Hong Kong sees second-worst ever slump in life insurance sales as Covid-19 travel restrictions keep mainland buyers away

- Mainlanders, traditionally the biggest spenders, spent 84 per cent less last year on insurance policies in the city

- Sales in the first quarter of this year are looking dismal too

Total sales of new policies dropped 22.8 per cent from a year earlier to HK$133.4 billion (US$17.19 billion). That is the second-worst slump on record, after a drop of 25 per cent that followed the 2008 global financial crisis, according to data released by the Insurance Authority on Friday.

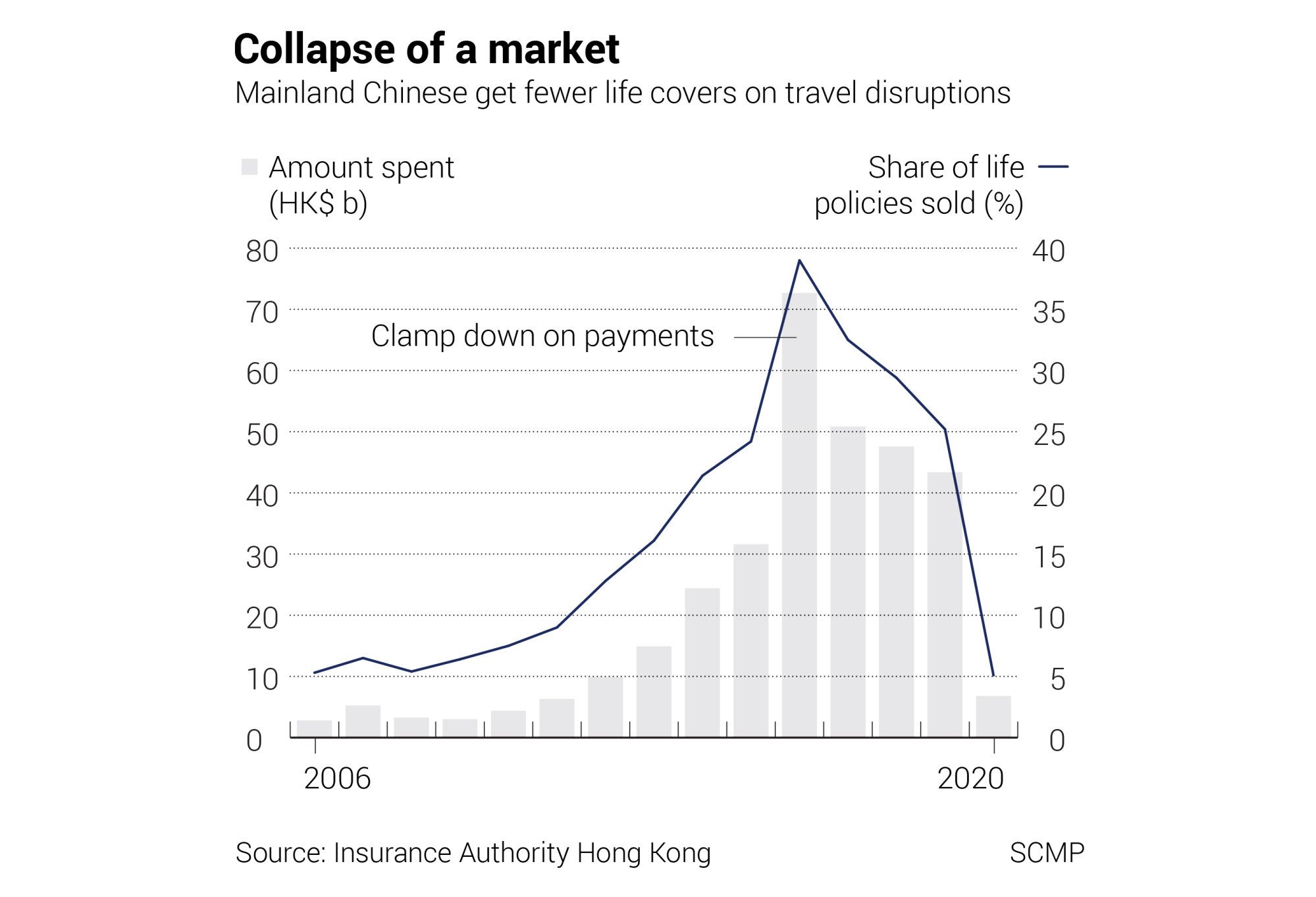

They only spent HK$6.8 billion (US$875 million) on life and medical insurance policies in Hong Kong, just 5.1 per cent of the total.

It is the smallest amount in a decade. At the peak, in 2016, they bought HK$72.68 billion worth of policies, representing 39 per cent of all premiums collected in the city.

The Insurance Authority blamed the plunge on cross-border travel restrictions that brought tourist arrivals to a standstill. Since March last year, overseas visitors have needed to be quarantined for 14 days – later expanded to 21 days – on arrival in Hong Kong, while mainlanders returning home would have had to undergo another 14 days of quarantine.

The number of mainland visitors to the city dropped 93.8 per cent year to 2.7 million last year, according to the Hong Kong Tourism Board.

Mainland tourists must buy their insurance products in person in the city under the law, so the sharp fall in visitors hit the industry and its 100,000 salespeople hard last year.

“The first quarter new sales are not looking good as the cross-border traffic remained closed while Hong Kong has social distancing rules. However, I am optimistic that this year as a whole there will be a gradual recovery as the vaccine programme has started, and will bring the outbreak under control,” said Eric Hui Kam-kwai, chairman of the Hong Kong Federation of Insurers (HKFI).

Hui said the insurance and pension sectors in Hong Kong are well developed, so that mainland buyers are sure to return to the market once they are able to.

The HKFI introduced a virtual platform in September to assist insurance companies in developing online sales channels as the social distancing rules prevented agents from meeting with their customers, Hui said.