Advertisement

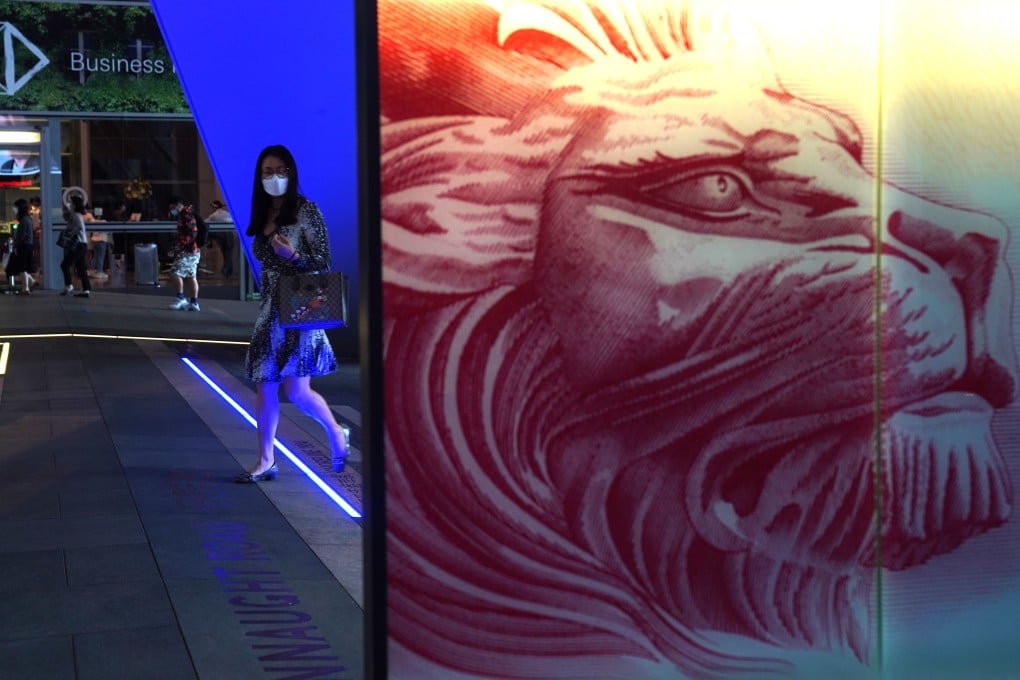

HSBC to sell most US branches to Citizens Bank, Cathay Bank in tactical retreat from America as competition hits

- HSBC to focus on serving international companies and wealthy clients in the US as part of latest revamp

- Lender to sell much of its banking operations for the mass-market and small businesses in US to Citizens Bank, Cathay Bank

Reading Time:3 minutes

Why you can trust SCMP

13

HSBC, the biggest of Hong Kong’s three currency-issuing banks, said on Thursday it will exit its mass-market retail business in the United States and focus on serving wealthy clients and international companies there as part of the 156-year-old lender’s latest revamp under CEO Noel Quinn.

The London-based bank said it would sell its banking operations for the mass market and small businesses on the East Coast to Citizens Bank, part of Citizens Financial Group, and sell its West Coast retail operations to California’s Cathay Bank. Combined, those businesses held US$10.2 billion in deposits and US$3 billion in outstanding loans as of March 31.

HSBC said it would retain a small network of about 20 to 25 brick-and-mortar locations, which will be repurposed into wealth centres to service affluent and high-net-worth international customers. It will wind down the remaining 35 to 40 branches.

Advertisement

“They are good businesses, but we lacked the scale to compete,” Quinn said in a statement regarding the sale. “Our continued presence in the US is key to our international network and an important contributor to our growth plans.”

10:01

Hong Kong can't miss Greater Bay Area boat in post-Covid-19 recovery, Victor Fung of Fung Group says

Hong Kong can't miss Greater Bay Area boat in post-Covid-19 recovery, Victor Fung of Fung Group says

Some investors argued last year that the lender should leave the US entirely after the bank found itself embroiled in rising Sino-US tensions, particularly after its top executive in Asia publicly supported a controversial national security law enacted by Beijing for Hong Kong last year.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x