China loosens rules on fund flows between Greater Bay Area cities, in a partial relaxation of capital controls

- Wealth Management Connect will encourage big players such as UBS, HSBC and other private banks and fund houses to increase investment in Hong Kong

- Bay area has high number of wealthy people, including China’s richest man Pony Ma, who is founder of Tencent Holdings

China’s government will loosen the rules on two-way fund flows between nine cities in the nation’s southern Guangdong province with Hong Kong and Macau, taking a tentative step toward partial relaxation of its capital controls.

Greater Bay is shaping up as Asia’s largest capital market. Here’s how

The partial liberalisation of China’s capital control could also act as a buffer against the sanctions and censures adopted by the United States and European Union against China’s enactment of the security law, as it cements the role of Hong Kong – the largest financial market, and second-biggest economy – in the 11 cities that make up the GBA.

The scheme adds to the litany of cross-border Connect investment channels since 2014 that have gradually widened two-way investments flows in equities and fixed-income financial products between mainland China and Hong Kong. It also gives Hong Kong a leg up over other Asia-Pacific urban centres like Tokyo, Seoul, Singapore and Taipei as they vie to tap China’s 25 trillion yuan (US$3.5 trillion) wealth management market.

Guangdong province, where nine of the 11 cities of GBA are based, is China’s manufacturing hub, boasting the second-highest number of households with investible assets of more than 6 million yuan (HK$6.57 million), just shy of the Chinese capital, according to Hurun.

The scheme was welcomed by HSBC, Standard Chartered Bank and Bank of China (Hong Kong), the three issuers of currency notes in the city.

“GBA, the wealthiest urban cluster in China, is one of the world’s largest banking clusters with expected banking revenues to reach US$185 billion by 2025,” or a compound annual growth rate of 10.3 per cent, said HSBC’s Asia-Pacific Head of Wealth and Personal Banking Greg Hingston, in a statement. “The launch of Wealth Connect is good news for GBA investors looking to expand their investment opportunities and to build more diversified portfolios.”

The new connect scheme is the fourth cross-border investment channel between Hong Kong and the mainland since 2014, after similar ones linking stock and bond markets.

