Exchanges take shape in Macau, Guangzhou to turbocharge southern China’s Greater Bay into Asia’s largest financial market

- Second instalment on Hong Kong’s role in the Greater Bay Area looks at how the city, Macau, Guangzhou and Shenzhen could form Asia’s top financial marketplace

- The up-and-coming Macau exchange is a Nasdaq-like market that helps start-ups raise capital, while Guangzhou’s explores carbon emission futures trading

Two new financial markets are taking shape on the drawing boards in southern China, with the potential to turbocharge the Greater Bay Area (GBA)’s economic growth engine. This is the making of Asia’s largest and peerless capital market.

A carbon futures exchange is due for commencement this year in Guangzhou, augmenting the brisk transactions of emission certificates that had been ongoing in the Guangdong provincial capital since 2013. Across the Pearl River in the special administrative region of Macau, state planners are huddling with consultants to kick start a Nasdaq-like stock exchange that can help start-ups and growth companies raise capital.

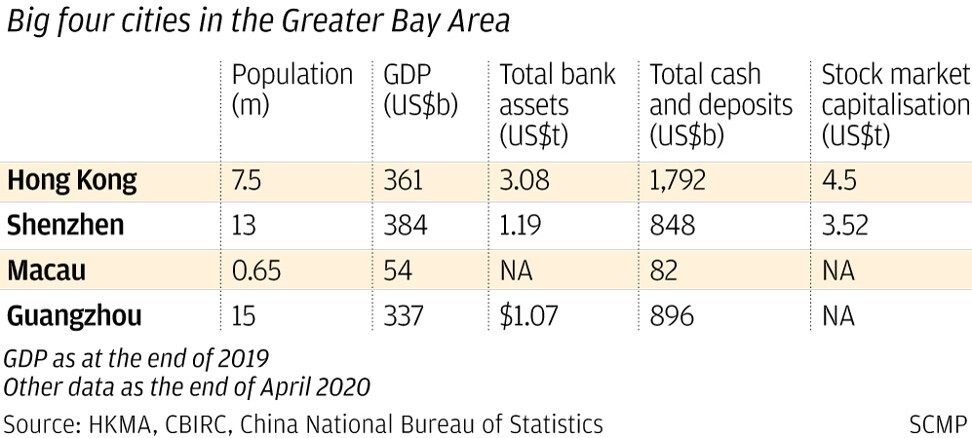

The up-and-coming Guangzhou and Macau bourses would add to the US$8.84 trillion of combined market capitalisation of Hong Kong and Shenzhen, where the equities and corporate bonds of 4,769 companies change hands, making the region Asia’s largest capital pool.

“Each market will have its unique role and clear financial product differentiation,” said Christopher Hui Ching-yu, Hong Kong’s Secretary for Financial Services and the Treasury, during a recent interview. “With the development of the Greater Bay Area, financial business will grow and it can support multiple exchanges. The US and many other overseas markets also have several exchanges and financial centres.”

The plan underscores the long-term ambition and prospects for the GBA, which can be considered the world’s 11th largest economy ahead of Russia and behind Canada, if the US$1.65 trillion combined output from its 11 cities including Hong Kong and Macau were counted as a stand-alone entity.

With the Chinese government’s imprimatur and financial heft behind it, the GBA’s population is poised to expand by 43 per cent to 100 million over the next 15 years, according to one official forecast.

The four cities picked to host the various exchanges have 36 million residents between them – half of the GBA’s current population – and US$3.62 trillion in bank deposits, giving them the capital pool to support corporate fundraising.

The four markets can help broaden the offering of financial instruments and products, a crucial step in attracting more capital inflow, said Johnny Lam, a divisional councillor of CPA Australia.

“The key success factor is to differentiate the market position and role of each bourse in the GBA,” Lam said.

Hong Kong is the oldest financial market of the quartet, tracing its root to 1891 during the British colonial era when shares of such companies as Hongkong and Shanghai Hotels changed hands.

The Hong Kong Exchanges and Clearing Limited (HKEX) – the market operator itself – was formed 20 years ago through a consolidation of a futures exchange, a pre-existing stock exchange and three clearing houses.

Since then, HKEX has grown into the world’s largest destination for initial public offerings (IPOs), topping the global ranking seven times in the past 11 years, offering an attractive place for such Chinese companies as Alibaba Group Holding, Tencent Holdings, and Industrial and Commercial Bank of China (ICBC) to raise capital.

