Credit Suisse bid to head off Archegos crisis ends with rival banks brawling before Goldman sets off fund implosion

- Forced liquidation of stocks leads to one of the biggest hedge-fund debacles since Long Term Capital Management in 1998

- Archegos built positions using total return swaps, derivatives that allows family offices to hide their leveraged stock bets from public view

The forced liquidation that sent bellwether stocks tumbling last week and continues to send shock waves across capital markets, was preceded by bickering in the highest rungs of international finance that quickly devolved into finger-pointing and now fury, according to people with knowledge of the situation. Banks are just starting to tally the carnage.

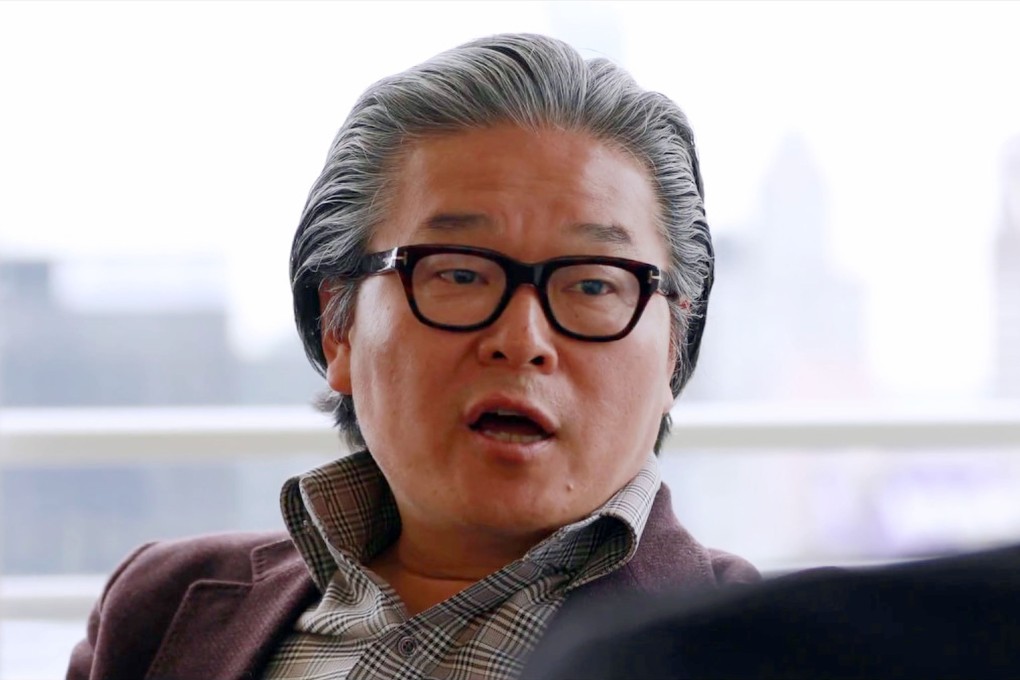

Emissaries from several of the world’s biggest prime brokerages tried to head off the chaos by holding a call with Hwang before the drama spilled into public view Friday morning. The idea, pushed by Credit Suisse, was to reach some sort of temporary standstill to figure out how to untie positions without sparking panic, the people said.

But any agreement was elusive, and by Thursday night, some banks had shot off notices of default to Archegos to seize collateral and potentially shop it to buyers to contain the banks’ potential losses, the people said. Yet even then, it wasn’t clear when terms with Archegos would allow sales to proceed, one of the people said.