China’s fintech giants led by Ant Group retool and innovate, as they roll with the punches in new regulatory landscape

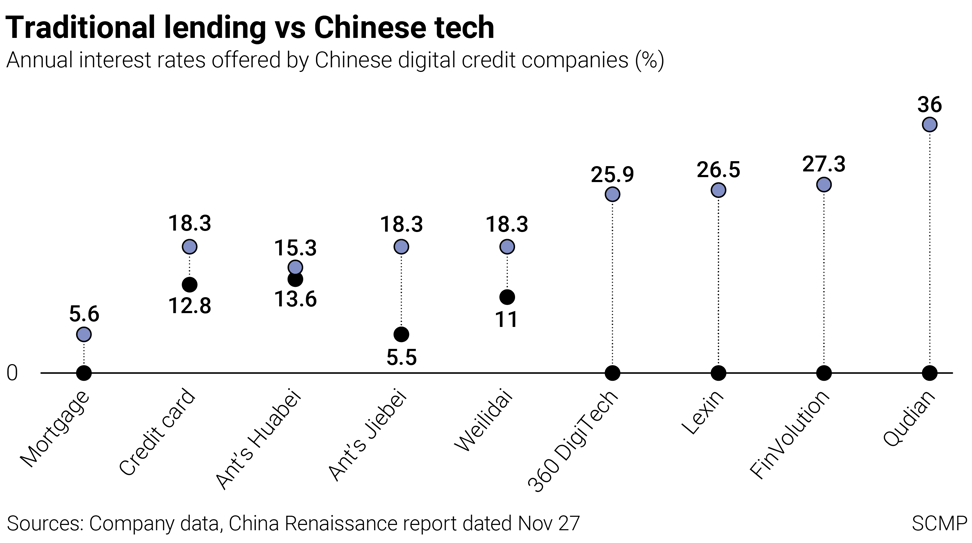

- Lufax, 360 Digitech, LexinFintech, FinVolution lower interest rates at buy-now, pay-later units; Ant Group says will comply with rules without revealing details

- China’s economic recovery from pandemic, consolidation and superior technology will bolster fintechs’ 2021 profits against harsh new rules, say analysts

This final instalment in a five-part series on the future of China’s fintech industry looks at what the largest fintech companies must do to survive and thrive in a harsher regulatory landscape. Earlier instalments are here.

On Friday, Ant Group removed internet-deposit products offered by banks from the shelves of its virtual financial market place as it sought to assuage regulators’ fear of small and regional banks slipping under their radar by marketing on digital platforms.

03:04

What is Jack Ma’s Ant Group and how does it make money?

Ant Group’s smaller peers are also adapting to the torrent of new rules since August, designed to bring the swashbuckling Chinese fintech sector to heel. Profits of Wall Street-listed Chinese fintech firms – Lufax, 360 Digitech, LexinFintech Holdings and Finvolution – rose in the third quarter even after Beijing lowered the boom on outsize interest rates in the industry.

The nimble fintechs are also expanding into less-regulated markets across Southeast Asia and into wealth management.

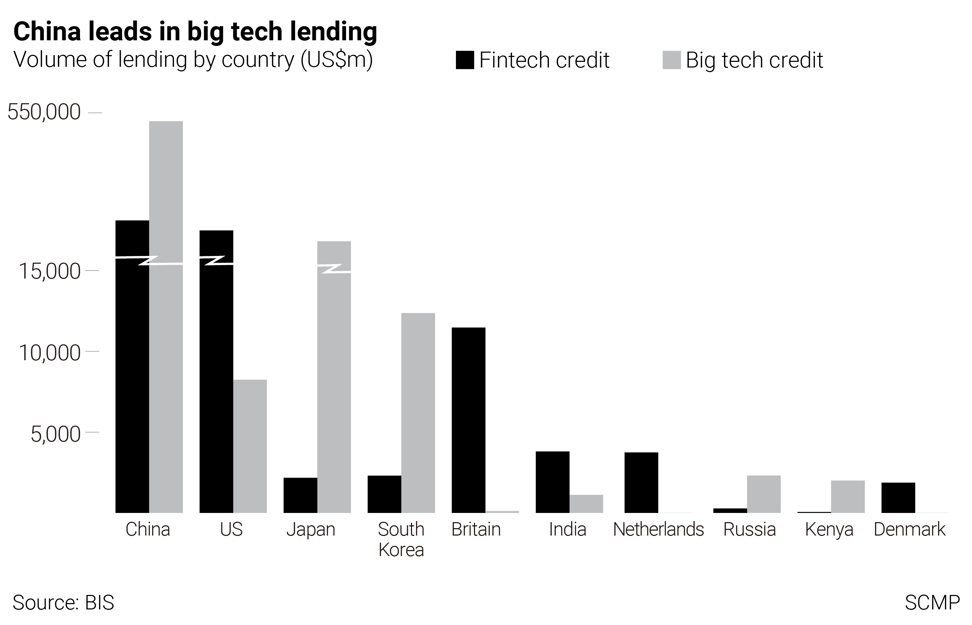

China used to allow start-ups to flourish and experiment as they helped spread financial services into rural regions, amid periodic crackdowns, such as on peer-to-peer lending in 2016. This time around, China is leading the assault on Big Tech lenders, stamping out monopolistic behaviour and fending off systemic risks.

