Advertisement

Chinese bankers in Hong Kong feel the sting of a tripling tax bill as China’s tax authority collects tariffs on citizens’ global income

- China’s tax authority last week moved to tax the global income of Chinese citizens worldwide

- That leaves Chinese professionals living in Hong Kong facing tax rate of as much as 45 per cent, compared with the previous 15 per cent

Reading Time:3 minutes

Why you can trust SCMP

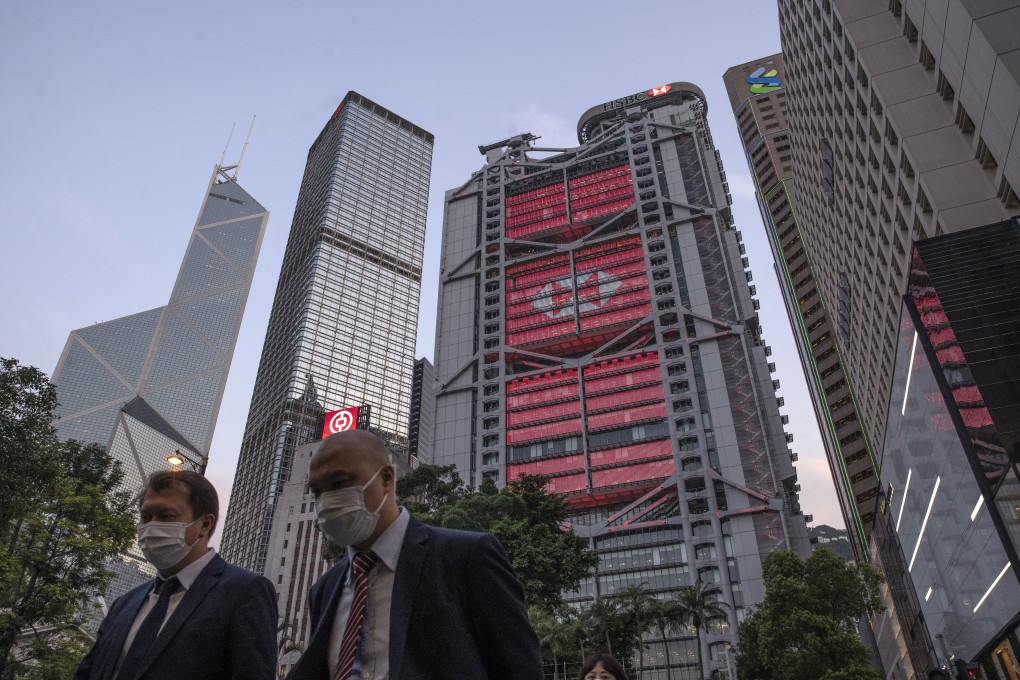

Fears of a Hong Kong brain drain are increasing after China moved to tax its citizens’ global income, undermining the financial hub’s appeal to thousands of bankers and other white-collar workers from the mainland.

Faced with a tax rate as high as 45 per cent – up from about 15 per cent previously – Chinese professionals across Hong Kong are considering moving back home to avoid getting squeezed by both the new levy and sky-high living costs in the former British colony, according to interviews with workers and recruiters.

The prospect of an exodus has upended expectations that mainland talent would help offset any outflow of locals and foreign expatriates from Hong Kong, many of whom are looking to escape the city’s controversial new national security legislation.

Advertisement

While it’s too early to gauge how many people will ultimately move out, professionals of all stripes now have reasons to leave a city that not long ago was viewed as one of the world’s most attractive places to build a career. That risks weighing on Hong Kong’s battered economy and further undermining its status as a premier financial centre.

The focus on China’s new tax regime has intensified in recent weeks after state-owned enterprises in Hong Kong told workers who transferred from the mainland to declare their 2019 income so they can start paying taxes at home. Chinese SOEs are also informing employees in other locations such as Singapore, Bloomberg News reported last week.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x