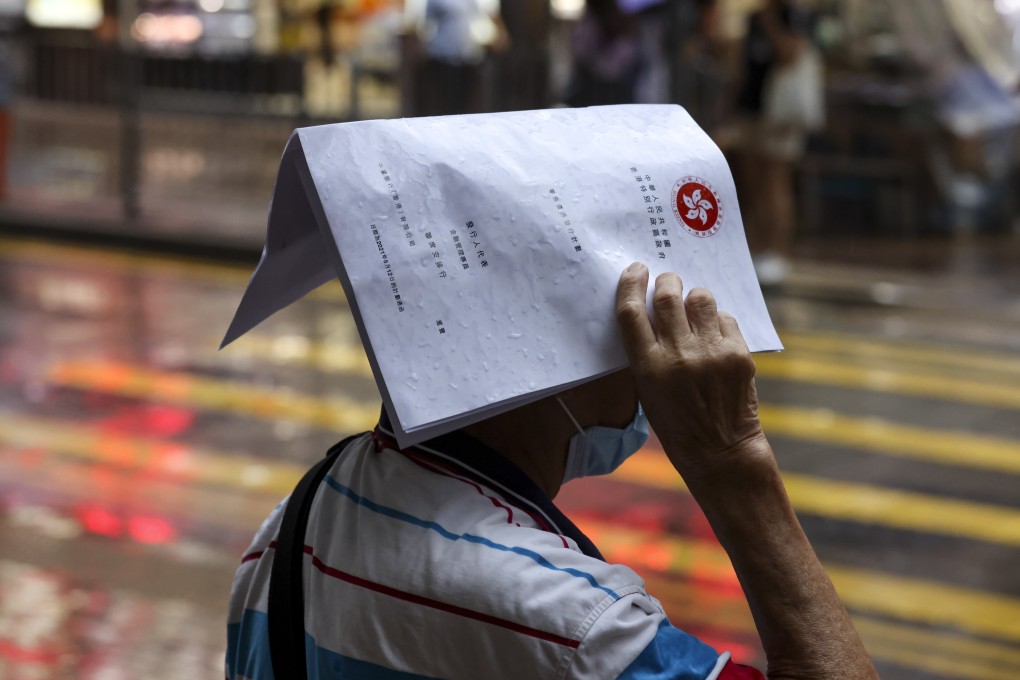

Hong Kong’s latest round of iBonds subscriptions off to strong start as savers seek shelter from historically low interest rates

- Hong Kong’s government plans to issue up to US$2.6 billion in latest round of inflation-linked debt

- Subscription period runs through June 11

Hong Kong’s latest round of inflation-linked government debt, known as iBonds, got off to a strong start on Tuesday, as savers flocked to the government programme as interest rates remain at historic lows and consumer prices ticked higher this year, according to banks and brokers.

The iBonds, the eighth series issued since 2011, will make an interest payment every six months based on the average rate of the consumer price index over that half-year period, offering a guaranteed minimum payment of 2 per cent. The minimum payment is double what the government offered four years ago.

10:01

Hong Kong can't miss Greater Bay Area boat in post-Covid-19 recovery, Victor Fung of Fung Group says

“The response received this year has been stronger than last year,” Bright Smart Securities CEO Edmond Hui Yik-bun said. “We have seen a lot of new customers coming to us to open new accounts for iBond subscriptions.”