Chinese companies power sale of depositary receipts despite mounting US political, trade tensions

- Chinese issuers continue to tap US dollar funding via the ADR market despite mounting US-China tensions

- China Pacific Insurance and Beike Zhaofang were involved in the biggest issues this year

Chinese issuers were the biggest issuers of depositary receipts this year, as their appetite for capital increased despite mounting political tensions with its trade partners.

Mainland-based issuers collected US$6.1 billion in capital through the sale of American depositary shares (ADSs) and global depositary receipts (GDRs), or more than two-thirds of the fundraising in the first half, Citigroup said in a report published last week.

About US$4.9 billion of the total US$8.8 billion came through initial public offerings (IPOs) while the balance was raised from follow-on share sales. Despite the large presence of Chinese issuers, the amount of money raised was 25 per cent lower than a year earlier.

The capital raising activity shows “that this structure remains an attractive vehicle for issuers”, Scott Pollak, global head of depositary receipt services at Citigroup in New York, said on Monday.

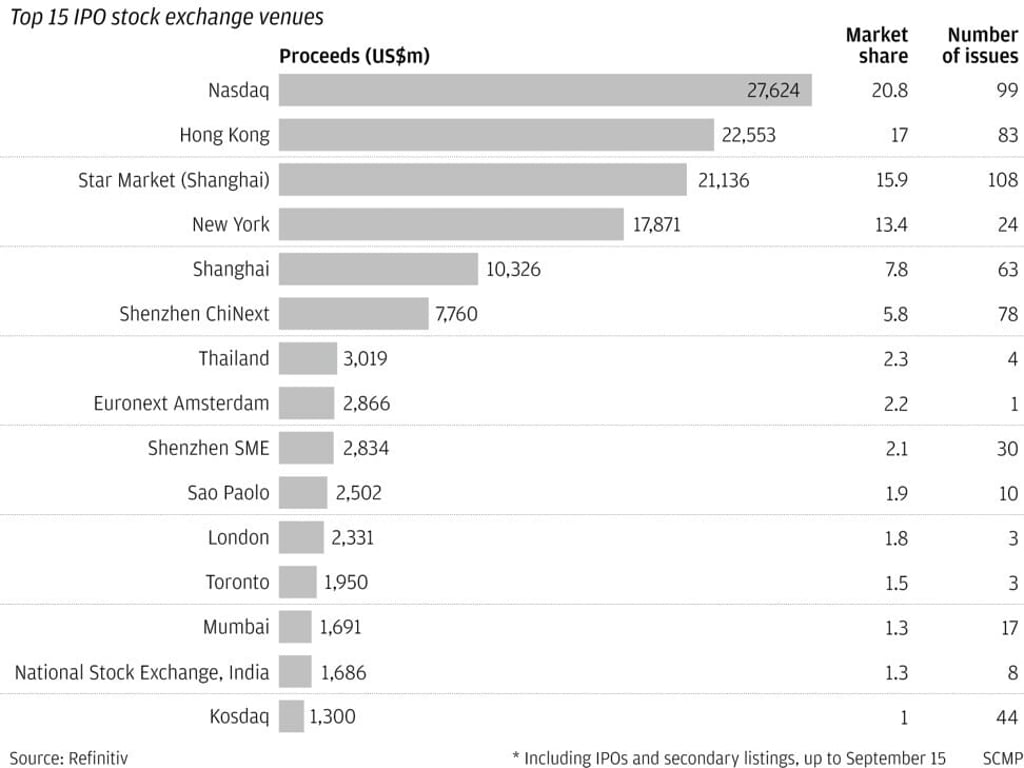

Apart from depositary receipts, Chinese companies wishing to raise foreign-currency capital have tended also to sell shares in Hong Kong. Mainland Chinese firms collected more than 90 per cent of the US$11.2 billion in proceeds from 54 IPOs in Hong Kong from January to June, according to data compiled by Deloitte and Refinitiv.

Chinese issuers have continued to access overseas markets while US-China relations sank to their lowest point in decades due to a broad range of issues, including the source of the coronavirus outbreak, trade tariffs and national security concerns, among others.