China’s regulator gets tough on insider trading with record penalty

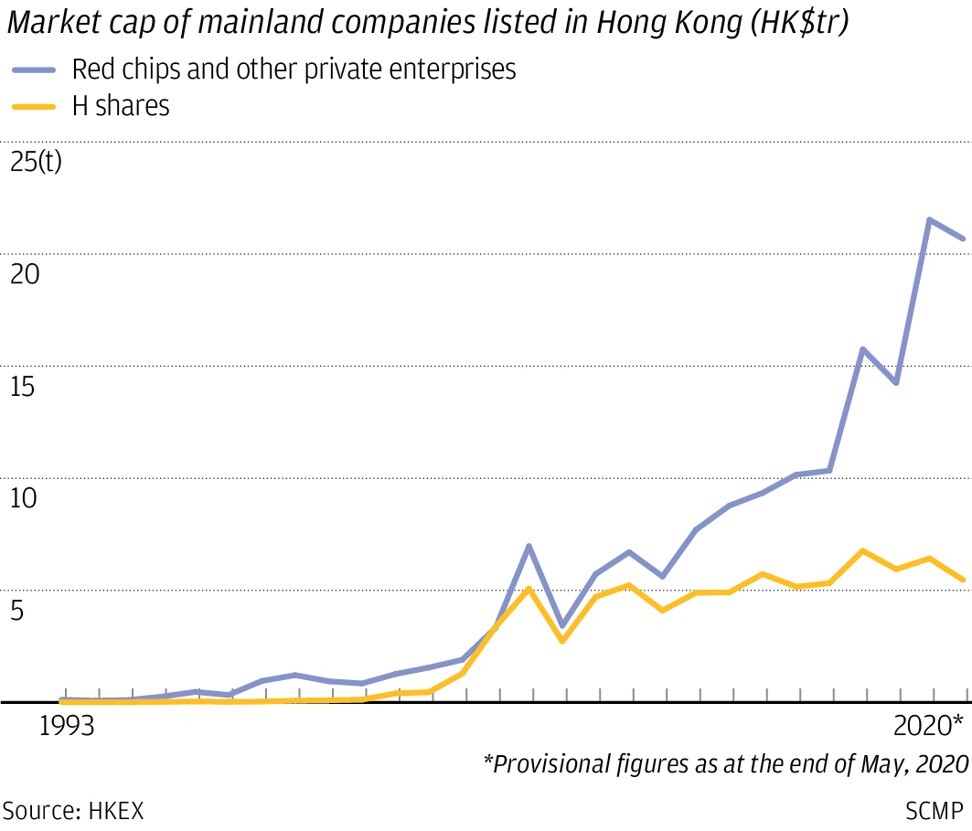

Tsingtao Brewery, China’s best-known beer exporter, was the first Chinese company to raise funds in July 1993, with an HK$889 million (US$115 million) IPO. Some 1,260 companies have since followed, raising an estimated HK$3.19 trillion (US$412 billion) along the way. They make up about 80 per cent of the total market value and turnover on the city’s exchange.

“International companies look at Hong Kong as the more important market and will be more willing to come here to seek listings,” said the HKEX’s listing committee chairman Andrew Weir, adding that the GBA will be the next driver for the exchange’s growth.

A slew of listing reforms in 2018 would become the most consequential game-changer in the HKEX’s history, as it opens the way for technology start-ups with multiple classes of shares and pre-revenue biopharmaceutical firms to raise funds.

In the aftermath of hardline policies in the US against New York-listed Chinese companies, Hong Kong would also be the most attractive alternative market, with its fully convertible currency and deep capital pool.

“China and the rest of the world need each other,” the HKEX’s chief executive Charles Li Xiaojia wrote in a blog to mark the exchange’s 20th anniversary that falls on June 26. “We are not only aiming to be the most important financial market leader in the Asia time zone, but we also aspire to remain the critical juncture where China embraces the world and the world embraces China.”

CPA Australia’s Lam said the HKEX should push the reform further by lowering the HK$40 billion threshold of minimum market value to allow more US-listed mainland tech firms to list here.

Shenzhen, across the border from Hong Kong and the Petri dish for China’s experiments with market capitalism, started its stock exchange in 1990. The first stock to be traded on the exchange was Shenzhen Development Bank, a state-owned lender that later evolved into what is now known as Ping An Bank.

The exchange, capitalised at 27.2 trillion yuan (US$3.9 trillion) and is about 30 per cent smaller than Hong Kong’s, specialises in helping smaller technology companies raise capital.

From 2010 until last week, 625 companies raised US$230.7 billion in Hong Kong, while 1,410 stocks raised US$138.42 billion in Shenzhen, according to Refinitiv data. A raft of reforms on the ChiNext board for start-ups, including a registration-based IPO system akin to Nasdaq, would make it easier for up-and-coming companies to raise money.

“Hong Kong is an international financial centre, while Shenzhen [is] still not yet fully open to global investors,” said Jeffrey Chan Lap-tak, founding partner of Oriental Patron Financial Group. “Companies which want to have international exposure like to list in Hong Kong.”

The Chinese government has a different set of plans for Macau, the only place on Chinese soil where casinos are legal, outlining a litany of policies to diversify the territory’s economy from gambling and tourism.

