Advertisement

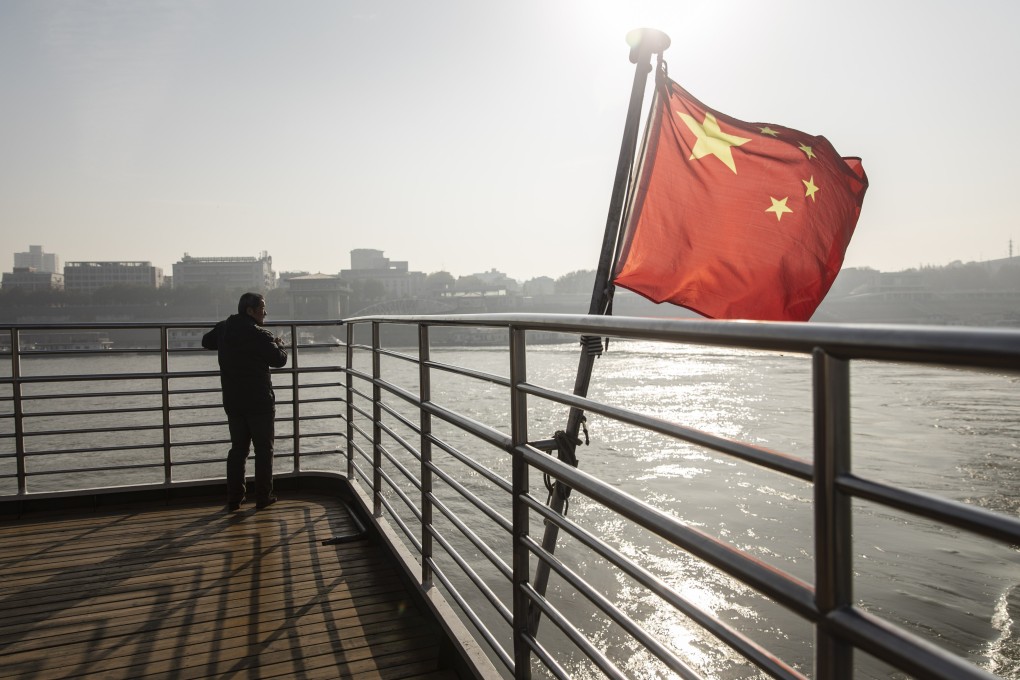

Foreign companies on China M&A deal spree as Beijing further opens up financial, auto sectors

- Inbound M&A activity surpassed outbound deals as companies capitalised on further liberalisation in mainland, bankers say

- Rising tensions with US, greater scrutiny discouraged overseas deals by Chinese firms

Reading Time:3 minutes

Why you can trust SCMP

Wall Street banks and carmakers led foreign companies into China this year as the government eased ownership limits and economic recovery hopes grew. Chinese investors, bothered by greater scrutiny overseas, simply flexed their financial power at home.

Inbound mergers and acquisitions (M&A) reached US$13.4 billion this year through June 19, versus US$12.5 billion of outbound deals, according to data provider Refinitiv. This would be the second straight year the scale is tipped at half-year mark. Such a feat has not happened on an annual basis since 2005.

“With China’s further opening up, the enthusiasm of foreign investors on mergers and acquisitions in mainland China will gradually increase,” said Cherrie Shi, senior counsel at the law firm FenXun Partners in Shanghai. Liberalisation policies have laid the foundation for higher levels of foreign investment, she added.

The foreign appetite in M&As in China came against the backdrop of rising tensions and economic calamity caused by the US-China trade war, the coronavirus pandemic and new security laws in Hong Kong. They have stoked global concerns about Chinese-funded deals in sensitive industries, forcing Chinese buyers to focus at home.

Advertisement

The likes of Goldman Sachs, JPMorgan Chase, HSBC and UBS have helped propel a rash of deals to acquire controlling stakes in their mainland securities, insurance and fund management joint venture units. German carmaker Volkswagen was the highlight in the auto sector.

German carmaker Volkswagen agreed to pump more than 2 billion euros (US$2.3 billion) to acquire a 50 per cent stake in the parent of its Chinese electric-vehicle joint venture and to buy a 26 per cent stake in a Chinese battery supplier.

Advertisement

“Foreign appetite for assets in China will remain robust, despite the chorus of political decoupling and economic reshoring talk, as long as China represents a sizeable share of global growth,” Rhodium Group partners Thilo Hanemann and Daniel H. Rosen wrote in June 18 report. “Over the past 18 months, we have recorded levels of foreign M&A into China that were not seen in the previous decade.”

Advertisement

Select Voice

Select Speed

1.00x