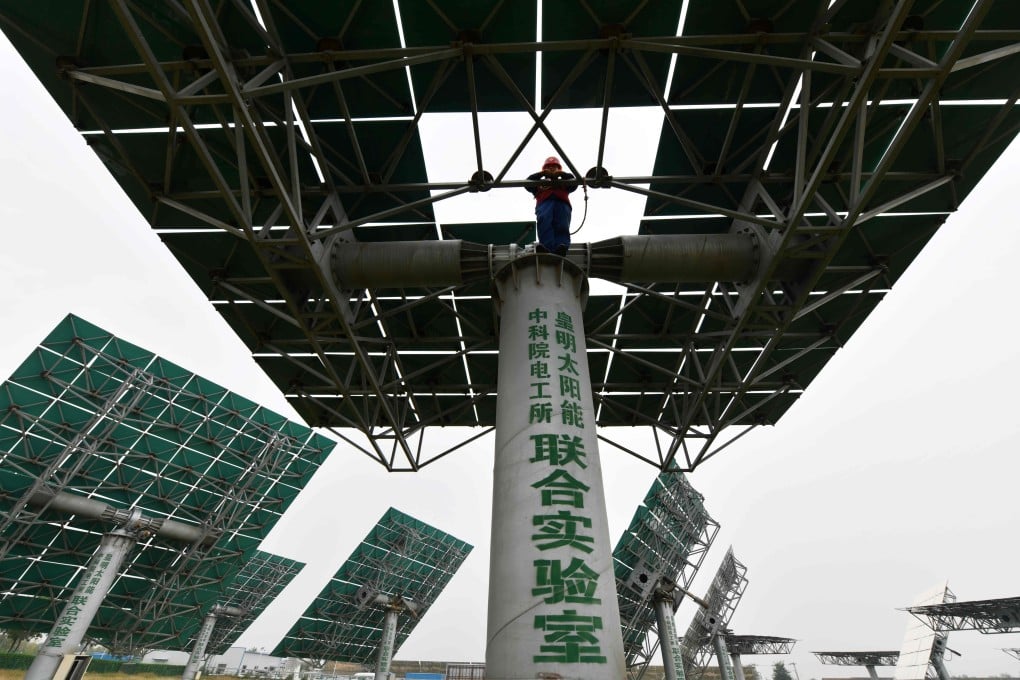

Green financing to help drive China’s 2060 push for carbon neutrality

- Sustainable financing is becoming ‘more mainstream’ and ‘more common’ in investment portfolios

- China was the second-largest issuer of green bonds globally in 2019, at US$55.8 billion

“This is effectively a movement that has gathered steam. If you look at the diversity of investors, it has gotten higher. I think the demand and the supply of green bonds and sustainability financing has become fairly mainstream,” Kok Siong Ng, chief financial officer at Link Asset Management, said. “I think this is going to get more mainstream and more common. I think this is something you can’t ignore.”

39:35

Sustainability: Green bonds to help drive China's push towards carbon neutrality

Green finance will be an important tool for policymakers on the mainland as they try to achieve a goal of carbon neutrality by 2060, according to Fitch Ratings.

China was the second-largest issuer of green bonds that met international standards after the United States last year, issuing US$55.8 billion of “labelled green bonds”, according to the non-profit Climate Bonds Initiative (CBI). Including bonds that only meet Chinese standards, China would have surpassed the US in issuance.