Advertisement

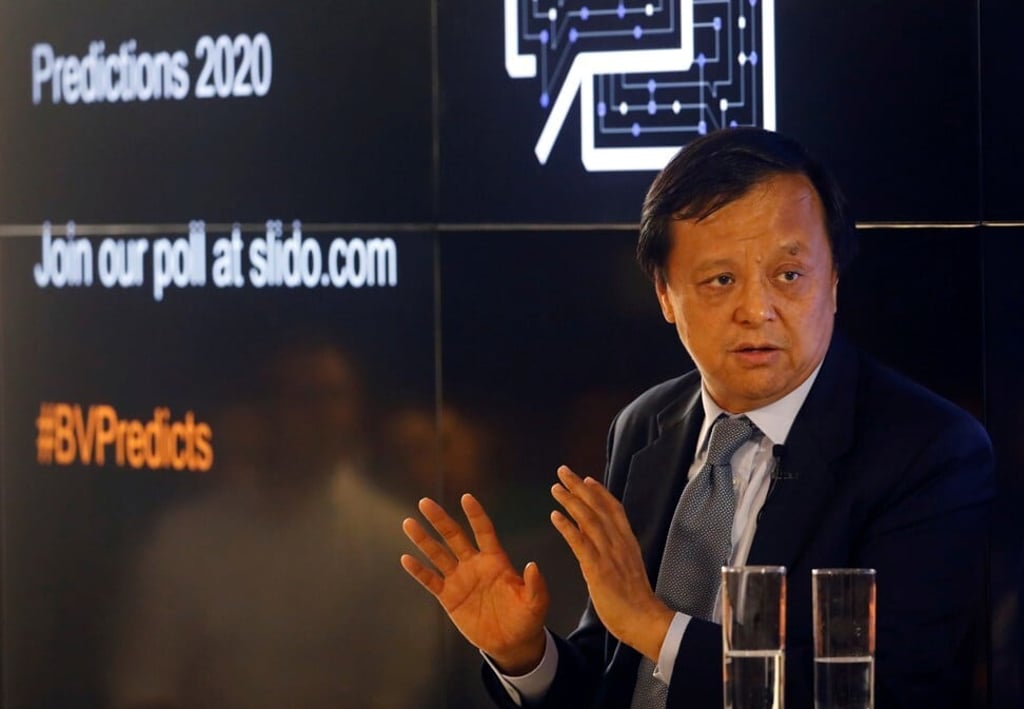

Exclusive | HKEX’s Charles Li wants to create another wave of mega IPOs in Hong Kong to stay ahead of Nasdaq in next market reforms

- A large number of US-listed companies cannot list in Hong Kong unless rules relaxed further, Li says

- Corporate shareholders are not allowed to own more voting rights than others in Hong Kong, which is why Tencent Music is barred under current rules

Reading Time:3 minutes

Why you can trust SCMP

Hong Kong’s stock market operator is keen to create another wave of mega stock offerings by mainland China’s new-economy companies in the city by further tweaking its listing rules, its chief Charles Li Xiaojia said.

The idea, if adopted, will enable the likes of Tencent Music and online learning company Youdao to make their so-called “homecoming” stock offerings, according to Hong Kong Exchanges and Clearing (HKEX), helping to entrench Hong Kong the primary fundraising hub in the region along with Shanghai.

“There are companies with hundreds of billions of market cap that want to be back here, but probably are not going to be able to come back unless we make those changes,” Li said during a webinar conducted by the South China Morning Post on Friday. Listing reforms should go further, he added.

Advertisement

HKEX issued a consultation paper in January to solicit a response to the idea of enabling the initial public offerings (IPOs) of companies whose corporate shareholders own more voting rights than other investors. The feedback has been positive from the broader market. US and Singapore bourses do not prohibit such corporate structures.

Advertisement

HKEX amended its listing rules in April 2018 by allowing companies with multiple classes of shares with individual-controlled voting rights to sell shares in Hong Kong. The reform, its biggest in decades, led to the current wave of secondary listings led by this newspaper owner’s Alibaba Group Holding and JD.com, among others.

Advertisement

Select Voice

Select Speed

1.00x