China’s banking regulator admonishes Xiaomi-backed online bank XW Bank for charging 30 per cent service fee on consumer loans

- Sichuan XW Bank was found to have charged as much as 30 per cent service fee for consumer loans with an auto financing platform, the banking regulator said

- The internet-only bank also failed to adhere to the government’s risk assessment and debt collection regulations

China’s banking regulator has issued an admonishment against an internet-only lender backed by Xiaomi for violating the country’s lending rules, as it intensifies its scrutiny of the financial businesses by technology platforms.

The verbal reprimand followed complaints by borrowers against the lender, which have increased significantly since the end of 2019, the regulator said. The regulator did not levy any fines or punishments on the bank, but stressed that all banks and insurers should examine their own operations, particularly where it concerned cooperating with third-party platforms.

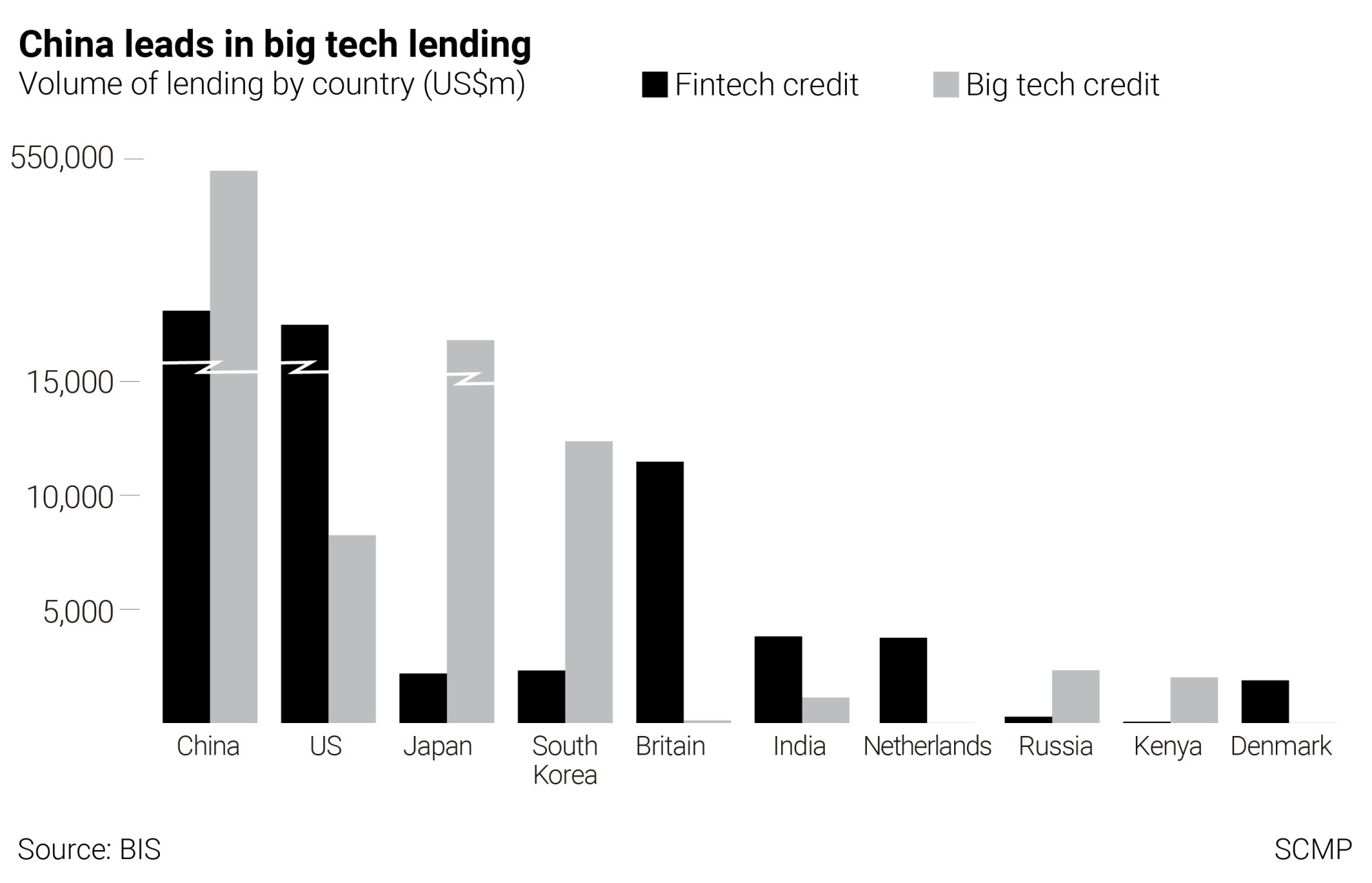

China has recently escalated a campaign to curb the influence of the nation’s largest home-grown technology champions after the top leadership pledged to expand oversight of financial technology, stamp out monopolies, and prevent the unregulated expansion of capital. After the financial regulator foiled Ant Group’s US$35 billion initial public offering, the antitrust and banking regulators issued a litany of rules to ring-fence fintech businesses to curtail any potential risk to the country’s financial stability.

XW Bank, which means the “new internet” bank, was one of several online lenders approved in recent years to spearhead China’s experimentation with fintech. Along with Ant’s MYbank and Tencent Holdings’ Webank, XW Bank operates without any bricks-and-mortar branches, just like the eight virtual banking licenses issued in Hong Kong.

XW Bank’s largest single shareholder is New Hope Group, a Sichuan-based producer of animal feed meal, with a 30 per cent stake. Xiaomi, which makes smartphones and a range of household electronic gadgets, owns 29.5 per cent via a unit. The bank had 44 trillion yuan (US$6.8 trillion) of assets by the end of 2019, according to its annual report.