Advertisement

DBS buys 13 per cent stake in Shenzhen Rural Commercial Bank for US$814 million as it ‘doubles down’ on bay area

- Deal positions Singapore’s biggest bank to increase presence in Greater Bay Area

- Shenzhen Rural Commercial Bank operates one of the largest branch networks in Shenzhen, DBS says

Reading Time:2 minutes

Why you can trust SCMP

DBS has agreed to buy a 13 per cent stake in Shenzhen Rural Commercial Bank Corp (SZRCB) for 5.29 billion yuan (US$814 million) as it becomes the latest lender to seek to expand further in the Greater Bay Area.

Singapore’s biggest bank will acquire 1.35 billion new shares in the privately owned commercial lender at 3.91 yuan a share, representing 1.01 times the book value of the company’s shares as of December 31, DBS said.

Following the deal, DBS will be the bank’s largest shareholder and have representation on its board of directors.

Advertisement

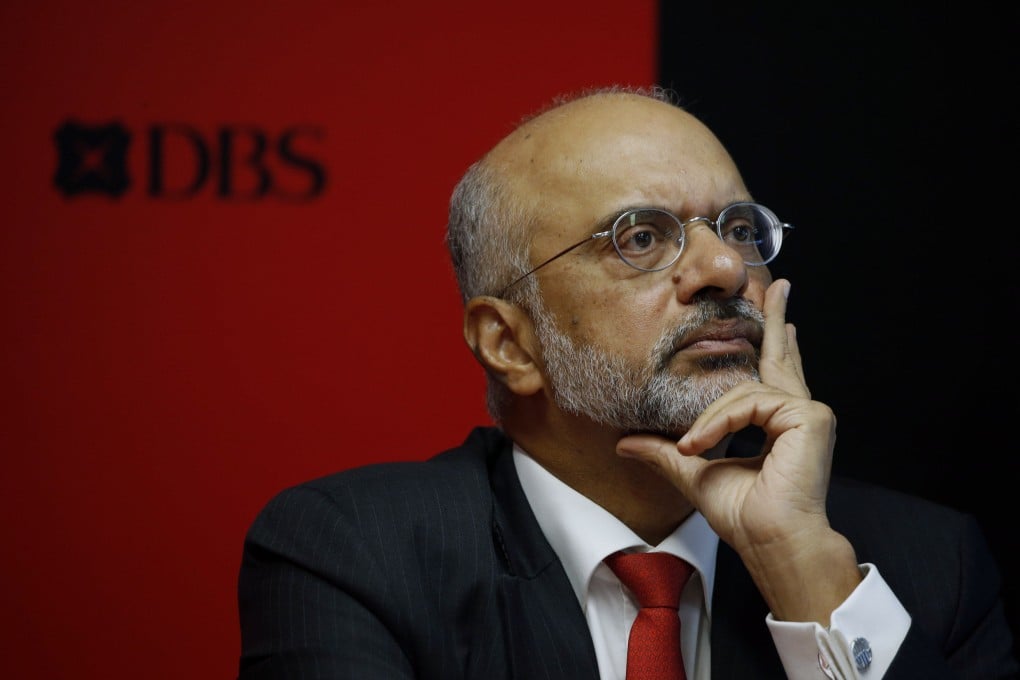

“We see this as a highly complementary strategic partnership that will allow us to double down on the GBA [Greater Bay Area] and leverage [Shenzhen Rural Commercial Bank’s] local network and know-how to deepen DBS’ GBA strategy,” DBS’ chief executive officer Piyush Gupta said in a stock exchange filing. “At the same time, we would be able to support the continued growth and digital transformation of SZRCB through our regional presence and digital capabilities.”

The deal strategically positions DBS to increase its stake in the Shenzhen lender after China eased rules on foreign ownership in the financial services sector, the bank said.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x