China’s central bank plans to finance Xi Jinping’s goal of carbon neutrality by 2060. Here’s how

- Mandatory requirements for banks to disclose green finance activities

- China’s banks have extended more than US$1.7 trillion in green loans, the most globally

China’s central bank is mulling imposing mandatory requirements on the country’s sprawling state-owned financial institutions to help promote green economic activity as part of the country’s ambitious push towards carbon neutrality by 2060.

To turn the world’s largest greenhouse gases emitter into a carbon-neutral country in less than four decades will cost around US$5 trillion and prompt social upheaval as coal-mining jobs are lost.

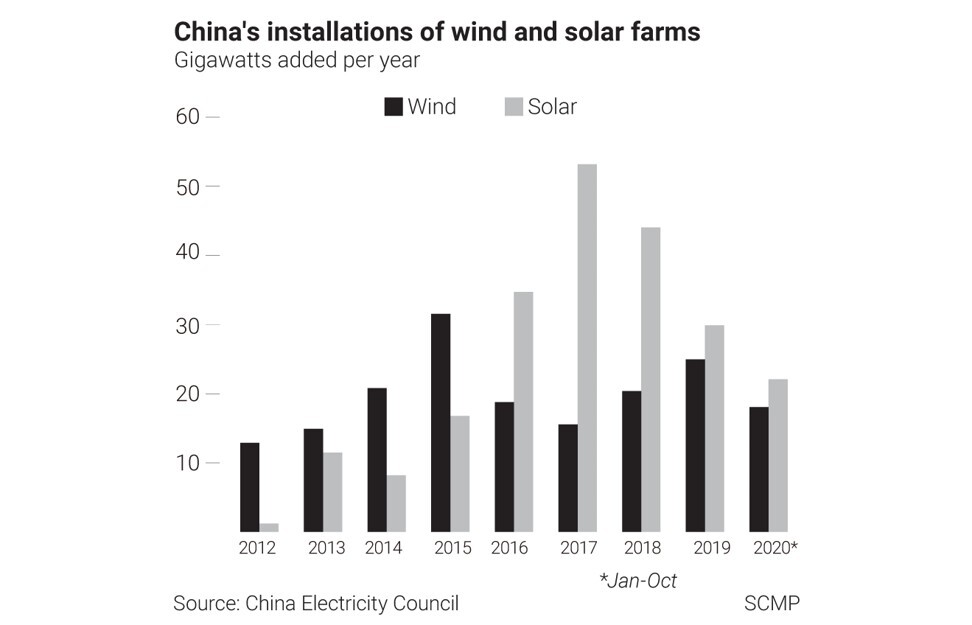

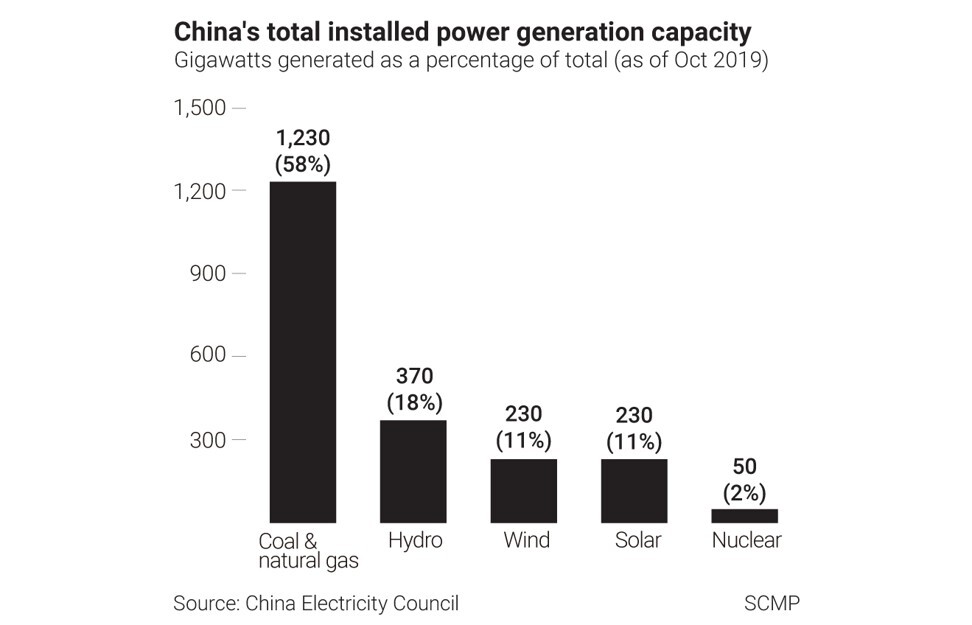

The country’s financial regulators are banding together to rally financial institutions to fund the shift towards greater reliance on wind and solar energy, led by the powerful central bank.

Green bonds and green loans could play a big part in financing low carbon energy and manufacturing technologies and infrastructure. As of June, China’s banks had extended more than 11 trillion yuan (US$1.7 trillion) in green loans, the most by a nation globally. Green bonds totalled 1.2 trillion yuan, the second-largest in the world.

The PBOC has already strengthened its oversight of green finance, including evaluating banks’ performance in supporting green finance. The mandatory requirements would be a step further.

However, the central bank still allows up to half of the proceeds to be used as “general working capital” not earmarked for specific green projects, well above London-based non-profit Climate Bonds Initiative’s 5 per cent standard.

“We will promote harmonisation of green-finance standards at home and abroad by updating domestic standards and strengthening international cooperation,” said Yi.

The measures outlined by Yi build on China’s previous efforts to support green economic activity.

In 2016, the PBOC and other ministries published overarching guidelines for establishing a green financial system. Since then, China has developed a range of green financing products such as green credit, green bonds, green agricultural insurance, green energy insurance and green trusts.

China has established zones to pilot green financial reforms in nine cities since 2017.

“In these pilot programmes strong progress has been made in strengthening the green finance policy framework, introducing new products and services and implementing policy incentives,” said Yi.