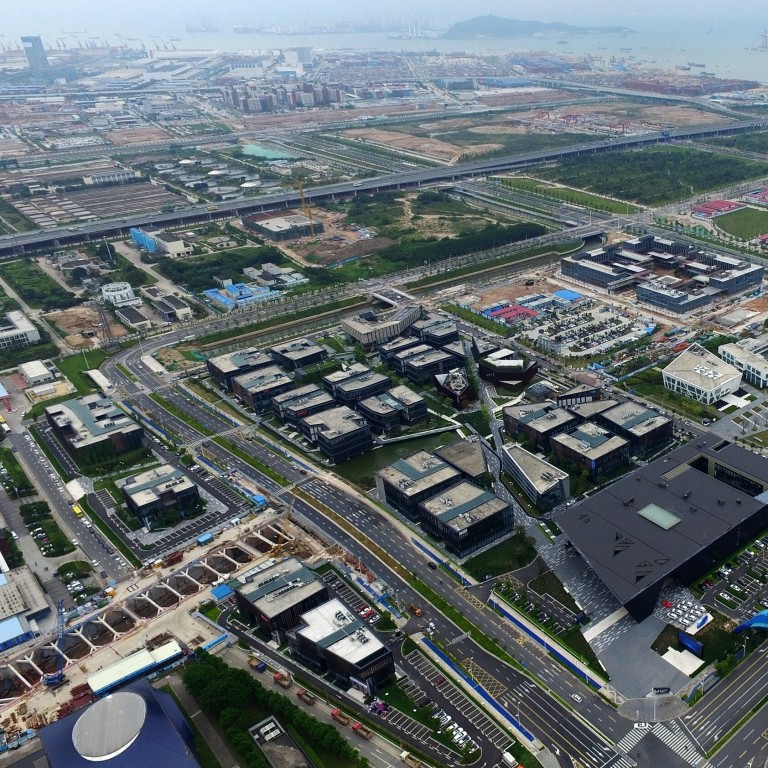

Wealth management connect to bring more Hong Kong finance firms to Qianhai special economic zone, official says

- Launch of wealth management connect scheme will see banks and finance companies from Hong Kong setting up offices in the special economic zone: Witman Hung

- With 11,325 firms from Hong Kong in Qianhai, the next target is to attract talent from the city to work in the free-trade zone

An increasing number of financial firms from Hong Kong will make a beeline for the Qianhai special economic zone as a soon-to-be launched wealth management scheme brings in new business opportunities, according to a senior executive of the free-trade zone.

“It will attract more banks and other financial firms to expand in Qianhai to capture the new business opportunities from the new cross border scheme,” he said.

Hung said this would lead banks and financial companies from Hong Kong to set up offices in the special economic zone, which is next to Shenzhen and about an hour’s drive from Hong Kong, to provide after sales service to mainland clients. Already big banks like HSBC, Hang Seng Bank, Bank of East Asia and Credit Suisse have set up offices in Qianhai in recent years.

The connect is crucial to the bay area, which has been envisioned to encourage the flow of talent and capital between the nine Guangdong province cities and Hong Kong and Macau, the two special administrative regions in China.

In October, authorities set an aggregate quota of 300 billion yuan (US$45 billion) for fund movement in both directions under the connect scheme.

Since 2014, Qianhai has offered tax incentives and relaxed policies to attract mainly financial, logistics and new economy firms. This has resulted in a steady increase in the number of Hong Kong companies registered in the special economic zone, which stood at 11,325 at the end of last year, exceeding the 10,000 target initially set by the authority.

01:38

Xi starts tour of southern China to mark 40th anniversary of Shenzhen special economic zone

Despite the coronavirus pandemic, which brought business activity to a standstill in early part of last year, financial, logistics and technology companies from Hong Kong continued to invest to develop their business in Qianhai. They accounted for US$4.3 billion or 88 per cent of the overall investment in Qianhai last year.

Hung said that this year he expects recruitment activity to pick up as some 1,500 companies urgently require non-Chinese professionals in construction, technology and various other sectors.

“Looking ahead, the focus will be on developing more job opportunities in Qianhai for Hong Kong professionals and workers,” he said.