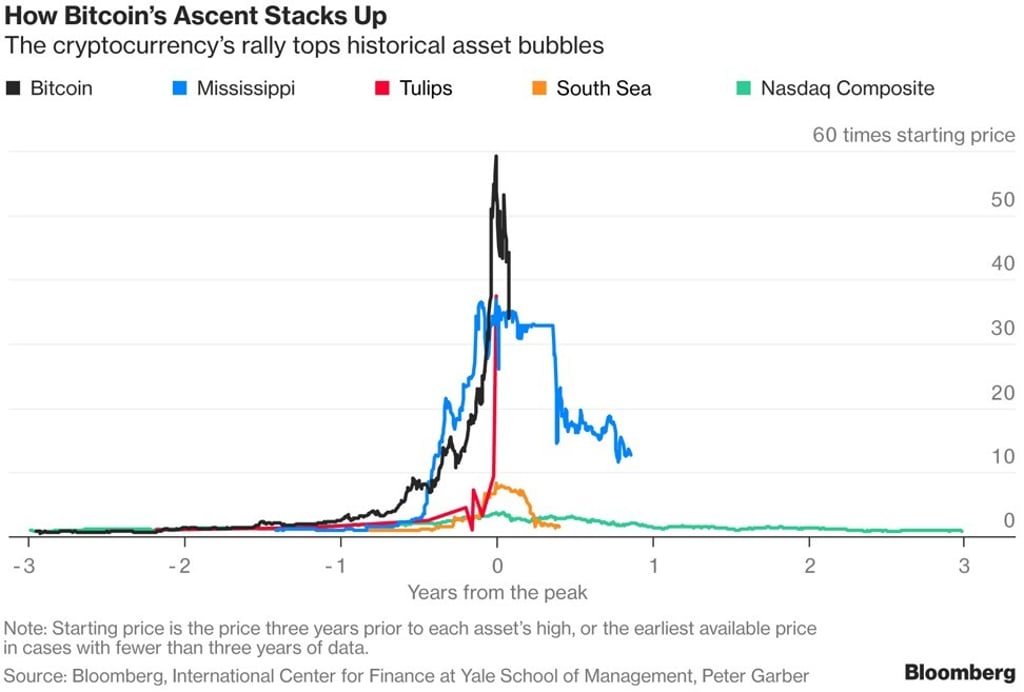

“We do not recommend bitcoin on a strategic or tactical basis for clients’ investment portfolios even though its volatility might lend itself to momentum oriented traders,” said the Goldman report, the contents of which were discussed on a call Wednesday featuring the firm’s Jan Hatzius as well as Harvard’s Jason Furman. The report compared Bitcoin’s run to the tulip mania of the 1600s in the Netherlands, one of the most infamous instances of speculative bubbles.

One by one, Goldman laid out rebuttals against many of the merits frequently cited by cryptocurrency evangelists that aim to hold up the superiority of the digital tokens. Cryptocurrencies, including bitcoin, are not an asset class – they do not generate cash flow or earnings and do not provide consistent diversification benefits. Nor is there evidence they are an inflation hedge, the report said.

While hedge funds might find digital tokens appealing due to their high volatility, that allure alone doesn’t form a viable investment rationale, according to Goldman.

Bitcoin investors often cite its limited supply, capped at 21 million, as a catalyst for an ultimate price surge. But, Goldman said, cryptocurrencies as a whole are not a scarce resource. For instance, some of the largest cryptocurrencies, including the bitcoin-offshoot bitcoin Cash, were formed following a programming fork. The bank also cited recent illicit activities tied to cryptocurrencies, including Ponzi schemes, ransomware attacks and money laundering.