Asset manager Federated Hermes raises concerns over HSBC’s public support of national security law for Hong Kong

- Federated Hermes concerned law could have ‘adverse impact’ on human rights in the city

- Asset manager ‘engaging’ with HSBC to ‘fully understand’ its reason for supporting legislation

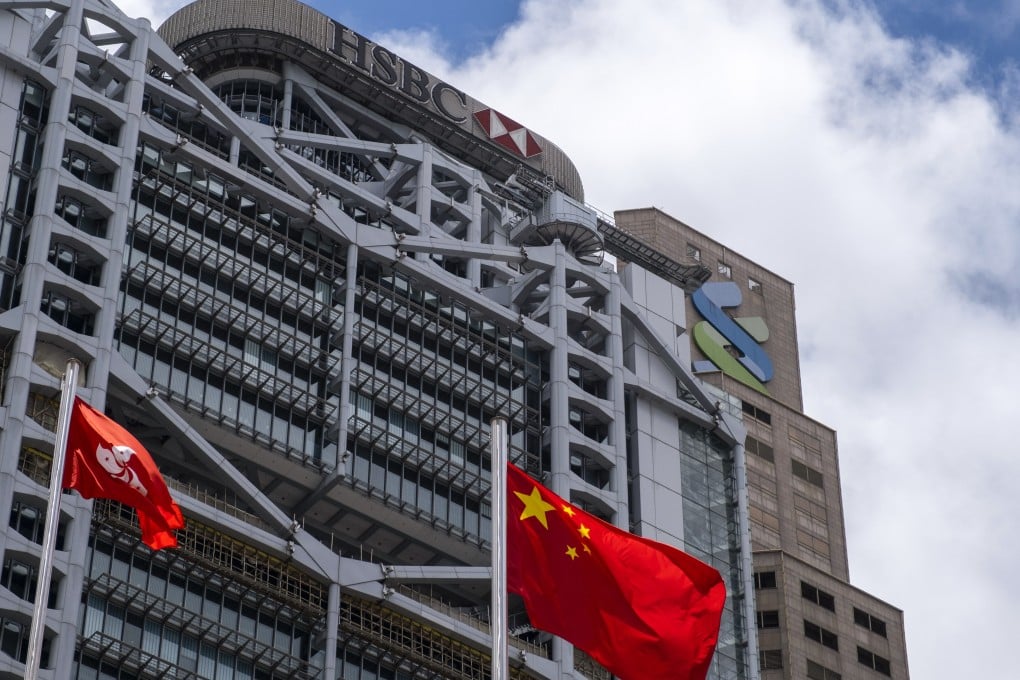

HSBC is facing more questions over its public support of a controversial national security law for Hong Kong.

The asset manager, which has a long history of focusing on environmental, social and governance (ESG) issues, said it was “engaging” with HSBC to “fully understand” the bank’s position as part of its EOS stewardship service, which acts on behalf of institutional investors. Federated Hermes has £859 billion (US$1.06 trillion) in assets under advice globally.

“We have questions on the bank’s statement amid concerns that the new law may have an adverse impact on human rights in Hong Kong,” Roland Bosch, the lead engager for financial services EOS at Federated Hermes, said in a statement. “We expect companies to support improvements in protections for citizens and not back their removal.”

06:21

Hong Kong and the US: how much do they rely on each other economically?