Record low rates are here to stay regardless who sits in the Oval Office. Will that keep markets pumping in the age of Covid-19?

- A short-term pullback in stocks is possible despite historically low interest rates as investors digest the US election, analysts said

- Central bankers unlikely to tap the brakes until there is a sign of a more persistent economic recovery globally

After American voters made their preferences known at the ballot box, the world’s focus returns to the role of the United States Federal Reserve’s monetary policy during the coronavirus pandemic. The latest part of our US election series looks at the impact. Read other stories in the series here.

The uneven global recovery has investment strategists and economists split on whether financial markets are ripe for a pullback, particularly as investors try to digest the outcome of the US elections this week.

One thing is clear: central bankers are unlikely to apply the brakes until there are signs of a more persistent recovery. Some monetary policymakers may even pursue more controversial policy measures, including negative interest rates, if further fiscal stimulus by governments remains elusive.

03:05

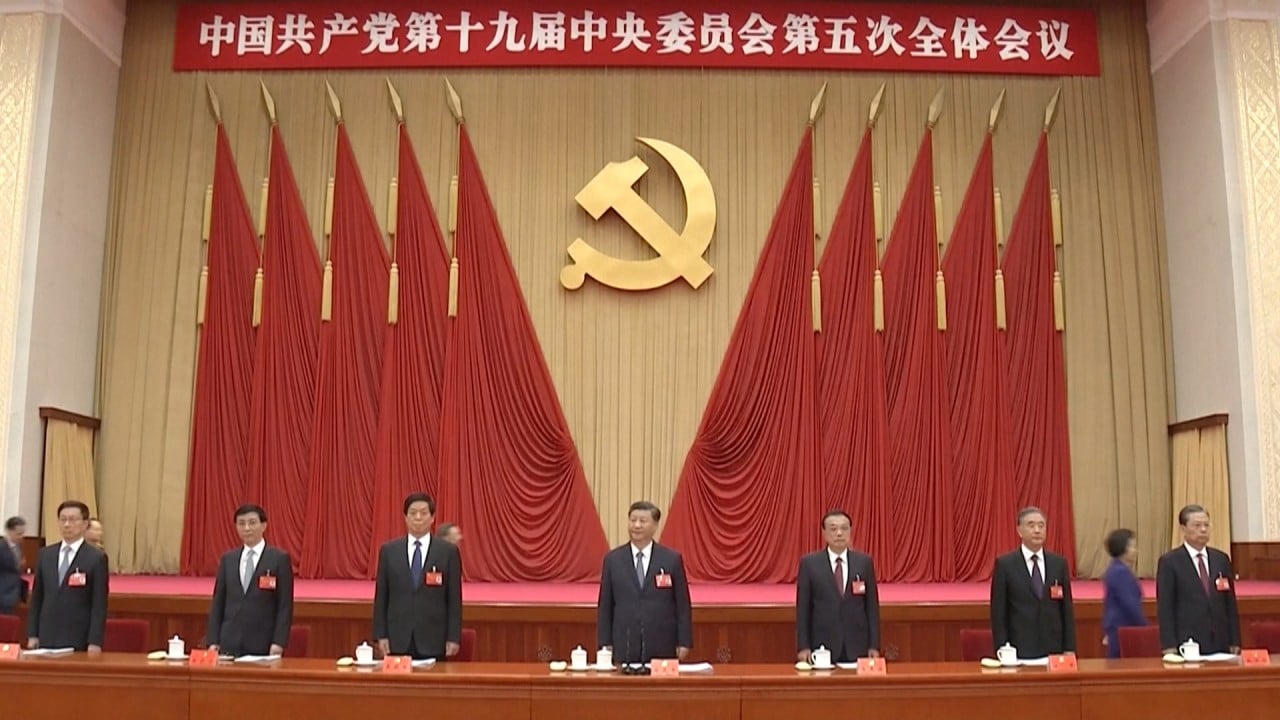

What happened at the Chinese Communist Party’s major policy meeting, the fifth plenum?

Heading into the US elections, Axi’s chief global market strategist Stephen Innes said he had never seen such a “broad based disparity” in market forecasts.

“This is just a symptom of the mess we’ve found ourselves in,” Innes said. “The data is unreliable. Forward-looking metrics that we’ve used in the past aren’t clear. Correlations that worked in the past do not necessarily work going forward. I think there’s a lot of assumptions people are making.”

“At some point in 2021, we’re going to have to face or pay the piper,” he said. “Eventually, all good things come to an end.”

Equity markets are likely to move “sideways” in the fourth quarter as investors digest the US election, but a sustained period of low rates should support equity prices and encourage spending and investments, according to Morningstar.

“Because there could be a more reasoned and more predictable approach … with less surprise, we think that would reduce a bit of the risk discount to some of the Chinese names,” Tan said.

Goldman Sachs, as its base case, does not expect the Fed to resume raising interest rates until 2025.

That could allow equity markets to continue to perform well, according to Neil Shearing, group chief economist at Capital Economics.

“The Fed will continue to pursue policies that keep real rates in negative territory as the US economy continues its slow recovery from the pandemic shock,” Shearing said in a November 2 note.

Loose monetary policy could increase financial instability and even create speculative bubbles for asset prices as investors chase yield, said Schroders’ chief economist and strategist Keith Wade.

“Three years of zero interest rates await,” he said in an October research. “This will significantly challenge investors, who will now struggle even more to generate income from their savings.”

It also could weigh on spending as investors are forced to set aside more assets to meet their investment goals and companies and governments are faced with increased pensions liabilities, Wade said.

“While US monetary policy remains accommodating, global financial markets will also be affected by other factors such as the evolution of the pandemic situation and the policy direction of the US administration following the presidential election,” the Hong Kong Monetary Authority, the city’s de facto central bank, said this week.

One concern for growth is the resurgence of Covid-19 cases in the US and in Europe. Third-quarter gross domestic product grew at a surprising 7.4 per cent in the US, but a surge in infections could be a significant headwind for the American economy heading into next year, analysts said. America’s daily confirmed cases topped 107,000 on November 4, a record.

Belgium, France, Germany, Greece and parts of the United Kingdom are also set for a second period of lockdowns as controlling the virus remains elusive and questions remain whether a vaccine will be available before the end of 2020.

Against this backdrop, monetary policymakers have called for more fiscal stimulus. US Fed chairman Jerome Powell warned that more fiscal policies were needed as many Americans will “undergo extended periods of unemployment” and “too little support would lead to a weak recovery,” creating unnecessary hardship for US households and businesses.

The central bank, which reduced the minimum borrowing amount from US$250,000 to US$100,000, faced criticism over the structure of its lending programme for main street, which underwrites a portion of loans made through traditional lenders. Since the programme began in June, about 400 loans worth US$3.7 billion were extended.

The European Central Bank (ECB) said it intends to pursue additional measures to bolster the euro zone economy, which could include billions of euros in additional bond purchases.

The Bank of England separately asked UK lenders to outline their operational readiness for a zero or negative bank rate. The central bank, which has not committed to negative rates, has set its base rate at 0.1 per cent.

“Over time, those inflation concerns build, the output gap closes. You get more concerns about tightening,” Moe said. “Then, that would perhaps be the sting in the tail: the delayed monetary policy response. In the shorter term, it could be a sweet spot for risk assets.”

The Bank of Singapore said in a note Thursday that the US appeared to be headed to a divided Congress, which could limit the size of stimulus spending.

“There is sufficient common ground between both parties to enact a relief aid package that is around US$500 billion in first-quarter 2021, which will be critical in supporting the nascent post-pandemic recovery,” the bank’s head of strategy Eli Lee said.