ICBC, Bank of China get regulator’s nod to provide financing to US$13.6 billion state-backed green fund

- ICBC and Bank of China will each contribute 8 billion yuan to the National Green Development Fund to finance climate-friendly projects along the Yangtze River

- State-owned banks have pledged support to fund green and sustainable projects to achieve Beijing’s carbon emission goals

State-owned Chinese banks, including ICBC and Bank of China, have won approval from the nation’s banking regulator to provide funding to the 88.5 billion yuan (US$13.6 billion) National Green Development Fund, taking it a step closer to deploying capital on climate-friendly projects.

The investment is an important way for the bank to develop and promote green finance while helping to protect the nation’s ecology, ICBC said.

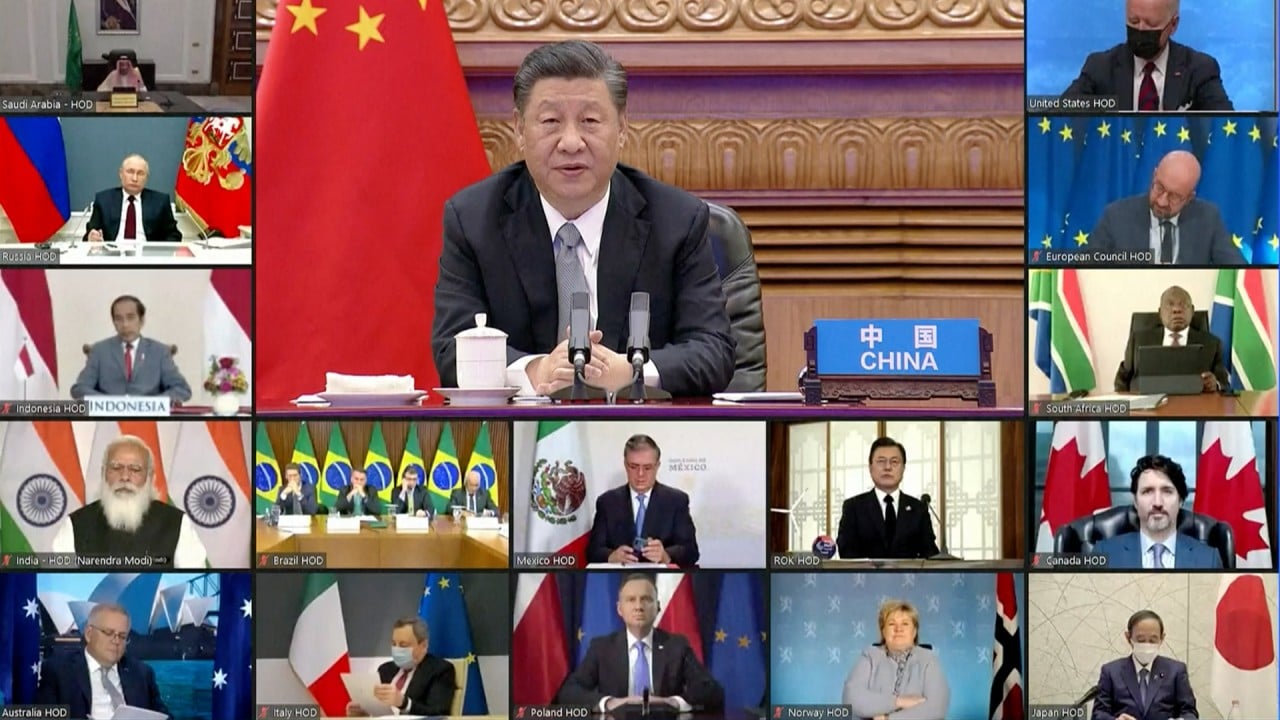

First promulgated by President Xi Jinping in 2016, the state-run private equity fund was launched last July by the Ministry of Finance, the Ministry of Ecology and Environment and the Shanghai city government to spearhead investments in green projects and sustainable development.

The fund is backed by 26 investors, with the Ministry of Finance as its biggest investor, committing a total of 10 billion yuan. Apart from ICBC and Bank of China, the other lenders involved in the project are China Construction Bank, Agricultural Bank of China and Bank of Communications.

The fund will initially finance projects in 11 provinces, including Jiangxi, Hubei, Hunan, Zhejiang and Anhui, along the Yangtze River. Their provincial governments are also sponsors of the fund.

Between 2016 and 2020, Beijing allocated 78.3 billion yuan to tackle water pollution, 97.4 billion yuan on air pollution and 28.5 billion yuan on soil pollution, as well as another 20.6 billion yuan to combat environmental problems in rural regions, according to mainland media.