Explainer | How an avalanche of rules buried Ant Group’s US$39.5 billion stock sale and looks set to reshape China’s fintech landscape

- Ant Group will need months at least to assess the fallout from the regulatory shift, make the business compliant with new rules and update potential investors

- We lay out a timeline of the key events leading up to China halting Ant’s IPO in Shanghai and Hong Kong at the eleventh hour

When internet billionaire Jack Ma walked out of a meeting with the top echelons of China’s regulators on November 2, his hopes of dramatically overhauling financial services in the world’s second-largest economy had just taken a heavy blow.

The regulators told Ma that in the future, greater financial inclusion driven by internet platforms would take a back seat to financial stability and protecting traditional lenders, which are still important policy levers in the developing economy.

Ant executives had sought to gold-plate the firm’s fintech business model by obtaining sign-off on a prospectus for a US$39.5 billion listing plan (including an overallotment option) from the highest regulatory levels only weeks earlier.

The IPO would have pegged Ant’s worth at a stunning US$359 billion, higher than the world’s largest bank, JP Morgan, and bigger than the state-backed Industrial and Commercial Bank of China (ICBC). China feared the privately run company, which was on the cusp of bringing more foreign investors into its capital structure, had become too big to fail.

What the executives did not know when they were marketing the IPO to investors was that the growth and scale of Ant’s digital platform revealed in the listing paperwork had unsettled regulators and stoked concerns of systemic risk.

A key line in the draft rules was that the internet platforms would have to put up 30 per cent of the capital for joint loans with banks. Ant has two small loan businesses, Huabei and Jiebei, and currently contributes about 2 per cent of the loans agreed on its platform, while the banks put up the rest.

That news sent Ant executives scrambling to figure out the definition of joint loans – would it only apply to loans where the firm contributed capital? Or all loans agreed over Ant’s platform? Would Ant need a new licence? Managers reached out to their counterparts among regulators for answers.

03:04

What is Jack Ma’s Ant Group and how does it make money?

Ant will need months at least to assess the fallout from the regulatory shift, make the business compliant with new rules and update potential investors.

There were 7,227 microfinance companies in China with 902 billion yuan (US$135 billion) in loans outstanding as of September 30, according to PBOC data.

On November 2, a CBIRC official also flagged concerns over WeBank’s Weilidai and JD.com’s Jintiao and Baitiao services. JD Digits, the fintech arm of JD.com, is planning an IPO also in Shanghai.

Further rules may sideswipe other areas of fintech businesses across China. Ant’s business spans digital financial services such as payments, investment and insurance, as well as consumer credit.

A timeline of the critical events leading up to China halting Ant’s IPO in Shanghai and Hong Kong at the eleventh hour:

April, 2019

July 1, 2020

July 20, 2020

July 26, 2019

The new regulations follow the emergence of numerous large conglomerates that have developed financial services in recent years, such as Tomorrow Holdings, HNA Group, Anbang Insurance Group, Ant and Fosun, says credit ratings agency Fitch Ratings.

August 25, 2020

September 11, 2020

PBOC issues the final rules to regulate financial holding companies effective on November 1. Conglomerates with financial operations will need to apply for a licence by November 1, 2021.

Ant plans to use its unit, Zhejiang Finance Credit Network Technology, as the entity to apply for being a financial holding company subject to regulatory oversights and hold its licensed financial services subsidiaries.

September 16, 2020

CBIRC says the debt of a microloan company shall not exceed four times its net assets.

September 18, 2020

October 19, 2020

October 21, 2020

October 24, 2020

October 31, 2020

“We need to encourage innovation and entrepreneurship, but also strengthen regulation,” the statement said.

November 2, 2020

Guo Wuping, director of the consumer protection bureau at the CBIRC, writes an opinion article saying that Ant’s Huabei and Jiebei, WeBank’s Weilidai, as well as JD.com’s Jintiao and Baitiao apps are services similar to credit cards, and that the business of microlending is not dissimilar to the small loans extended by banks. He repeats the need for financial stability and cites the FSDC’s October 31 meeting.

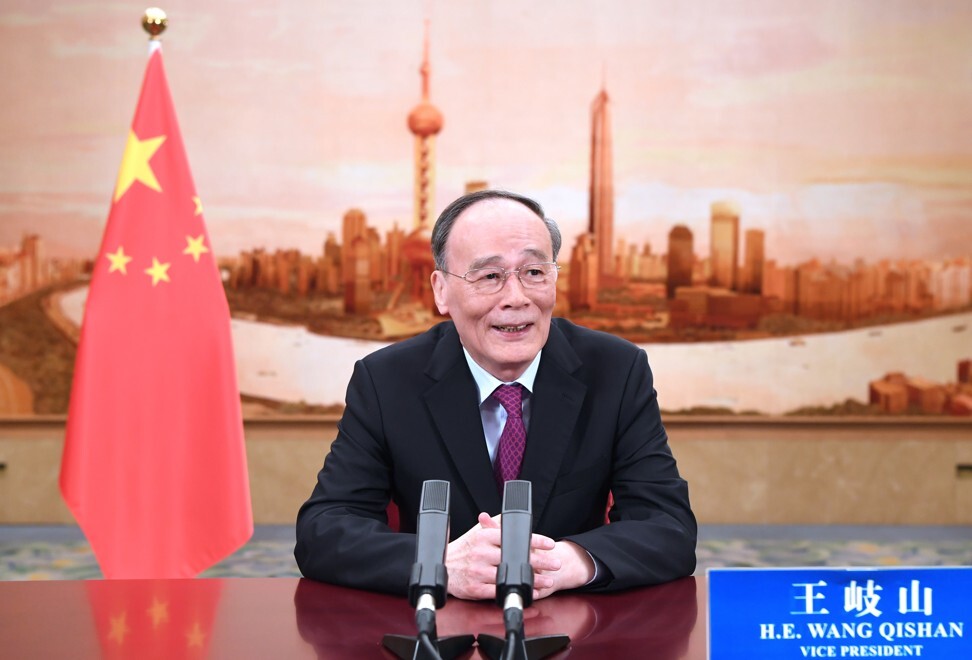

November 2, 2020

Views regarding the health and stability of the financial sector were exchanged, said Ant.

November 3

November 4

November 5

The China Banking and Insurance Regulatory Commission (CBIRC) denies certain unidentified media reports that purportedly said the Chinese regulator was instructing commercial lenders to stop working with Ant Group’s Alipay service on loans.