Advertisement

China’s embattled HNA cedes control of baggage handler Swissport to senior creditors in €1.9 billion debt-for-equity swap

- Hainan-based HNA, which had been trying to sell Swissport since its international expansion unravelled spectacularly, agrees to €1.9 billion of debt to be converted into equity or extinguished

- Swissport secures €500 million in new long-term facility and €300 million additional interim facility

Reading Time:2 minutes

Why you can trust SCMP

Swissport is under new ownership after struggling Chinese conglomerate HNA Group reached an agreement with creditors over a debt-for-equity swap and an injection of additional cash that will help ensure the survival of the airport cargo handling company during the Covid-19 pandemic.

The stakeholders have agreed about €1.9 billion (US$2.3 billion) of existing debt will be converted into equity or extinguished, Swissport said in a statement on Monday. The Switzerland-based company has also finalised a €500 million long-term facility and a €300 million additional interim facility.

Swissport has secured a significant injection of new capital and a substantial reduction of its debt from the deal, bringing to a close months of negotiation and creating a path to recovery. Operating in 47 countries, Swissport represents critical support infrastructure for the aviation and transport sectors.

Advertisement

“Today’s binding agreements secure Swissport’s long-term future,” said Eric Born, Swissport International’s CEO, in the statement.

Advertisement

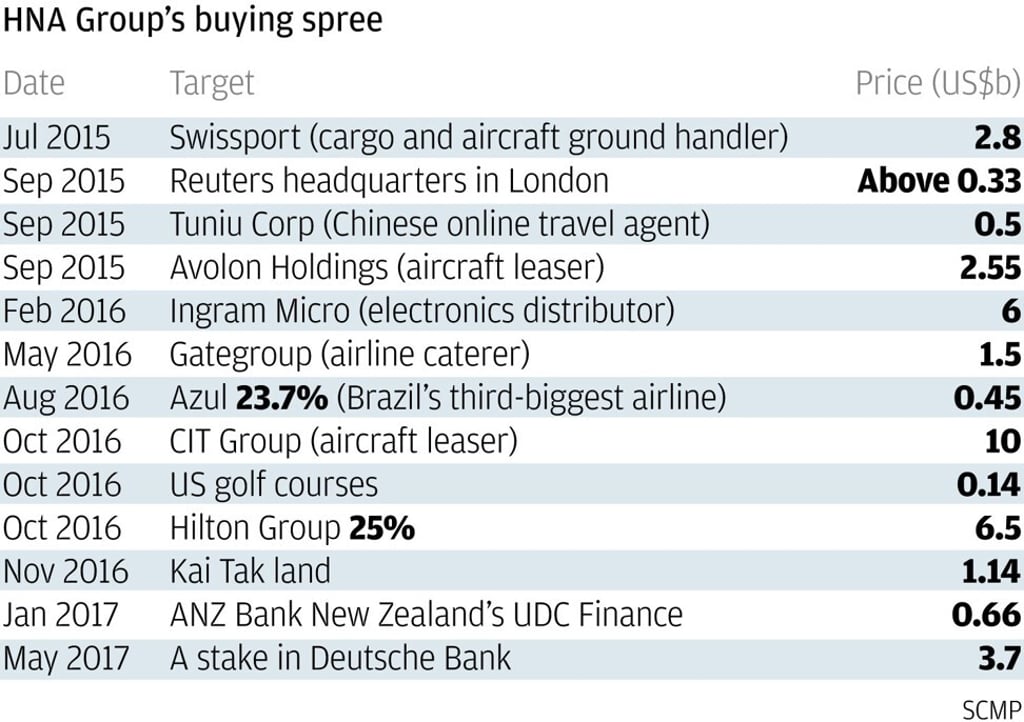

HNA, bought Swissport for 2.73 billion Swiss francs (US$3 billion/) in 2015 amid a debt-funded global acquisition spree.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x