HKEX taps JPMorgan’s Nicolas Aguzin as chief executive to helm the world’s most valuable stock market operator

- Aguzin’s appointment, subject to approval by Hong Kong’s Securities and Futures Commission (SFC), would take effect from May 24 for a three-year term

- Aguzin, an Argentinian and a permanent resident of Hong Kong, would become the first non-ethnic Chinese to lead the city’s bourse

A selection committee chose JPMorgan’s Nicolas Aguzin to lead the bourse, succeeding Charles Li Xiaojia – a former banker from the same US bank – in the role, according to an HKEX announcement. The role, subject to approval by Hong Kong’s Securities and Futures Commission (SFC), takes effect from May 24 for a term of three years, HKEX said.

The appointment comes at an important juncture in HKEX’s development, when new listings and investment funds flowing south from mainland China have swelled the city’s market value to HK$54 trillion (US$7 trillion), helping Hong Kong surpass Tokyo to become the world’s third-largest capital market. China-domiciled enterprises made up 52 per cent of the 2,545 companies listed in Hong Kong at the end of January, 90 per cent of the market’s trading volume and 81 per cent of its capitalisation.

“HKEX needs someone with strong China connection,” said Tom Chan Pak-lam, chairman of the Institute of Securities Dealers, adding that the chosen candidate was a surprise. “We do not know if the new CEO has the similar ties like [former CEO] Charles Li to connect China with the world.

Aguzin, known to his colleagues as “Gucho”, is CEO of JPMorgan’s international private bank. Before that, he was chairman and CEO of the US bank’s operations across the Asia-Pacific region.

With stints in New York, Buenos Aires and Hong Kong, Aguzin’s 30-year banking career began straight out of the University of Pennsylvania’s Wharton School, where he worked his way up from a job as financial analyst to the top. He was a senior country officer in Brazil and CEO of its Latin American business.

“I’m proud to congratulate my colleague, Nicolas (Gucho) Aguzin, on his important new role as the next CEO of the Hong Kong Stock Exchange,” JPMorgan’s chairman and CEO Jamie Dimon said in a statement. “Gucho is an outstanding leader and human being who has led businesses around the world for JPMorgan Chase with distinction over the past three decades. While we’re disappointed he is leaving us, we thank him for his many accomplishments at our company and wish him all the best.”

An Argentinian and permanent resident of Hong Kong, Aguzin will be the first non-ethnic Chinese to lead Hong Kong’s exchange since the modern bourse was established in 2000.

Paul Chow Man-yiu and Kwong Ki-chi, both Hongkongers, were the first two chief executives of the exchange before Li, who grew up in Beijing and spent his childhood in Gansu province, was appointed in 2010.

While the search was on for Li’s successor, the man who kept the HKEX running was Li’s right-hand man and chief operating officer Calvin Tai Chi-kin, who stood in as interim chief executive.

A number of bankers and finance executives were considered for the job of running the world’s most valuable exchange, according to Bloomberg’s December 29 report. They included HSBC’s co-head of Asia-Pacific banking Liu Che-Ning, the Canada Pension Plan Investment Board’s chief executive Mark Machin, Goldman Sachs’ former banker Wilfred Yiu, former JPMorgan banker Philip Zhai, and Tai himself, Bloomberg reported, citing people familiar with the matter.

Today’s appointment was not arrived at unanimously, sources said. Some members of the selection committee pushed for a banker with China experience and connection – like Li – to solidify the city’s connection with the mainland, according to several people familiar with the matter. Last year, 98 per cent of the IPO funds raised in Hong Kong were by mainland Chinese firms.

The SFC will review the candidate to check if he is a “fit and proper” person to run the exchange, according to a person familiar with the matter. The announcement by the HKEX before securing the SFC’s approval was “unusual’, said the Institute of Securities Dealers’ chairman Chan.

Still, Aguzin won after his supporters argued that his international background and network would help Hong Kong attract listings from around the world, helping to turn the city into a truly global financial market place.

At the same time, HKEX chairwoman Laura Cha Shi May-lung is well connected in the mainland as a former vice-chairman of the China Securities Regulatory Commission (CSRC) and can build on Li’s legacy of promoting cooperation with the mainland’s flourishing exchanges in Shanghai and Shenzhen, the people familiar said.

“The choice was unanimously agreed upon by the board of director of the HKEX, as [Aguzin] is the most outstanding candidate,” Cha said in a conference call after the announcement. “While HKEX has been very successful in equity fund raising, it still has a lot of room to grow such as bond issuance and commodities trading.”

