Chinese private education operators push ahead with IPOs as tighter rules loom

- Chinese private education companies are firming up their IPO plans ahead of tighter regulations by Beijing targeting K-12 tutoring

- The crackdown could reduce the number of Chinese tutoring operators that are likely to get regulators’ nod and could slow down their pace of fundraising

Chinese tutoring and higher education operators are preparing to kick off their offshore initial public offerings before Beijing implements tighter regulations on the burgeoning off-campus education market, according to bankers.

Zhangmen Education, an online one-on-one tutoring group focusing on K-12 (kindergarten to 12th grade) students, is targeting about US$500 million through an IPO on the New York Stock Exchange. South China Vocational Education Group, which offers private junior college undergraduate programmes, meanwhile hopes to raise about US$100 million in Hong Kong, according to people familiar with the plans of these companies. These companies could start marketing their IPOs to investors over the next two months at the earliest, they said.

“The government doesn’t restrict IPOs of the tutoring companies”, said Christopher Wong, head of equity capital markets for Asia at BNP Paribas, in Hong Kong. “[However], in the short term I foresee a very limited number of tutoring education companies which can comply with government regulations and get approval for a Hong Kong listing.”

02:21

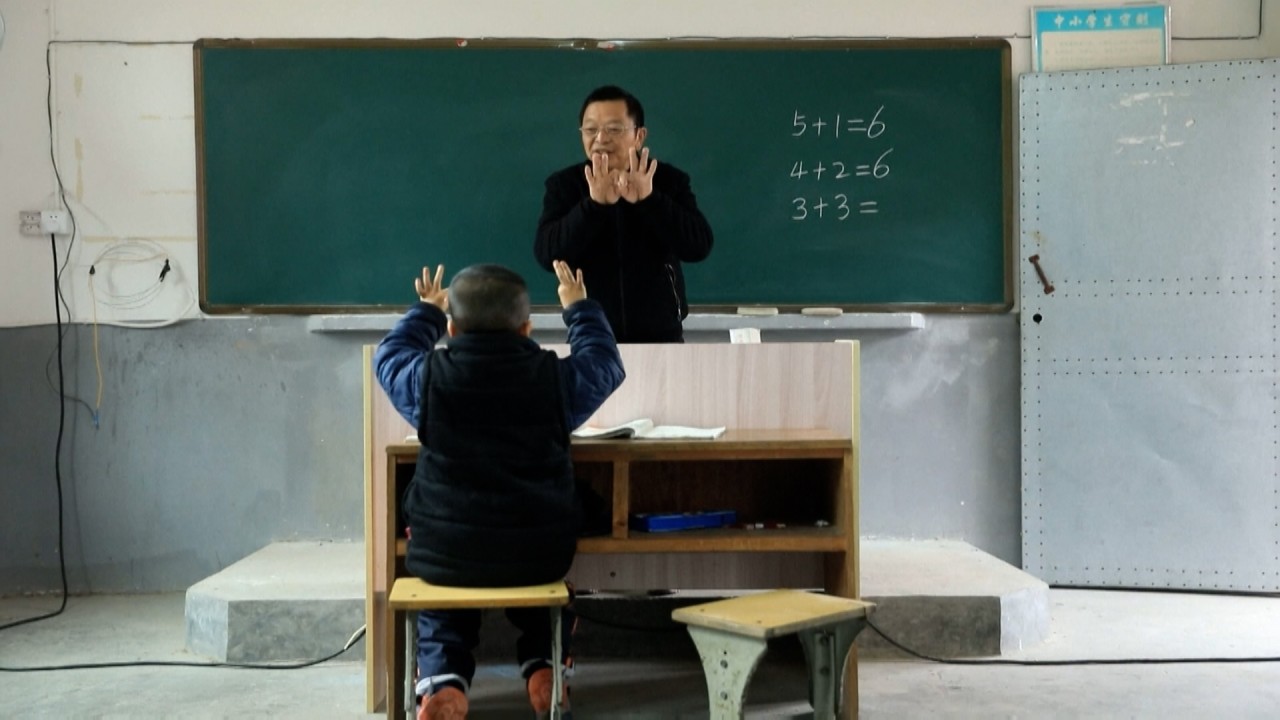

Primary schoolteacher in rural China remains loyal to his one last underprivileged pupil

Swelling wealth in China is also enabling parents to spend more on children’s education. Gross billing of online K-12 after-school tutoring market grew to 85.5 billion yuan (US$13.3 billion) in 2020, from 5.8 billion yuan in 2016, representing a compound annual growth rate of 95.9 per cent, according to Frost & Sullivan data cited by Zhangmen Education’s draft prospectus. It is expected to reach 414 billion yuan in 2025.

Shares of New Oriental Education in Hong Kong have plunged 38 per cent over the past one month. In New York, TAL Education, the biggest Chinese private tutoring group by market capitalisation, lost 35 per cent. Their losses were triggered by rumours that a Beijing district will unveil rules that will ban students from taking after-school courses during the summer holidays.

07:46

Covid-19 pandemic clouds future for Hong Kong’s university Class of 2020

Xi’s call for tougher scrutiny means that Chinese private education companies are bearing the weight of regulatory overhang, said Bruce Pang, head of macro, strategy research at China Renaissance.

Still, “the education sector as a whole is a good inflation hedge, in our view, given the strong pricing power to raise tuition fees”, he said.