China’s sovereign digital currency pilot in ‘early stage’ as transactions hit US$300 million

- Central bank governor Yi Gang says China still in early stages of its digital yuan pilot programme

- The sovereign digital currency has been used in over 4 million transactions totalling 2 billion yuan

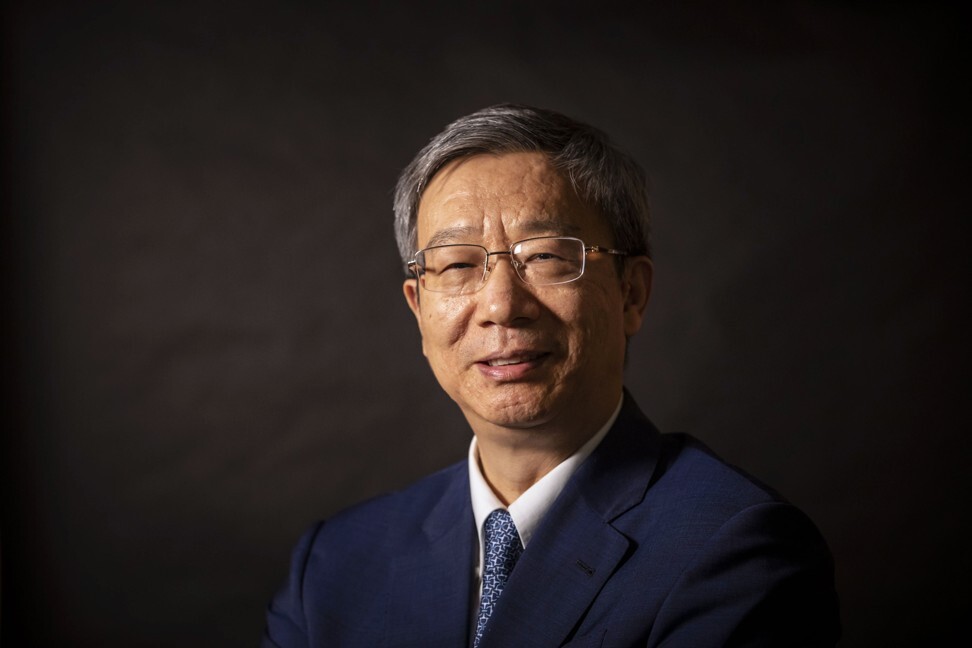

People’s Bank of China’s (PBOC) governor Yi Gang said China is still in the early stages of developing its central bank digital currency even as the usage of the digital yuan expands rapidly across Chinese cities.

Yi said usage of the digital yuan has increased rapidly over recent months and had been used in 4 million transactions valued at 2 billion yuan (US$299 million) in a trial across four Chinese cities, Shenzhen, Suzhou, Xiong’an and Chengdu.

“So far, the experiment and pilot programme have been [going] fairly smoothly,” said Yi during a virtual panel discussion that took place at this year’s financial technology jamboree in Hong Kong.

The PBOC’s pilot has discovered over 12,000 use cases for the digital yuan, up 80 per cent from the 6,700 ways to use the digital currency as of late August.

The central bank’s digital yuan is accelerating the world’s second-biggest economy’s journey towards a cashless society by increasing the number of consumers paying for goods with e-wallets, rather than banknotes and coins. China’s digital payments transaction volume is expected to jump to 412 trillion yuan by 2025, up from 201 trillion yuan last year, according to consultancy iResearch.

The digital yuan could also boost the central bank’s capability to monitor economic activity in real-time. To be sure, bank transfers and lending are already digital in most economies.

Throwing cold water over rising expectations that the digital yuan could be launched any time soon, Yi said that China still needs to complete “a fairly complicated, and complete legal framework and regulations [for digital yuan] that enhances its transparency”. He did not elaborate further on what was needed to complete the project.

While Yi did not say when the digital yuan will be launched, the country appears to be among the first major economies to issue a central bank digital currency.

Yi said the PBOC has completed the architectural design of its DCEP. Apart from testing the DCEP system with third parties in the four pilot cities, Yi reiterated that the PBOC will also test and run pilots of the digital yuan at the Winter Olympic in 2022.

Yi said features such as QR codes, tap-and-go transactions will be available to users of its digital sovereign currency.

The central banker reiterated that the digital yuan would gradually replace banknotes and coins but the process will take time and digital will coexist with physical currency for a long time to come.

“I would like to cooperate with the Bank of International Settlements, the Financial Stability Board and international central bankers to discuss a legal framework, [fostering] transparency and how to safeguard [the development] of central bank digital currencies,” said Yi.