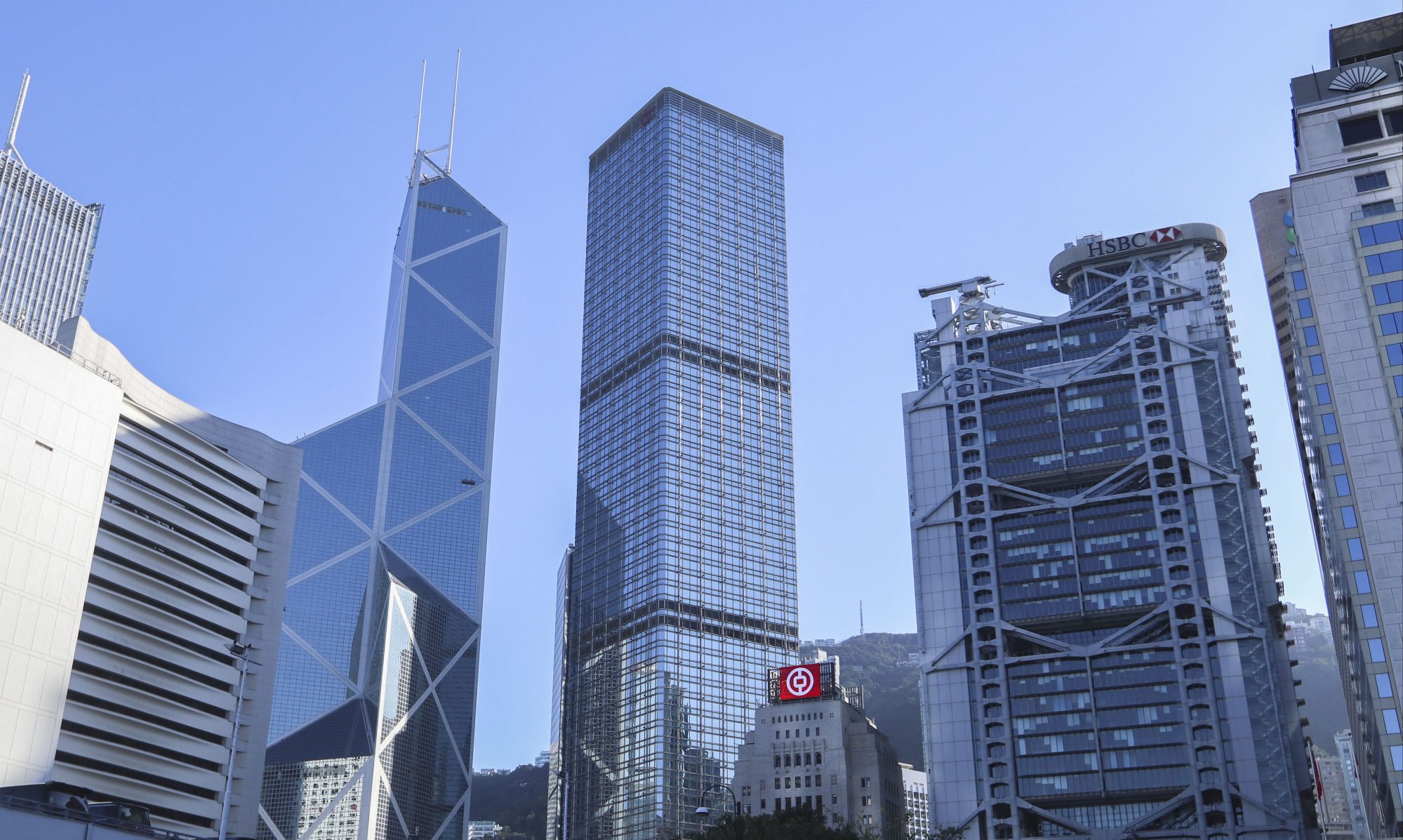

BitMEX in talks to rent more space at Hong Kong’s costliest offices as it goes on hiring spree in cryptocurrency boom

- Cryptocurrency exchange BitMEX is seeking more talent and expanding its pricey office space at Cheung Kong Center in Central, sources say

- Expansion comes as Hong Kong tightens licensing regime and oversight on cryptocurrency exchanges amid rising fraud and cybercrimes

“We have plans to grow from a crypto-derivatives exchange platform by expanding our business lines to include spot, brokerage, custody, and other capabilities in certain markets in the future,” a spokesman of 100X Group, the ultimate owner of BitMEX, said in an email reply to the Post, declining to comment specifically about its real estate plan. CK Asset declined to comment.

The company is hiring engineers, a head of financial crime compliance, derivative structurers and other supporting roles in Hong Kong, according to its website. Its operations in Central supports BitMEX’s information technology and other back-office functions such as human resources, compliance and finance.

The price of bitcoin has surged by almost 600-fold in the past 12 months to a record US$63,410 on April 15 before retracing by 48 per cent, changing hands at about US$33,000 in recent trading.

The spokesman of the 100x Group said it is “considering what licensing opportunities are available to us in various jurisdictions and closely monitoring developments in regulation.”

HDR Global, a member of the group and the parent of BitMEX, is registered in the Republic of Seychelles as an “international business company” and not a licensed entity subject to supervision. HDR Global’s website warns investors that the BitMEX platform is not available to users in Hong Kong.

“International business companies” that are engaged in cryptocurrency activities “are not licensed or authorised to conduct such activities in the Seychelles or anywhere else in the world,” Zenabe Daman, deputy chief executive of the island country’s Financial Services Authority, said in an email to the Post.

Seychelles is working on a legal framework that would require these companies that are engaged in virtual assets to apply for virtual assets service providers licensing or registration, Daman said. It expects to pass a law on this by year end, she added.

Additional reporting by Peggy Sito.