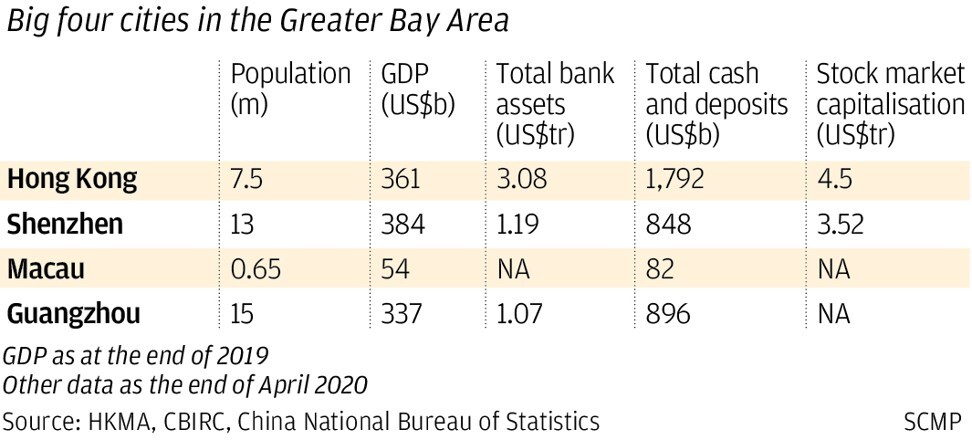

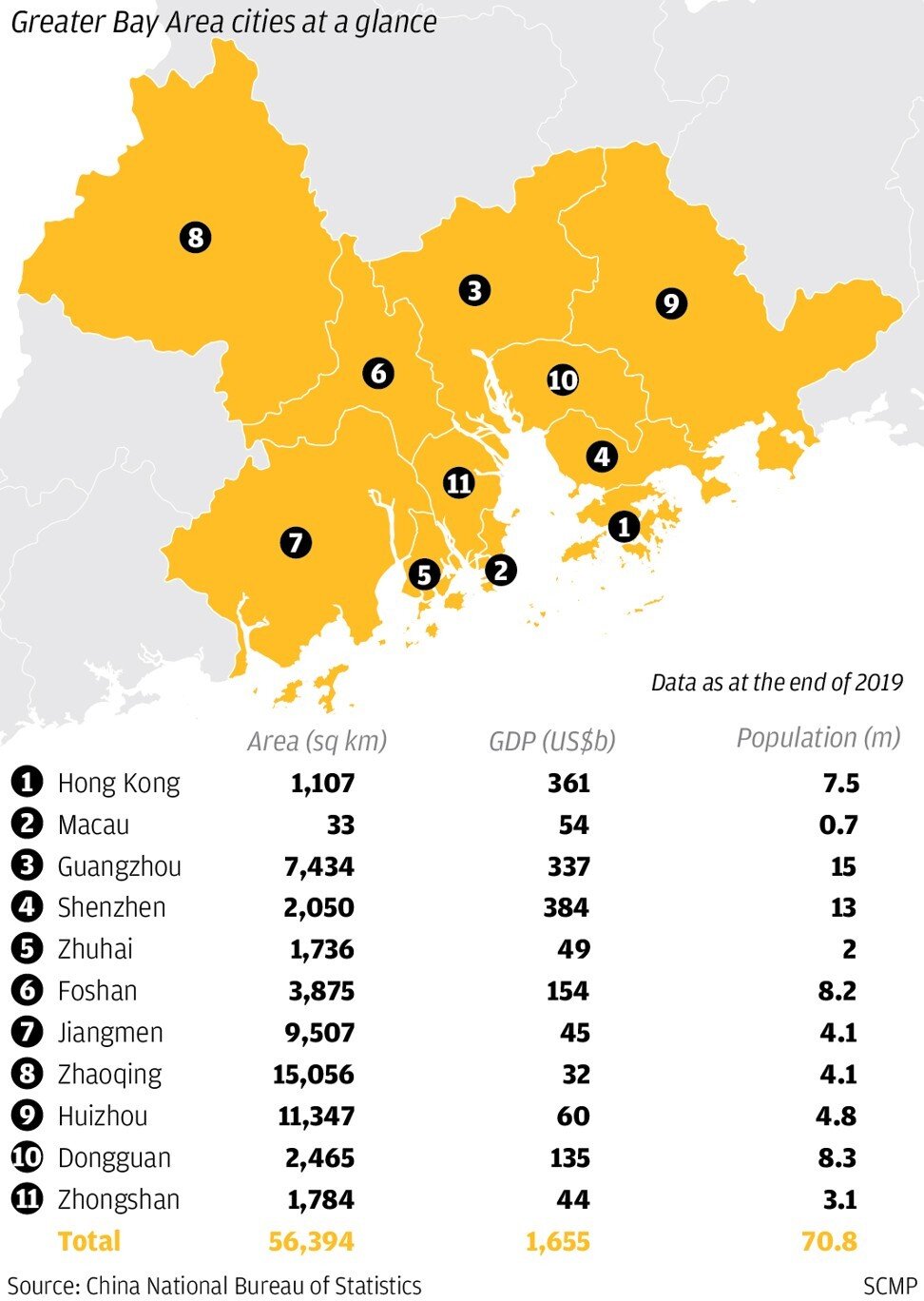

The 11 cities have a combined population estimated at 70 million and US$1.65 trillion in economic output, which makes the GBA the world's 11th largest economy ahead of Russia and behind Canada, if the cluster is counted as a stand-alone entity.

Hong Kong cannot ignore Greater Bay Area opportunities, experts say

The Wealth Management Connect will fuel assets under management in Hong Kong over the next decade, with global private banks and big players such as UBS and HSBC Holdings likely to tap into the opportunities in the bay area, according to a Bloomberg Intelligence report.

Funds authorised by the Hong Kong Securities and Futures Commission (SFC) “are well regulated and offer a wide variety of choices, in terms of asset classes, markets, investment strategies and currencies,” the Hong Kong Investment Funds Association (HKIFA), the industry guild, said in a statement after the announcement by the three monetary authorities.

“With the inclusion of authorised funds in the scheme, GBA residents will be able to build a more diversified portfolio so as to better manage risks and to capitalise on global investment opportunities.”

China’s legislature kicked off a special three-day meeting on Sunday to fast-track the passing of the security bill, considered a necessary legal instrument to empower the local government to crack down on organised attempts to fuel a secessionist movement.

“There are significant opportunities for the asset managers and insurers who create these wealth management products, as well as the banks who distribute them,” said Josephine Kwan, a partner at accounting firm PwC Hong Kong.

Veteran stockbroker says focus on mainland customers will pay dividends

International investors had traded A shares worth a total of 25.8 trillion yuan (US$3.6 trillion) through the schemes, while mainland Chinese investors had traded HK$11.04 trillion worth of shares in Hong Kong, as of the end of May.

Mainlander trading now represents about 5 to 10 per cent of local stock market turnover.

“We believe the proposed Wealth Management Connect scheme will provide more options for GBA residents to manage their wealth, and BEA is well-positioned to serve the different investment needs of our customers in the region,” said Adrian Li Man-kiu, Co-Chief Executive of Bank of East Asia, a family-run Hong Kong bank founded in 1918.