Hong Kong’s cheques are heading for the dust heap of history even if branches remain in the age of virtual banks

- Hong Kong cheques usage shrank 29 per cent since 2018 as people use mobile phone apps and Faster Payment System to transfer funds

- Hong Kong traditional lenders still have 1,200 branches

Cheques are likely to be relegated to the dust heap of history, becoming a relic of traditional banking in Hong Kong as a new generation of customers embrace the convenience of instantaneous, paper-free electronic transfers in the age of virtual banking, according to financial executives.

“Cheques will go away,” said Rockson Hsu, chief executive of ZA Bank, the first and largest of eight virtual banks that began operation in Hong Kong, during the China Conference: Hong Kong organised today (yesterday) by South China Morning Post. “Many peer-to-peer fund transfers and payment [methods] can already be conducted by e-wallets or the government’s faster payment system.”

In many aspects of Hong Kong’s daily life, the cheque is still the preferred instrument of payment instruction, from putting a deposit down on an apartment to applying for a gym membership. Still, the gradual erosion of its status and its displacement by FPS and a host of digital remittance systems mark a significant behavioural change among customers in Asia’s second-largest capital market.

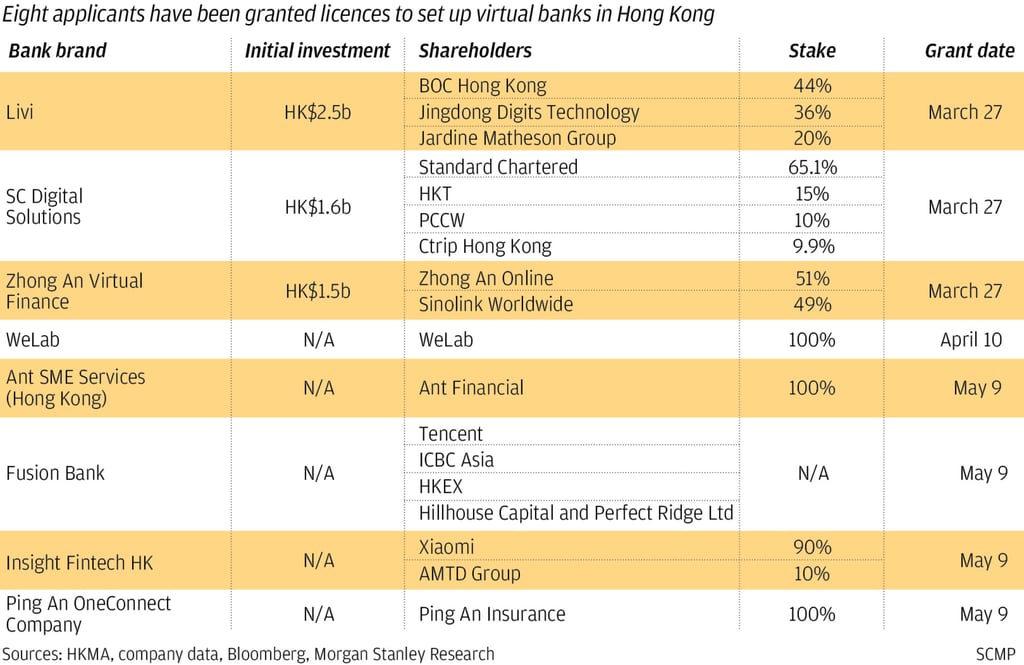

Hong Kong’s eight virtual banks, a major part of the fintech – the enhancement of financial services through the adoption of technology – push by the Hong Kong Monetary Authority (HKMA). Their licenses compel the banks to operate entirely online. Since their launch, the eight banks have collectively secured 600,000 customers, with HK$20 billion (US$2.6 billion) in combined deposits as of March.

The rapid growth of virtual banks, some after just a few months of operating, is the clearest sign that the fintech-enabled banking can compete in a city of 1,200 branches by 155 licensed banks for 7.5 million people, making Hong Kong one of the most overserved urban centres on earth for financial services.