China electric cars: Xpeng receives US$77 million investment from Guangdong government to strengthen expansion plan

- The funds will be given to one of Xpeng’s subsidiaries to strengthen its R&D capabilities and support its rapid growth

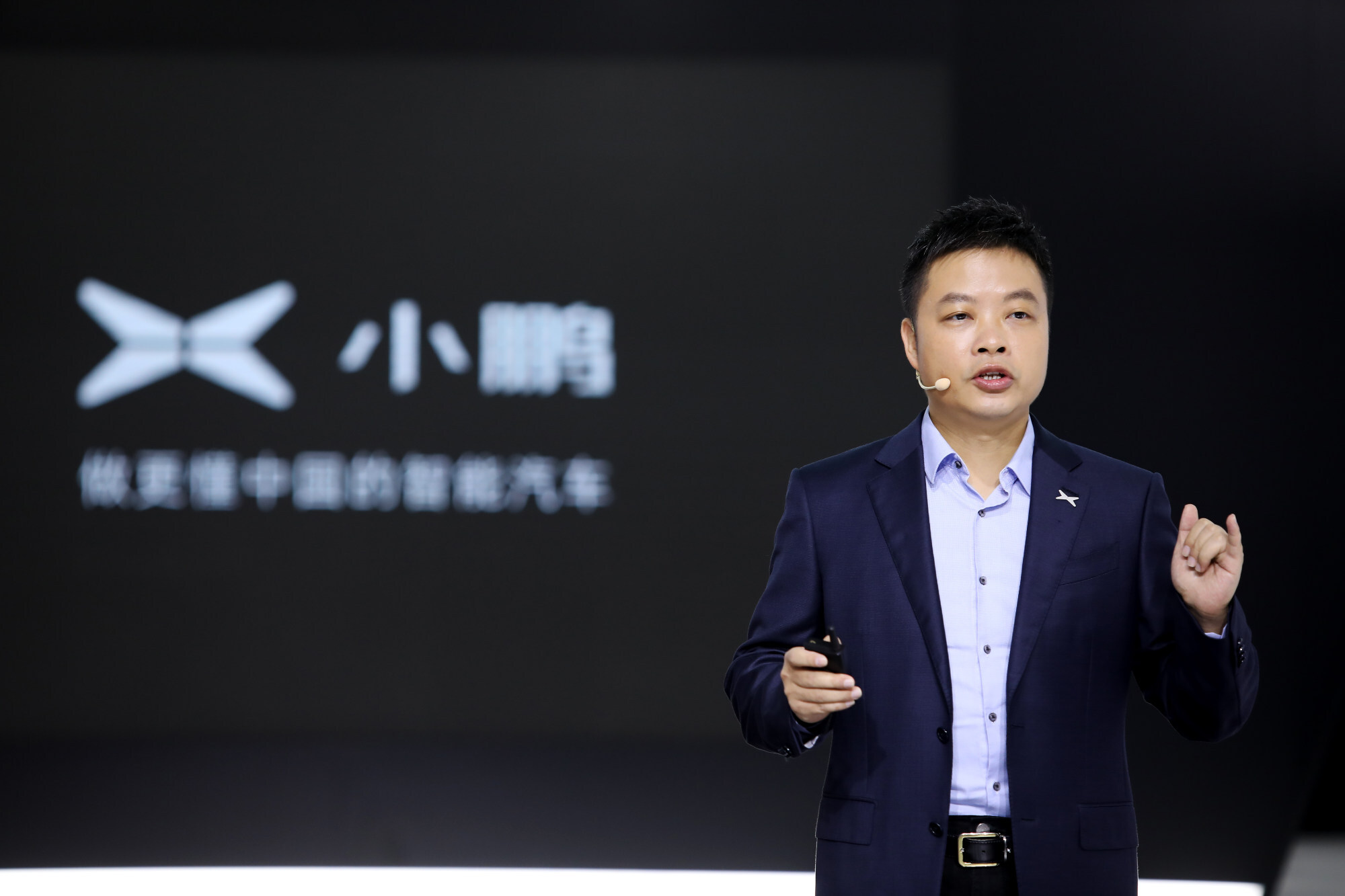

- The support from Guangdong provincial government reinforces the company’s commitment to building a comprehensive EV infrastructure, founder He Xiaopeng says

The Chinese EV start-up listed in New York said on Monday that the fresh funds would be given to one of its subsidiaries to strengthen its R&D capabilities and support its rapid growth.

The financing follows a 4 billion yuan investment by an arm of the Guangzhou government last September and a credit line of 12.8 billion yuan from major state-owned banks in January. Guangzhou is the capital of Guangdong province.

Local governments, echoing Beijing’s ambitions of building China into a global leader in EV, have been providing billions of yuan in financing to support promising start-ups like Xpeng, NIO and Li Auto.

But they still lag behind the US carmaker in terms of sales in the world’s largest EV market.

In 2020, Xpeng delivered 27,041 units, an increase of 112.5 per cent year on year. But it represented only one-fifth of Tesla’s sales of 137,459 units last year.

“There is competition among local governments to support promising EV companies that have the potential to create a mammoth industrial chain for their cities and provinces,” said Ding Haifeng, a consultant with financial advisory firm Integrity. “And the government’s financial support is of great significance to the start-ups as they are still burning cash in their bid for rapid expansion.”

Such support helped NIO to emerge from the brink of bankruptcy in the first half of 2020 after it received government funding worth US$1 billion.

Beijing wants 20 per cent of new cars hitting the streets to be new-electric vehicles (NEVs) – comprising pure electric, plug-in hybrid and fuel cell cars – by 2025.

The targeted sales could translate into more than 4 million units of NEVs.

UBS predicted that China would sell 6.6 million EVs in 2025 and three out of five new cars on China’s roads in 2030 would be powered by battery packs.