Its vision for a Nasdaq-like exchange would offer another alternative destination for start-ups in GBA to raise capital, and tap into the fundraising needs of the Lusophone Commonwealth, the Portuguese-speaking world of which Macau is.

“As a former Portuguese colony, Macau is the ideal gateway for companies in the Portuguese-speaking countries to enter the Chinese market,” Lam said, adding that the new bourse would need five years to build and gear up.

“China’s first-quarter trade with [the Lusophone] reached US$31.97 billion,” he added. “Along with China’s economic reforms, more companies from these countries, with a total population of 260 million, will increase their presence in the GBA.”

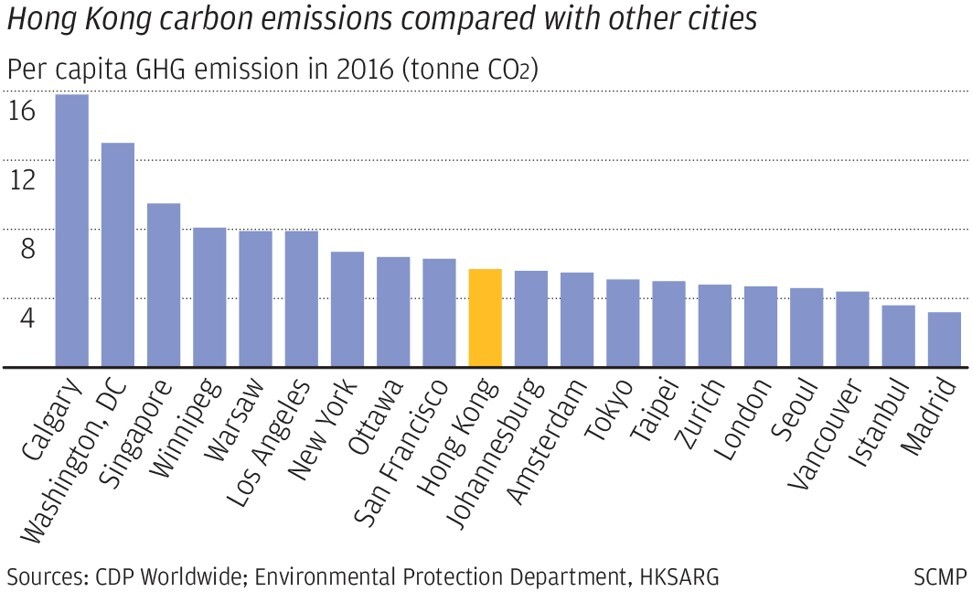

China’s financial-market authority on May 14 published some guidelines on the mechanics of a carbon emissions exchange in Guangzhou, the Global Times reported, along a plan for an environmental equity trading and financial services platform for the Greater Bay Area.

Carbon emissions options and futures were expected to be among the exchange's initial offerings, the report said. One denominated in foreign currencies will be put on a trial run and qualified overseas institutional and individual investors will eventually be allowed to trade the products in yuan or foreign currencies, it added.

Hong Kong health care firms lead the way in Greater Bay Area integration

HKEX is also joining the game. The bourse last week announced the launch later this year of a portal called STAGE to allow companies to promote their green bonds or other investment products that comply with ESG standards, without any charges. Issuers, however, must list their products on the exchange and pay the listing fee.

“The introduction of the STAGE portal shows that HKEX is ready to play a crucial role in the development of green financing and ESG integration into investment and financing strategy, amid increasing competition in the region,” said Grace Chong, the counsel of Singapore and Hong Kong region of international law firm Simmons & Simmons

While Guangzhou will be an onshore market, HKEX allows international investors to trade. The city can attract green products to list, only behind the CME Group and the Intercontinental Exchange in the US, Chong said.

Hong Kong will continue to be the gateway to the GBA for thousands of small-and-medium enterprises, as well as the giant transnational corporations, said the Hong Kong General Chamber of Commerce chief executive George Leung Siu-kay.

“The population and potential market for these companies will expand from 7 million in Hong Kong to 70 million in the bay area, reaching 100 million if you include the mobile population” of migrants and temporary residents, Leung said. That is attractive “not just for the large companies, but also the SMEs”, he said.

To make the plan work, many of the practical and logistics details of living and working in the GBA need to be ironed out, he said.

Many companies are interested in setting up a business or to invest in the GBA area as it has a big market. However, it is very complicated and inconvenient for them to register a business, buy a home, apply for a driving licence or open a bank account, Leung said.

The chamber will work with authorities and other parties to address these practical issues over the next few years, he said.

“We want to make sure it is easy and convenient for all to do business, live, work and retire in the bay area. If that can be done, the Greater Bay Area will be a great place to do business and to live in the world,” Leung said.