HSBC appoints Greater Bay Area head to capture cross-border lending, wealth management business

- Daniel Chan currently heads bank’s business and commercial banking division in Hong Kong

- Hong Kong banks are appointing proven leaders as they prepare for the soon-to-be launched Wealth Management Connect scheme: analyst

HSBC, the largest bank in Hong Kong, has announced the set up of a Greater Bay Area office, which will be headed by Daniel Chan Hing-yiu.

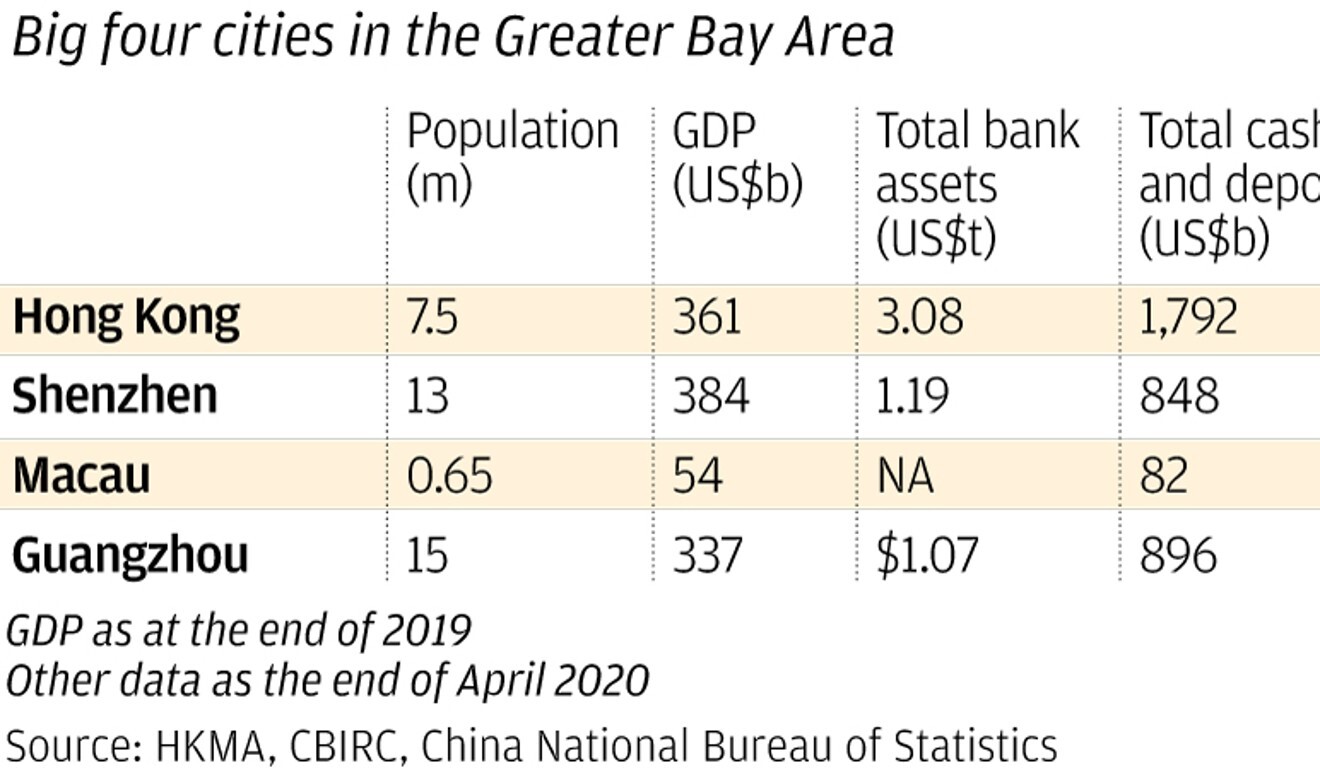

Chan’s appointment comes amid a flurry of activity by the city’s banks, which are gearing up to tap new lending and cross-border wealth management business in the Greater Bay Area development zone. The area, which has a total population of 72 million, had a combined economy of US$1.7 trillion – or the world’s 11th largest economy – in 2019.

“The banks in Hong Kong are appointing proven leaders for the bay area, as they prepare for the soon-to-be launched Wealth Management Connect scheme,” said Tom Chan Pak-lam, the chairman of industry body Institute of Securities Dealers.

The scheme, expected this year, will allow bay area residents to invest in wealth management products through banks in Hong Kong and Macau, while investors in these cities will be able to invest in wealth management products offered by mainland Chinese banks.

“The Greater Bay Area is a vibrant city cluster, which is experiencing a significant increase in demand for internationally competitive banking services,” said Diana Cesar, the CEO of HSBC’s Hong Kong office. “It is an area of strategic priority for HSBC, and we are investing in our digital infrastructure, cross boundary product capabilities and talent pools.”

In March last year, HSBC broke ground on a 16,000 square metre global training centre in Nansha, in Guangzhou province. The centre is expected to be completed in 2024.

05:48

Start-ups in the Greater Bay Area should use Hong Kong as a gateway to global markets

“Guangdong has always been at the forefront of China’s opening up and economic transformation,” he said. “Forward-looking policy developments announced in recent years will further promote economic connectivity in many different ways.”