Carbon neutrality goal: China is leading global surge in green bond financing this year

- The country accounted for 13.4 per cent of all green bond proceeds globally as of May this year, according to Refinitiv

- The pace of green bond issuance globally is its fastest in five years

China has led a surge in green bond financing this year, with global issuances growing threefold to about US$194 billion in the first five months of 2021, and was on target to easily pass record issuance levels seen in 2020, according to a new report.

Through May 27, China accounted for 13.4 per cent of all green bonds issued globally, raising US$26.1 billion, according to data provider Refinitiv. That is more than double the US$10.1 billion raised in the first five months of 2020 and nearly as much as the US$27 billion raised in all of last year.

The pace of green bond issuance globally is its fastest in five years, with more than double the number of bonds issued at this point in 2020, according to Refinitiv. Last year, companies and governments collectively raised US$242.8 billion in green bonds.

03:27

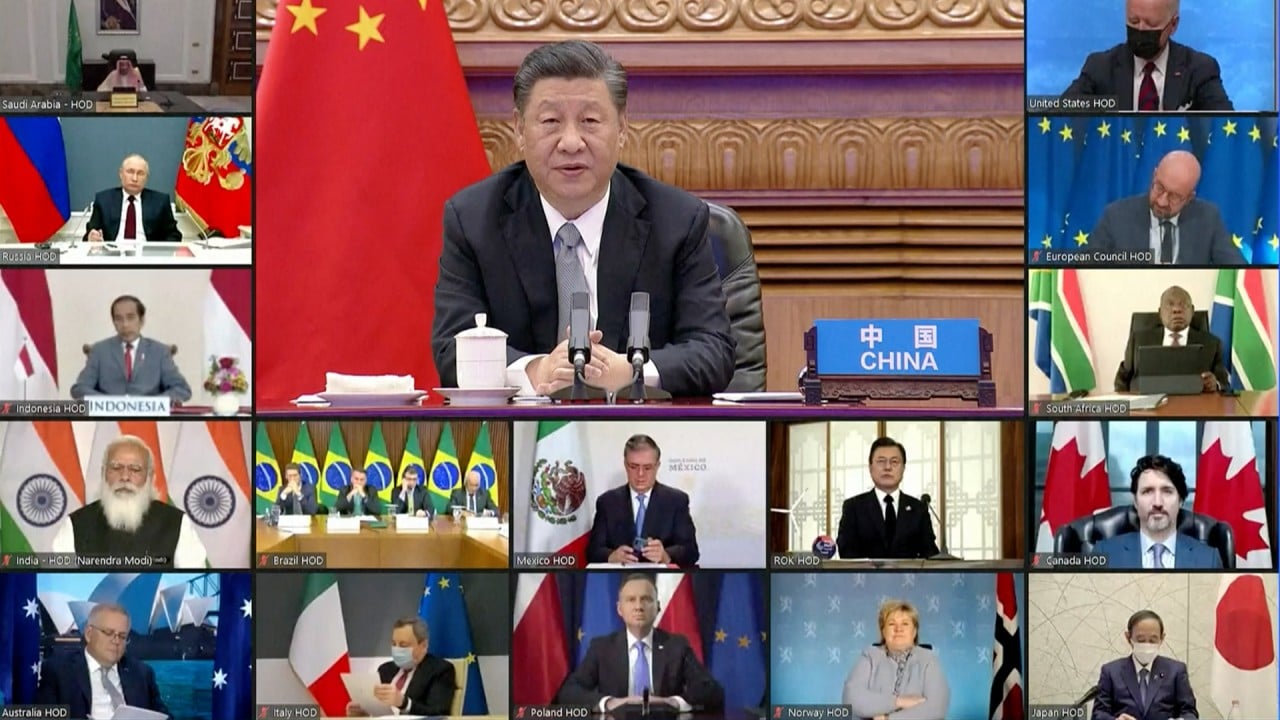

World leaders pledge to cut greenhouse emissions at virtual Earth Day summit

Green bonds are issued by financial institutions, companies and governments to fund projects that have environmental benefits. However, the rapidly growing Chinese green bond market remains closed to many foreign investors because of looser rules on how domestic businesses can use proceeds from the debt issuance. Onshore debt accounted for about 72 per cent of green bond issuance in China this year, according to Refinitiv.

Under Chinese regulations, up to half of the proceeds raised by green bonds can be used to repay bank loans or to bolster a company’s general working capital. International standards restrict that to no more than 5 per cent of the proceeds.

“Chinese financial market regulators need to take a serious look at how the country’s state-owned enterprises are using the proceeds of their green bonds,” said Christina Ng, the research and stakeholder engagement leader of Australia-based Institute for Energy Economics and Financial Analysis.

State-owned power companies China Energy Investment Corporation and China Huaneng Group planned to use about 30 per cent of the 7 billion yuan (US$1.1 billion) they raised combined from a series of carbon-neutral bonds this year for working capital, she said. “In other words, the proceeds are to fund their day-to-day – and not necessarily green – operations,” she added.

Their offering documents stated that coal-fired plants make up about three-quarters of their total power assets and coal power was expected to remain a core part of their businesses going forward, Ng said. The companies also provided little information on their future plans to phase out fossil fuel sources, she added.

The energy and power sector accounted for about 28 per cent of all green bonds issued in China this year.