Bilibili and Kuaishou’s Hong Kong listings will showcase the e-commerce prowess of China’s video-sharing giants

- Kuaishou Technology targets up to US$5 billion in Hong Kong IPO and Bilibili applies to raise about US$3 billion via a secondary listing

- ByteDance is said to be mulling spinning off domestic video-sharing service Douyin in Hong Kong listing

Kuaishou Technology and Bilibili executives will become the internet stars of their own online videos when they digitally market their video-sharing apps’ Hong Kong share sales in the coming months.

Kuaishou is readying a US$4 billion to US$5 billion initial public offering (IPO) before mid-February, while Bilibili has applied to the Hong Kong stock exchange to raise roughly US$3 billion via a secondary listing in the city. ByteDance is also mulling floating Douyin, the domestic version of its TikTok app, people familiar with the matter said.

China is the world leader in blending celebrity live streamers’ glamour with e-commerce. The companies at the forefront of the video-sharing market will showcase the nation’s creative approach to this “shopertainment” during listings in Hong Kong.

“We expect short-form video to become a key topic of discussion in the entertainment sector given the huge user base, time spent, and monetisation potential,” said Thomas Chong, an analyst at brokerage Jefferies.

The listings come as investors hunt for beneficiaries of retail’s shift online last year. Consumer brands turned en masse to influencers to live-stream the promotion and sale of their excess inventory as the coronavirus pandemic curbed trips to shopping malls. Small businesses and artisans could still reach customers by sharing short videos on digital platforms.

Investors gauging the industry’s growth prospects will note that China is home to the world’s largest mobile internet population, about a quarter of the global total. The country’s 873 million netizens in 2019 will swell to 1.1 billion by 2025, according to a forecast by consultancy iResearch.

Not only are more people logging on but they are spending more time glued to their screens, with 4.35 hours each day in 2019 turning into 5.73 hours by 2025, with about a third of browsers’ time in 2019 spent on video-based social and entertainment platforms.

China’s video-sharing apps are also proving they can monetise audiences by selling virtual items to users who then gift them to streamers they admire, as well as via fast-growing e-commerce commissions, advertising revenues and subscriptions.

Sales of virtual gifts to users expanded 16-fold between 2015 and 2019 to 108 billion yuan (US$16.67 billion) and could hit 310 billion yuan in 2024, based on a forecast by consultancy Frost & Sullivan.

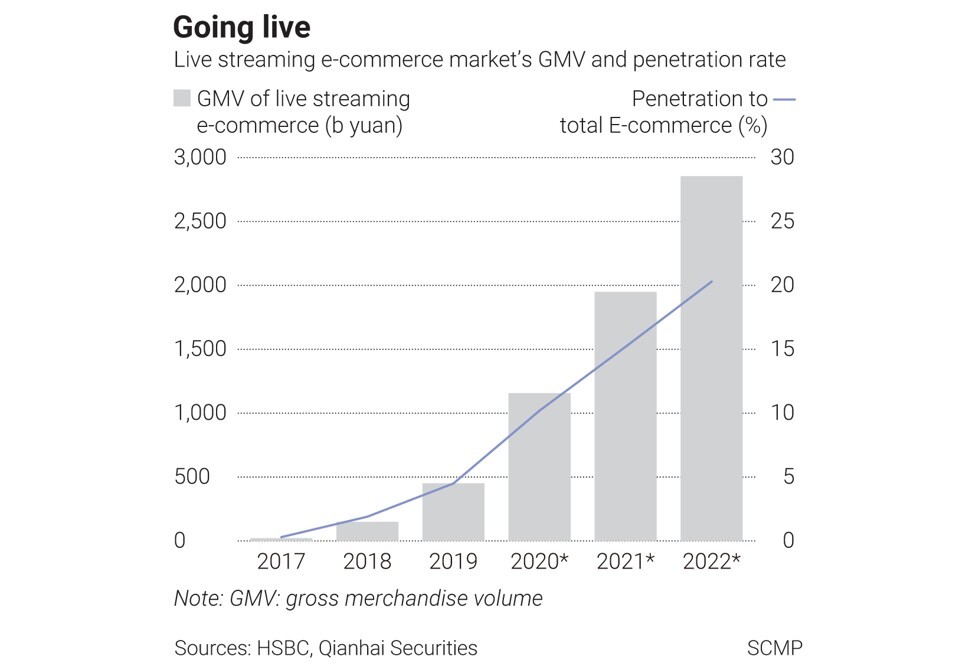

By 2022, the trading volume of live e-commerce will top 2.86 trillion yuan, or more than a fifth of China’s e-commerce market, analysts at HSBC estimated. The apps are increasingly taking fatter commissions from live streaming e-commerce by completing transactions on their own platforms, rather than passing shoppers onto cyber bazaars such as Taobao or JD.com.

