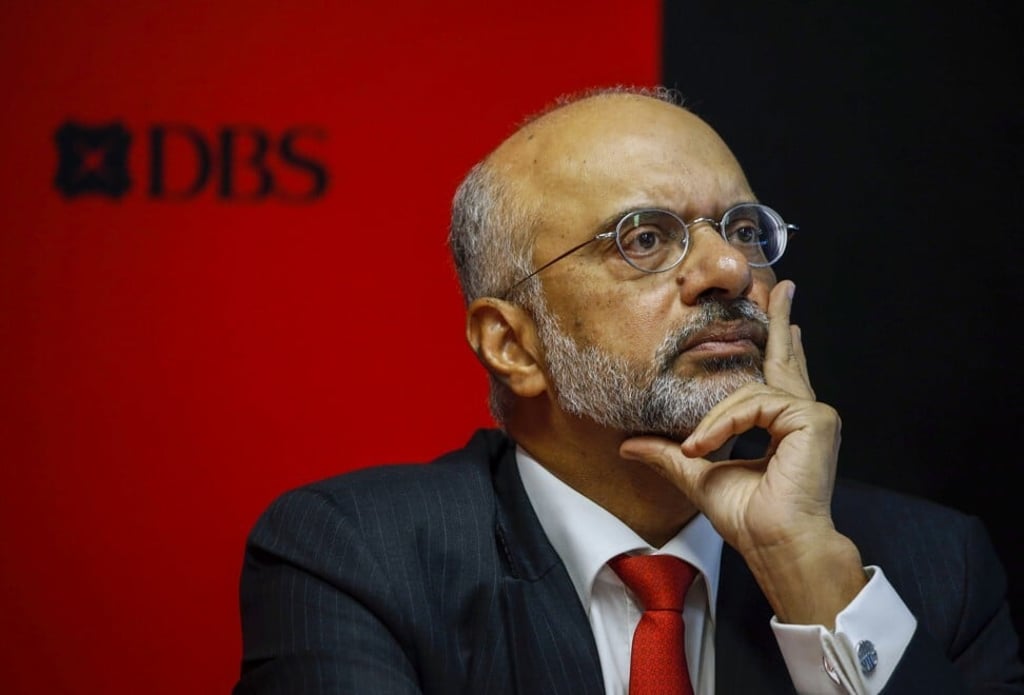

DBS CEO Piyush Gupta warns of correction as financial markets disconnect from real economy and IMF prepares to downgrade views

- Economic recovery likely to be ‘long and drawn out,’ according to Piyush Gupta, CEO of Southeast Asia’s biggest banking group

- Emotions are ‘running wild’ as investors react to geopolitical, stimulus news, JP Morgan Asia-Pacific boss says

A “liquidity-driven boom” is creating a dislocation between the real economy and the financial markets and a correction is likely “somewhere along the line,” according to Piyush Gupta, the chief executive of DBS Group Holdings of Singapore.

Speaking at the Bloomberg Invest Global virtual conference on Tuesday, the head of Southeast Asia’s biggest banking group said the amount of stress on the real economy will be “huge” after months of lockdowns from New York to Singapore because of the coronavirus pandemic.

The viral outbreak last quarter caused a slump in economies from the US to China and Europe “unlike anything the world has seen before,” according to the IMF, while stock-market losses have evoked some parallels to the Great Depression era. The threat of a second wave of infections in recent weeks are threatening an early rebound, putting policymakers on notice for more liquidity stimulus.

“Everything suggests the recovery is going to be long and drawn out, including in China,” Gupta said. “I don’t think this V-shaped recovery is going to persist. China needs demand from the rest of the world as well.”

The global economy is in for an extended period of slow growth, he said, making it hard to justify strong corporate earnings. Without that backing, it is equally hard to justify that markets will rise forever, he added.