Hong Kong bank deposits surge by US$50 billion in August as investors target Ant Group, other hotly anticipated IPOs

- Bank deposits increased for third month in a row, topping HK$14.8 trillion

- HKMA forced to intervene to weaken currency 15 times in September as hot money chases hot IPOs, secondary listings by Chinese firms

Deposits held in accounts rose by HK$387.9 billion (US$50 billion), or 2.7 per cent, to reach HK$14.8 trillion at the end of August, the Hong Kong Monetary Authority (HKMA) said on Wednesday. Deposits were up 8.9 per cent from a year earlier.

01:06

Mike Pompeo urges US officials to beware China’s attempts at engagement

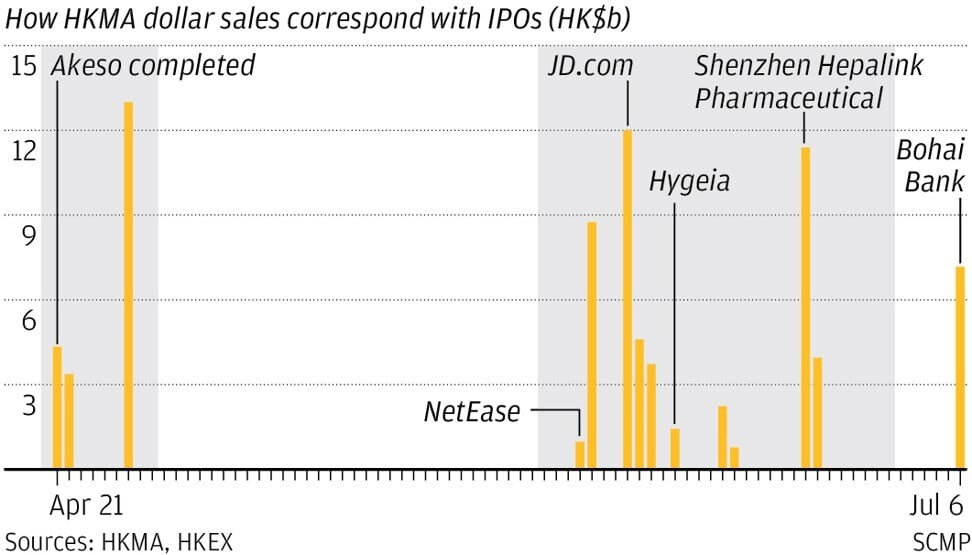

Tens of billions of dollars of hot money – short-term investment cash chasing quick returns – flowed into the city since April as investors sought to invest in secondary listings by the likes of JD.com, NetEase and Yum China, the operator of KFC and Pizza Hut in the mainland, as well as Nongfu Spring‘s red hot IPO.

A number of Chinese firms that originally went public in the United States sought secondary listings closer to home in Hong Kong or engaged in “take-private” transactions as relations between Washington and Beijing worsened this year. More such deals are anticipated in the coming months, according to reports.

With so much capital flowing into the city, the HKMA intervened multiple times in the currency markets this year to try to weaken the Hong Kong dollar.

The HKMA stepped into the markets 15 times this month, including twice on Wednesday, to sell HK$69.4 billion worth of its currency and to buy the same amount of the US dollars, pushing the exchange rate to HK$7.75 per US dollar. It is the highest amount of Hong Kong dollars it sold this year, surpassing HK$53.3 billion in July.

Even after 15 interventions this month, the Hong Kong dollar was trading at HK$7.7502 per dollar on Wednesday afternoon, which is just below the top end of a trading band with the US dollar.

Under Hong Kong’s currency peg system, the local dollar is pegged to the US currency at HK$7.80, and the HKMA will intervene to make sure it trades within the HK$7.75 and HK$7.85 band.

HKMA has intervened 53 times this year for a total of HK$189.6 billion.