Hong Kong exchange operator’s push to raise the bar for IPOs meets with stiff opposition

- HKEX wants to triple profit requirement for new listings, a move which would give the bourse the world’s highest barrier to entry for market debutants

- Opponents say the rules would bar smaller companies from listing in the city

Hong Kong Exchanges and Clearing faces an uphill battle to push through its proposal to drastically raise the profit threshold for companies seeking a listing on its main board, a blow to the exchange operator’s push to enhance corporate governance on the HK$54 trillion (US$7 trillion) bourse.

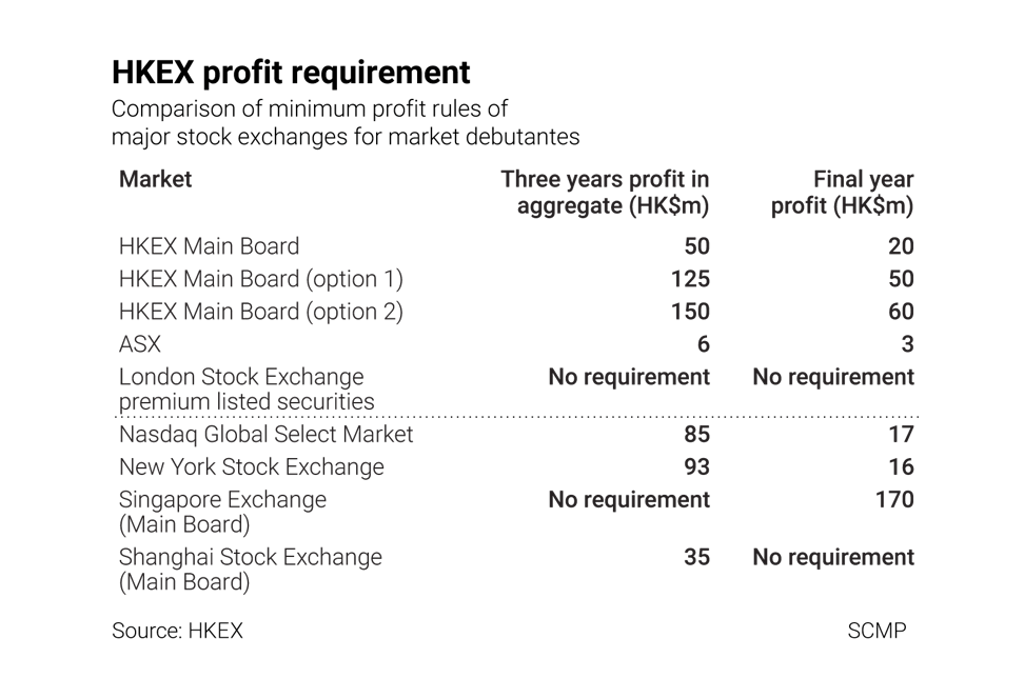

HKEX proposed a tripling of its profit requirement for listing applicants in November, to clean up problematic corporate behaviour, enhance the quality of market constituents and to protect investors.

However, lawmakers, accountants, and brokers have complained that the move would bar many small local firms from raising funds, especially now that the pandemic has dented their profits during the city’s worst economic recession on record. This stiff opposition could lead to the exchange abandoning the fight or make amendments to its plan.

“The proposals seem to discriminate against small-and-medium enterprises, particularly those in the traditional industries,” said Raymond Cheng Chung-ching, president of the Hong Kong Institute of Certified Public Accountants, representing 46,000 accountants in the city. “Many of today‘s blue chips companies and mega-corporations started as SMEs.”