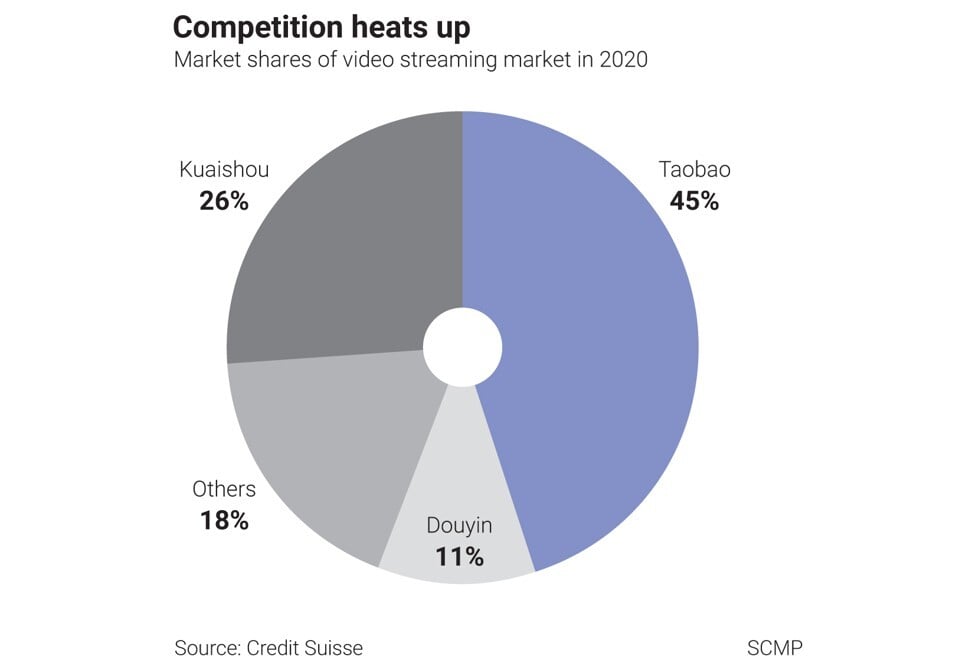

Kuaishou is the largest live-streaming platform globally by gross billings from virtual gifting and by average live-streaming banner advertisements, and the second-largest live streaming e-commerce platform, based on gross merchandise value of 109.6 billion yuan in the six months ended June 30 last year, according to iResearch.

Still, some analysts said advertisers and agents find the return on investment from marketing on Kuaishou lower than on ByteDance due to its less advanced ad placement algorithm and a smaller user-base focused on lower-tier cities.

Bilibili hasn’t monetised its users as much as its peers yet, registering e-commerce revenues of about 413.4 million yuan in the third quarter.

Investors should also be clear about the risks of investing in China’s effervescent video-sharing market, including rising competition. New entrant Taobao Live quickly dominated China’s e-commerce live streaming space while JD.com, WeChat and Pinduoduo are also stepping into the act.

Some investors told the Post they may buy Kuaishou shares because of its relationship with social media and gaming giant Tencent Holdings. The WeChat operator, which owns a 21.6 per cent stake in Kuaishou, tends to boost the prospects of companies within its ecosystem by channelling traffic and expertise to them, they added.

01:08

Police in eastern China arrest 138 over live-streaming scam

While ByteDance is unlikely to trigger a divestiture of Douyin until it completes talks with Walmart and Oracle about TikTok‘s US assets; Kuaishou may seek approval for its IPO from Hong Kong stock exchange’s listing committee from as early as this week so that it can complete the deal before the Lunar New Year next month.

Hong Kong has become the go-to destination as escalating US-China tensions have spurred a trail of mainland Chinese technology unicorns into the city’s stock market. The city’s exchange has opened its arms to these fast-growing technology companies, even loosening restrictions on dual-class shares, to accommodate their stock offerings.

Hong Kong requires at least two financial years of regulatory compliance on another qualifying exchange before allowing a secondary listing. Bilibili listed 42 million American depositary shares on Nasdaq in March 2018.

The time looks right now to pull the trigger. Bilibili more than tripled in value last year and the S&P 500 index of US equities is trading close to record highs. Some investors expect Bilibili’s secondary listing in Hong Kong to price at a slight discount to its Nasdaq valuation.

“This is perfect timing for Chinese companies to IPO in Hong Kong or Shanghai,” said Raymond Ng at offshore law firm Harneys, who said he is busy working on about 20 IPOs, some of which are mainland Chinese technology companies.