Advertisement

HKEX hires top women managers to oversee IPO applications after bribery scandal taints world’s favourite market

- New compliance chief to check on listing department’s policies and internal controls; a co-head of IPO vetting will fill a vacancy in September

- The appointments follow the arrest of a former department head for accepting kickbacks in vetting IPO applications

Reading Time:2 minutes

Why you can trust SCMP

Hong Kong Exchanges and Clearing has installed two senior executives to tighten its stock-listing process following a bribery scandal that tainted the world’s favourite initial public offering (IPO) market last year.

The stock exchange operator named accountant Karen Lok as senior vice-president and head of listing compliance - a newly created position - to improve governance and internal controls, it said in a statement late Thursday. It also hired lawyer Janice Wu as managing director and co-head of IPO vetting, who will fill an existing vacancy from September.

Lok joined this week from PwC while Wu is currently the deputy general counsel at TPG Asia, a unit of US private equity firm, according to the statement. They both raised the tally of top women executives to at least five within the department that contributes about 16 per cent to the group’s fee-based revenue.

Advertisement

“HKEX has taken the right moves,” said Christopher Cheung Wah-fung, a lawmaker representing the financial services sector. “The new management hopefully can restore the confidence” in the stock- listing process, he added.

Advertisement

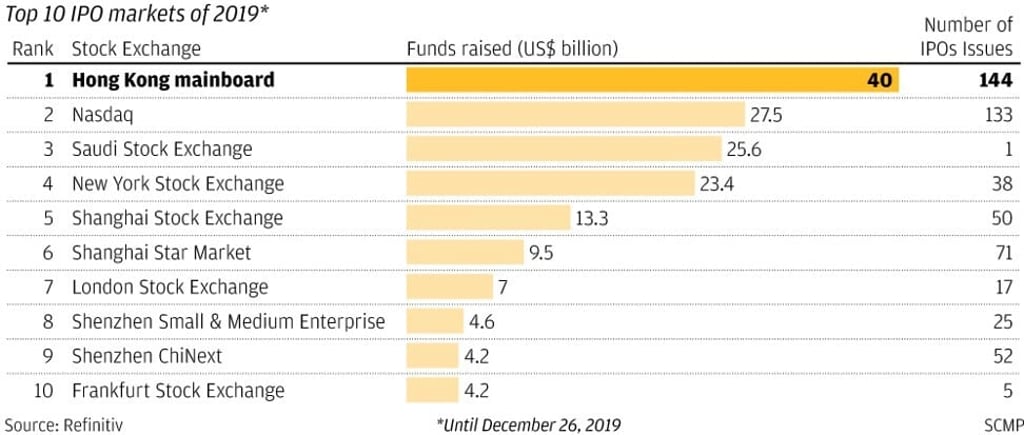

The appointments reflect outgoing chief executive Charles Li Xiaojia’s intent to repair its reputation after an ex-head in the department was arrested and charged for accepting kickbacks to sway IPO applications between June 2017 and April 2019. Hong Kong was the world’s top IPO destination for seven times in the past 11 years including in 2019, helping drive fees and trading revenue.

The Securities and Futures Commission earlier this month rebuked HKEX for its lapses in oversight, ordering the exchange to erect a conflict-proof “Chinese wall” to separate business executives and its listing department.

Advertisement

Select Voice

Select Speed

1.00x