Advertisement

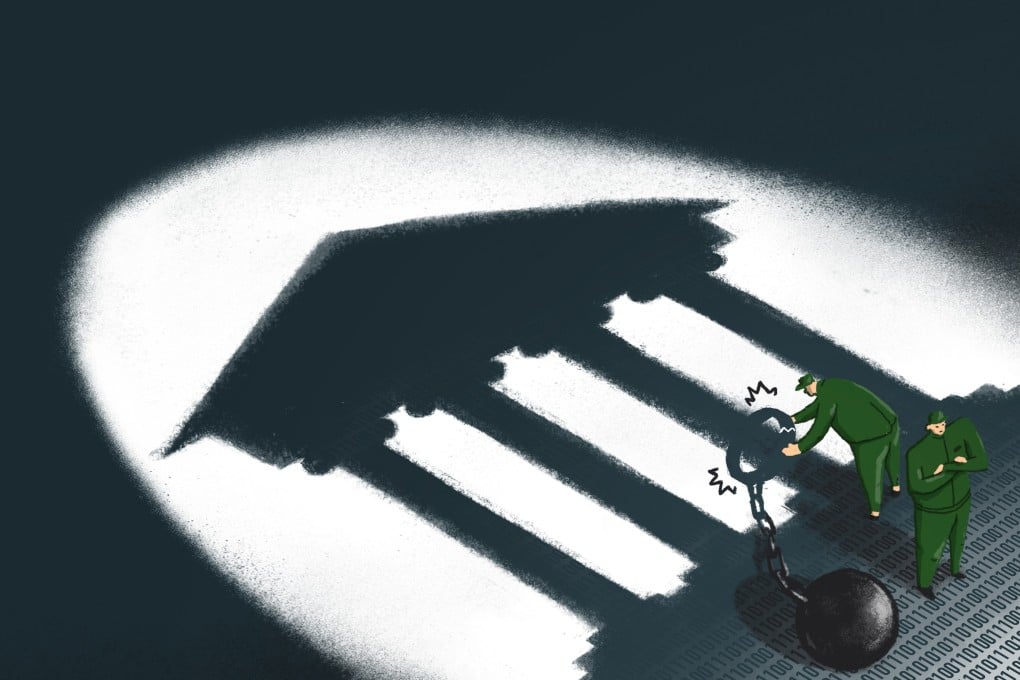

China’s regulators put up a fence around risks as technology’s surging influence threatens to overshadow finance in fintech

- Over the past five years, China’s household debt levels grew at a pace similar to the US ahead of the global financial crisis

- New fintech rules on online microlending could force China’s internet giants to rethink business practices

Reading Time:6 minutes

Why you can trust SCMP

This is the first of a five-part series looking at China’s fintech industry in the wake of regulators’ decision to suspend the initial public offering of Ant Group, which was widely expected to be the world’s biggest capital raising.

Late at night on Monday November 2, a blog appeared in the official Sina.com account of the Chinese government’s mouthpiece news agency Xinhua, hours after regulators summoned executives of the world’s largest fintech company to tell them that the rules governing their industry were evolving.

Using the pseudonym Xiuxin, the blogger told a story about the potential harm that could be done by loose words, unrestrained behaviour and indiscretion, accompanied by an artwork showing a white horse afloat in a sea of clouds, an allusion to the Chinese name of one of China’s wealthiest men, Jack Ma.

Advertisement

A day later, the blog’s implication became apparent. Regulators did the unthinkable: pulling the rug from under the largest capital raising exercise in global finance – the US$35 billion initial public offering in Hong Kong and Shanghai by Ant Group – 48 hours before trading was due to start, citing changes in regulatory environment that cause the fintech giant to be in breach of market disclosure rules.

Advertisement

The new rules are part of regulators’ attempts to redefine and rethink fintech, amid concerns that technology has usurped the fundamentals of finance, creating potential systemic risks in the world’s second-largest economy.

“Chinese fintech groups have, in some cases, grown so big that their collaborations with banks are increasing contagion risks in China’s financial system,” said Grace Wu, an analyst at Fitch Ratings. “We expect tighter regulations on fintech companies to continue.”

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x