Advertisement

China to expand stock connect programme as it looks to speed up opening of its financial markets

- The stock connect programme linking mainland exchanges with Hong Kong will be expanded to allow foreign investors to trade more commodities futures products

- Revised rules on qualified foreign institutional investors will be announced soon to boost their confidence to invest in China, says vice-chairman of CSRC

2-MIN READ2-MIN

China will accelerate the opening up of its capital markets and deepen reforms to attract more foreign investors, a top official at the China Securities Regulatory Commission said.

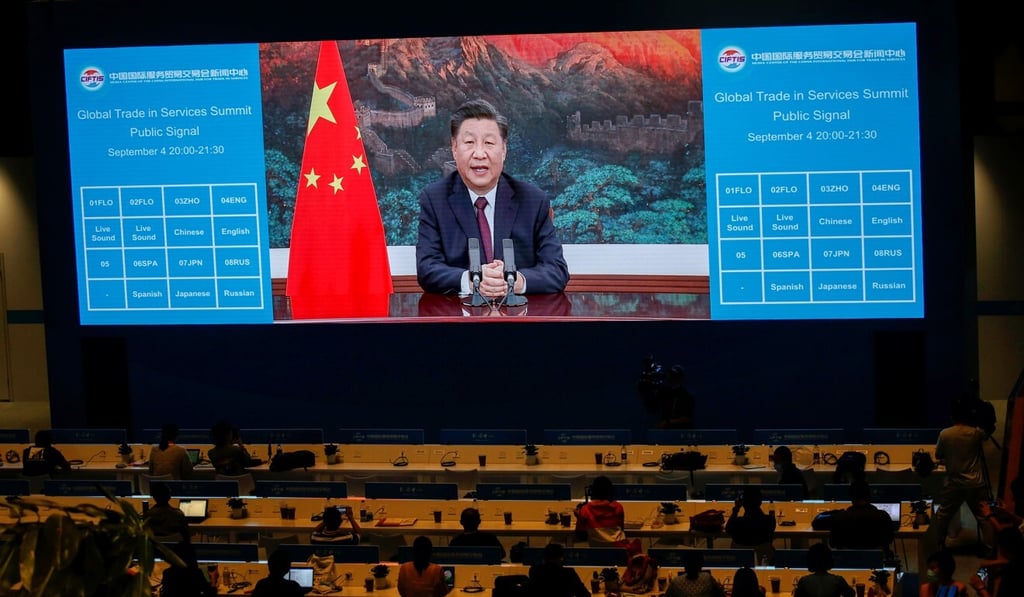

The regulator will expand the scope of investments allowed in the stock connect programme link with Hong Kong, and allow foreign investors to trade more commodities futures products, Fang Xinghai, vice-chairman of the CSRC told a financial forum on Sunday in Beijing as part of the China International Fair for Trade in Services.

Officials are planning to announce revised rules on qualified foreign institutional investors as soon as possible to increase their “willingness and confidence” to invest in China, he said. Foreigners currently hold only 4.7 per cent of Chinese stocks in circulation, way below the more than 30 per cent in markets like Japan and South Korea, he said.

Advertisement

“There remains a huge potential” to usher in foreign capital, Fang said.

Advertisement

China is also opening its financial markets this year to allow Wall Street giants such as Goldman Sachs to take full ownership of ventures in the country, counting on them to provide fresh investments and foster a more competitive local industry.

Advertisement

Select Voice

Select Speed

1.00x