Hong Kong Exchange Fund reports late surge in income as markets rebound, expanding currency war chest to US$581 billion

- Returns recovered over the course of the year after the coronavirus pandemic rattled markets in early 2020

- Exchange Fund’s war chest stood at HK$4.5 trillion even after 85 interventions in 2020 to protect its currency peg

Hong Kong’s Exchange Fund, the war chest used to defend the local currency from attacks by short sellers, recorded one of its best quarters in a pandemic-ravaged year, as profit surged from a rebound in local sentiment and a rally in global asset prices.

The late upturn in performance preserved the war chest at HK$4.5 trillion at the end of 2020, a comfortable level that allowed the HKMA to protect the local dollar within its peg to the US dollar. The de facto central bank intervened in the market 85 times in 2020, selling HK$383.5 billion to keep it within its trading band.

The Hong Kong government is expected to receive HK$32.6 billion of income for the full year, as the treasury places its fiscal reserves as part of its asset management. The other government bodies will receive HK$11.5 billion. The figure released by the HKMA did not include payments to Hong Kong’s Future Fund, which will be announced later.

The infusion comes amid calls by some lawmakers for the city’s leaders to tap deeper into its fiscal reserves to help pull the economy out of its worst recorded recession.

However, economic scholars and some business sector lawmakers said the Exchange Fund’s investment returns should be better utilised.

“The Exchange Fund is used to support the currency peg, and some of it is used to invest,” said Terence Chong Tai-leung, an associate professor in economics at Chinese University. “But the problem is after growing the investment, what are you going to do with the profit? Even if the investment return grows tenfold it will not all go into backing the currency.”

If willing, the government could dip into the fund to help alleviate citizen’s economic woes, Chong said. He suggested profits from the Exchange Fund could be redistributed into the city’s pension fund, known as the Mandatory Provident Fund (MPF), to benefit residents in the long term.

The government, however, would have to make an exceptional discretionary decision if it really finds it necessary to use the profits from the Exchange Fund, according to economist Andy Kwan Cheuk-chiu, director of ACE Centre for Business and Economic Research.

“But I don’t think the government is likely to do so because otherwise once you do, it opens the floodgates and people would keep asking to use [the fund] whenever there is a recession,” Kwan said.

03:02

Hong Kong coronavirus lockdown: 10,000 people confined as police cordon off part of Yau Tsim Mong

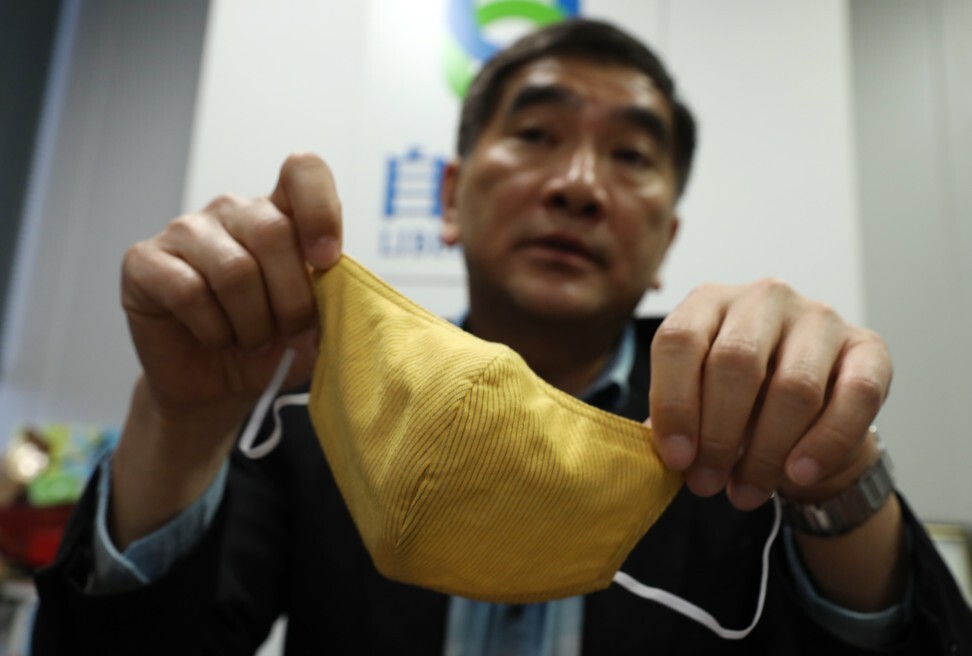

Liberal Party leader Felix Chung Kwok-pan said it was time to use the accumulative gains from the fund to help the city’s citizens, saying last year’s returns were more than enough to assist the economy.

Chung said in a meeting with the finance chief two weeks ago, the government mentioned concerns of utilising the fund may affect the dollar peg, and give an impression that the city’s financial situation was in danger.

“He is just making excuses,” Chung argued. “It would not affect the capital by utilising the gains only. The government can allocate HK$40 billion to roll out a new round of employment support scheme.”

The fund’s returns for the year were driven by HK$92.5 billion in gains on bond holdings and HK$69 billion in earnings from overseas equities, 25 per cent less than the HK$215.2 billion earned by those two categories combined in 2019. After suffering a loss in the first half, the fund reported a gain on Hong Kong equities of HK$4 billion, compared with a HK$22.1 billion gain in 2019.

The Hang Seng Index fell 3.4 per cent during the year, compared with a 9.1 per cent increase in 2019, while the MSCI World Index rose 15.9 per cent last year, which is lower than its 27.7 per cent gain in 2019.

“To many investors, 2020 was a year full of unexpected twists and turns. The novel coronavirus has posed significant challenges to the world economy,” Eddie Yue Wai-man, the HKMA CEO, said at a press conference on Wednesday.

“For the year as a whole, the Exchange Fund achieved a decent return on its equity and bond investments,” he added.

Additional reporting by Kathleen Magramo