Exclusive | Hong Kong exchange set to vet Ant Group’s IPO application early next week, as it plays catch-up with Shanghai

- Bourse to also decide whether to grant waiver to reduce size of Ant’s IPO down to 10 per cent of market capitalisation

- Approval expected before public holidays in city on October 1 and October 2

Hong Kong’s stock exchange plans to vet Ant Group’s listing papers early next week, as staff work overtime to catch up with Shanghai’s speedy examination of what could be the world’s largest initial public offering, according to people familiar with the matter.

At stake is Hong Kong’s long-standing reputation for efficiency and cutting through red tape to get business done. Shanghai’s listing approval process has also proven to be transparent, as regulators have filed updates more frequently than Hong Kong. A spokesman for bourse operator Hong Kong Exchanges and Clearing declined to comment on Ant’s hearing date.

Investors are carefully scrutinising every update from regulators so that they can roughly gauge when China’s largest digital payments provider by volume will make its debut on public markets. Some investors are selling shares in other companies to make room for Ant in their portfolios.

Overseas investors are piling into Hong Kong ahead of the IPO, as they jostle for a piece of the offering. More than HK$36.2 billion (US$4.7 billion) has flowed into the city since September 14, forcing the city’s de facto central bank to intervene several times in currency markets to try to weaken the Hong Kong dollar.

Companies seeking to raise funds in Hong Kong, or on the Star Market, will also be keeping an eye on the timing of Ant’s mega offering, so they can adjust their own timing to avoid competing head-on for investors’ attention.

Also on the agenda is whether to grant Ant a waiver to shrink its free float to 10 per cent of its shares. The Hong Kong stock exchange’s rules state that a listed company’s free float must be at least 25 per cent, unless the company’s market capitalisation is so big that its shares are likely to be easily tradeable at a lower threshold.

Ant is homing in on a valuation of US$230 billion to US$250 billion, according to some brokers’ research reports, where the figures vary according to the methodology applied by analysts. At least one of Ant’s existing investors has marked up their yardstick of Ant’s worth to around US$300 billion.

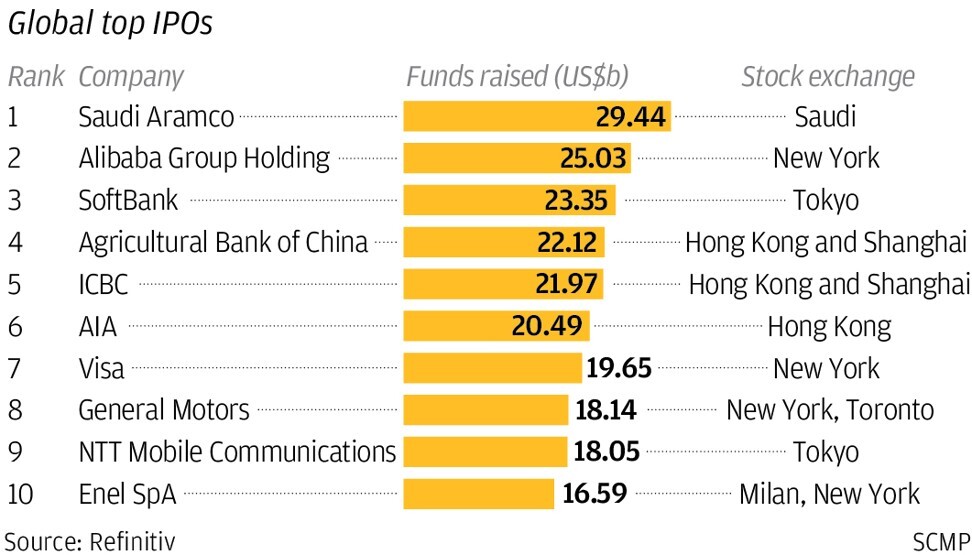

With or without that waiver, Ant’s listing will generate significant trading activity and revenue for both the Hong Kong and Shanghai exchanges at a time when there is stiff competition globally for such business. It is also likely to break the record held by Saudi Aramco’s US$29.4 billion IPO last December for the world’s largest stock market debut.

Given the high profile of Ant’s listing, the Hong Kong stock exchange is making processing its filing a priority. Ant is among 55 companies submitting a listing application this financial quarter in the city, and while this number is short of the 87 applications the exchange handled in roughly the same period last year, it’s workload has been quite substantial given the size of IPOs this year.

Expectations are high that Hong Kong will get the job done before breaking for public holidays on October 1 and October 2.

A one-third share in Ant Group is held by South China Morning Post parent Alibaba Group Holding.