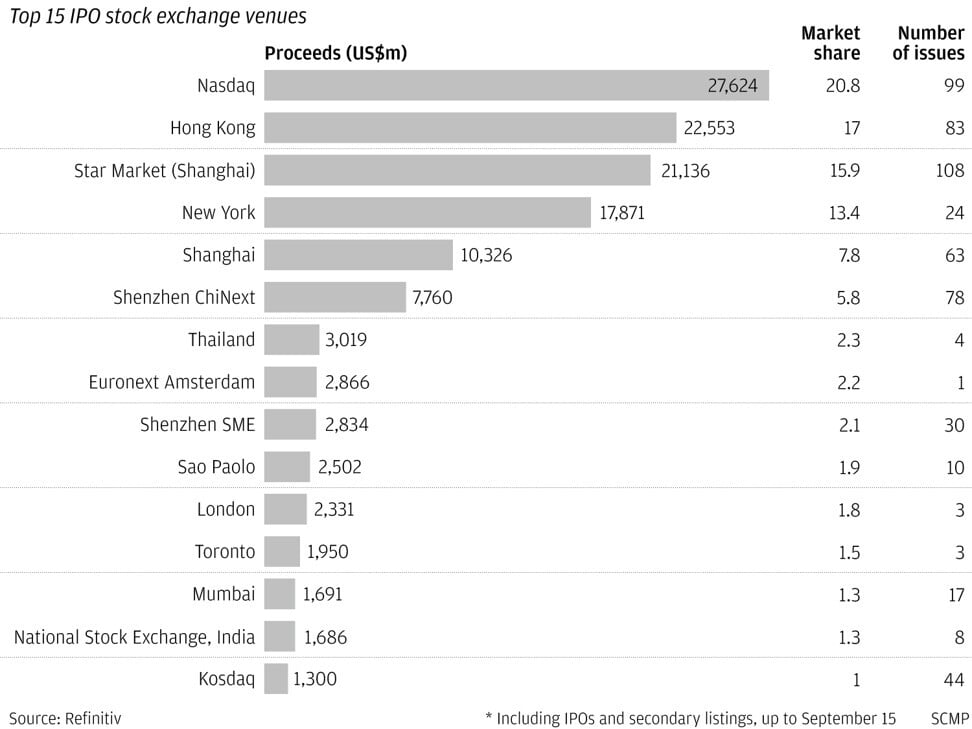

The stock exchange’s main board has been the world’s largest initial public offering market seven times over the past 12 years. HKEX shares, which are listed on the city, have risen 92 per cent in the past 12 months.

Investors will weigh whether HKEX can look to mergers and acquisitions as a growth driver, its future in mutual market access with mainland China, any further product and geographic diversification and the long-term strategy of the exchange, said Citigroup’s analyst Tian Yafei in a note after the announcement.

That performance has made Hong Kong into an indispensable gateway for onshore and offshore funds seeking a springboard into China and fear missing out on some of the world’s most profitable companies. Mainland Chinese enterprises accounted for 52 per cent of the 2,545 listed companies in the city at the end of January, and 81 per cent of the market capitalisation and 90 per cent of the trading volume.

“As China’s economy and capital markets continue to open, HKEX will become ever more relevant, facilitating anticipated significant new flows of capital, and supporting the strong demand for capital to fuel growth, acting as a catalyst that connects China with the world, and the world with China,” said Aguzin in a statement announcing his appointment.

The appointment of one of the world’s leading private bankers comes as Hong Kong looks to strengthen its position as a wealth management hub, capitalising on expanding links between Hong Kong and other parts of the Greater Bay Area (GBA). The area, which has a total population of 72 million, had a combined economy of US$1.7 trillion – or equivalent of the world’s 11th largest economy – in 2019.

A new Wealth Management Connect scheme, expected later this year, will allow GBA residents to invest in wealth management products through banks in Hong Kong and Macau, while investors in these cities will be able to invest in wealth management products offered by mainland Chinese banks.

JPMorgan ranked tenth in terms of investment banking fees garnered from across Asia last year, according to data provider Refinitiv.

Li started his career aged 16 in the oilfields of north-eastern China before studying in the US to become a lawyer. He was China Chairman of JPMorgan Chase & Co ahead of landing in the city’s highest-paid financial regulatory job, which commanded HK$51 million in salary, bonus and share awards last year.