Asian Infrastructure Investment Bank commits US$100 million to ADM Capital’s latest renewable debt fund

- HK-based ADM Capital bags US$100 million commitment from Asian Infrastructure Investment Bank for its green energy debt fund

- The renewable energy debt fund is targeting US$500 million from investors

Hong Kong-based private credit manager ADM Capital said it is raising a US$500 million debt fund focused on financing Southeast Asian renewable energy projects after bagging a commitment from Beijing-based Asian Infrastructure Investment Bank (AIIB) for US$100 million.

The US dollar fund will have a fixed life of about 10 years and will lend debt financing to entrepreneurs that are running solar, wind, hydro and biomass energy projects in Vietnam, India, Indonesia, Philippines and Thailand, Chris Botsford, co-founding partner and joint chief investment officer of ADM Capital told the Post.

“The bulk of the renewable energy projects over the next 20 years would be from smaller developers, who are not getting traditional financing from banks due to their small operational scales,” said Botsford, adding the fund expects to invest in about 12 to 15 renewable energy projects.

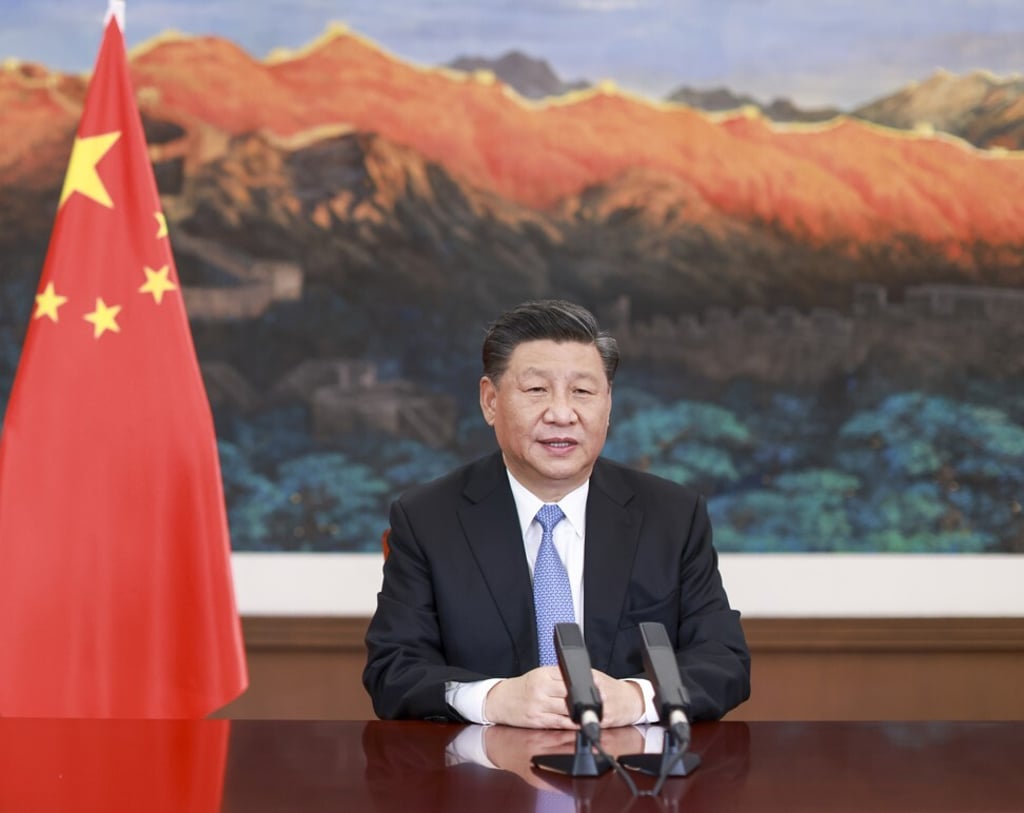

AIIB’s US$100 million seed commitment to the debt fund resonates with Beijing’s priority in combating climate change. As AIIB’s largest shareholder, China holds about a third of AIIB, and about 26.6 per cent of the voting rights in the multilateral development bank.

Last year, climate finance from the 103-member development bank amounted to US$1.7 billion, or 39 per cent of total financing approved, up from US$2.5 billion between 2016 and 2018. Climate finance seeks to support mitigation and actions that will address climate change and forms a key part of AIIB’s infrastructure financing in the region.