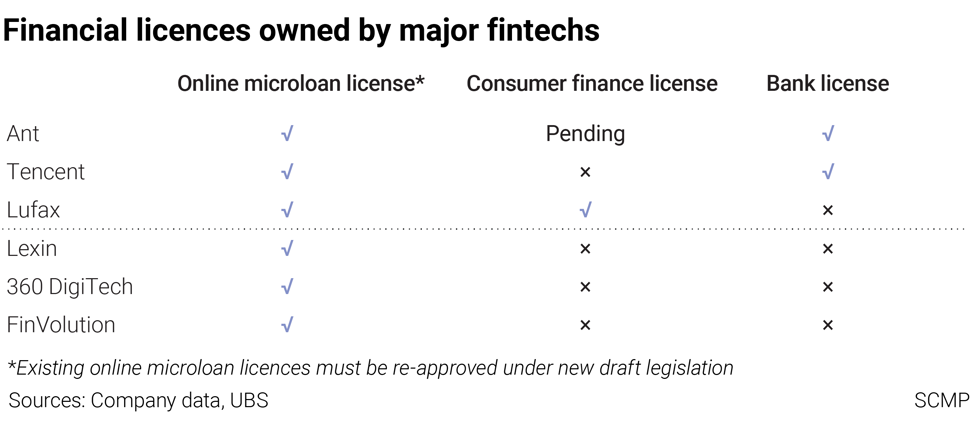

Analysts at UBS expect China’s regulators to intervene to limit growth case-by-case; set capital requirements and firewalls within a financial holding regulatory framework include fintechs’ lending partnerships with banks in China’s macroprudential assessment framework on banks; and set more stringent rules on data-sharing and mis-selling of financial products. Regulators may also guide banks to slow growth of loans under lending partnerships, said UBS.

“Ant Group’s IPO halt reflects a turning point of regulators’ stance on fintech regulation towards a tightening bias,” said UBS analyst May Yan.

The number of online wealth management and insurance products available to Ant Group’s customers has fallen in the past couple of months as the product providers temporarily withdrew from the market to adjust to new guidelines, according to market sources.

A fundraising plan by JD Digits, the fintech unit of China’s second-largest e-commerce platform JD.com, is still awaiting approval by Shanghai’s financial authorities.

Ironically, larger platforms may benefit from the harsher but clearer rules. Entrants into the market may struggle to win a licence or raise meet capital requirements, stifling competition.

“The proposals will increase barriers to entry in the sector,” said Katie Chen, director of financial institutions at credit rating agency Fitch Ratings last month.

Founded in 2013, Lexin offers instalment payments to 18 to 36 year-olds to buy products on its e-commerce platform Fenqile.

Fenqile aggressively promoted buy-now, pay-later deals to students for iPhones, iPads and other gadgets, according to the support group Debtors’ Union.

Even after lowering its APR, Lexin’s third-quarter gross profits rose from the second quarter. Profits across the industry were bolstered by the market’s growth, China’s swift recovery from the pandemic which reduced credit costs, and fintechs’ diversification.

China’s consumer credit market will almost double to 24 trillion yuan by 2025, according to Oliver Wyman. Ant Group is the largest player with a market share of 16 per cent as of June 30, followed by Tencent-backed WeBank with a market share under 5 per cent. WeBank offers micro loans under the brand Weilidai.

Fintechs are looking to spin the narrative in their favour.

“In the spirit of reducing customers’ borrowing cost, providing better services to them, also in line with our strategy of targeting better quality customers, we have voluntarily lowered the borrowing rates for new loan originations since August,” said Feng Zhang, CEO of FinVolution, which has changed its name from PPDai.

FinVolution’s third-quarter operating income rose by 21 per cent quarter-over-quarter to 689 million yuan.

Ant Group put up about 2 per cent of the 2.2 trillion yuan of credit agreed over its platform as of June. The firm may bolster the disclosure in its co-lending partnerships, according to people familiar with the firm’s thinking.

Shanghai-based Lufax said it would put more “skin in the game” to 20 per cent of the loans it digitally matches between banks and borrowers by June. Lufax is backed by China’s biggest insurer Ping An Insurance (Group) and raised US$2.4 billion from its recent listing in New York, so has ample capital to put to work. Lufax’s third-quarter adjusted net profit rose 2 per cent from a year earlier.

“This lends confidence that Lufax could manage the impact of a tighter regulatory environment, as it did after the crackdown on peer-to-peer lending in 2017,” said HSBC’s Asia-Pacific head of internet research Binnie Wong.

Public consultation on the draft lending rules closed on December 2, with the results expected in six to nine months. Regulators may clarify what prices banks can offer borrowers over digital platforms, and which banks can continue to partner with digital platforms, said industry insiders.

Ever nimble fintechs are looking at new ways to keep earnings growing, such as building new alliances.

“The market probably won’t grow as fast as it has in the past, given these changes,” said chief executive officer Greg Gibb, so Lufax is looking to widen its cooperation with more banks and asset management companies.

360 Digitech is cementing its tie-up with Kincheng Bank of Tianjin, which should lower its funding costs.

“Southeast Asia will have higher profitability compared to China,” said Finvolution’s chief financial officer Ho Tak Leung.

Fintechs are also using their scads of data to cherry-pick more creditworthy borrowers, as well as selling infrastructure as a service to other firms. Wealth management units are still relatively small but growing.

“We are able to maintain healthy and sustainable profitability despite this lower [lending] pricing,” said Ho.